Housing Programs for Millennial First-time Home Buyers

July 8, 2022

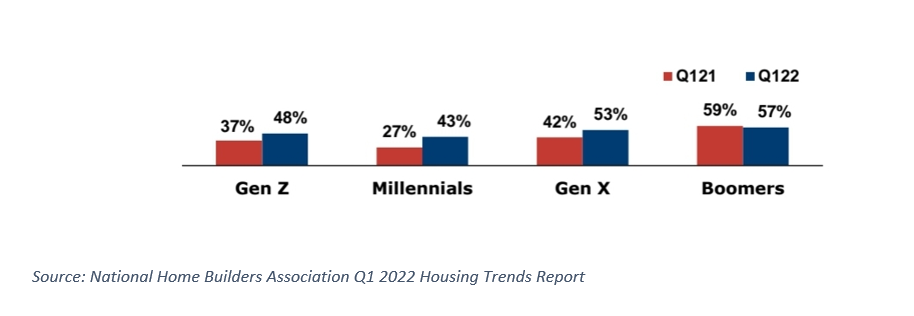

Housing affordability has been an issue in the U.S. for many years, but in this current market millennial first-time home buyers have been some of the hardest hit. The National Association of Realtors reported that millennials make up 43% of home buyers across all generations. Despite this jump in homeownership among millennials, many still feel that they cannot afford a home. A report by the National Association of Homebuilders showed that in the first quarter of 2022, 43% of active millennial buyers listed difficulty finding affordable housing as the main reason they stopped looking, up from 27% last year.

With mortgage rates rising and housing prices continuing to climb, many millennials looking for their first home have been priced out of the market. What can help relieve the financial burden of home buying for millennials? One of those relievers is taking advantage of housing programs designed to aid those buying a house for the first time. Virginia has several state programs, the two most notable being Virginia Housing and Virginia Department of Housing and Community Development. Below is a breakdown of each program’s benefits and requirements for each initiative.

Virginia Housing was created in 1972 with the intent of providing affordable housing to Virginians. They have three major programs:

- Down Payment and Closing Cost Assistance Grant gives borrowers 2% of the purchase price to apply towards a down payment or closing costs on a home.

- The benefits of these grants are that each offers a Mortgage Credit Certificate (MCC), a dollar-for-dollar credit toward your federal income tax. In addition, neither grant must be repaid.

- There are requirements for both grants though. The Down Payment Assistance Grant must be used with an eligible loan from Virginia Housing, and the home must be your primary residence. The Closing Cost Assistance Grant must be used with a Rural Housing Service or Veterans Affairs loan and the mortgage must be locked down prior to receiving the grant.

- A conventional loan from Virginia Housing is a 30-year fixed loan used by first-time and repeat home buyers. With this loan, less cash is needed at closing. Some of the requirements are a 3% down payment, a 640 credit score, and a debt-to-income ratio of 45%.

- Virginia Housing Plus Second Mortgage combines the first Virginia housing mortgage with a second mortgage to cover down payment costs. This loan requires borrowers to have 1% of the purchase price available at closing and have a conventional or FHA loan from Virginia Housing.

The second state program is Virginia DHCD, a state agency with several programs including the Homeownership Down Payment Assistance Program (DPA) and Virginia Individual Development Accounts (VIDA).

- DPA provides gap financing for first-time home buyers below 80% of the area median income. Buyers can receive up to 10% of the sale price and an additional $2,500 towards closing. Program applicants must use the property as their primary residence, receive homeownership counseling, and put 1% of the sales price toward the home.

- VIDA helps potential buyers save for a down payment matching eight dollars for every one dollar saved. Individuals applying must complete 14 hours financial management training in 6 to 24 months and meet income and household limits.

There are also regional and local housing programs in Virginia that can be found on the US Department of Housing and Urban Development site.

You might also like…

Managing Your Business and Clients While on Vacation

By Sean Olk - June 5, 2024

Memorial Day has passed, the kids are out of school, and all the signs of summer are here. Traditionally, summer is a busy time in real estate, and… Read More

Global Real Estate Tools for REALTORS® in Virginia

By Leslie J. Frazier - April 24, 2024

The Commonwealth of Virginia has been engaging in foreign business since its inception, and today we are no different. International trade is a key part of our economy… Read More

Get Ready for Fair Housing Month TODAY

By Virginia REALTORS® - March 21, 2024

April is Fair Housing Month and it’s coming soon! While we know you are committed to Fair Housing and show your support all year long, what can you… Read More