Are Renters Heading to the Suburbs, Too?

December 16, 2020

During the pandemic, a shift to teleworking and higher rates of COVID-19 cases in cities have led more people to move out of some urban centers to smaller communities. While the claim of an “exodus” from U.S. cities appears to be overblown, here in Virginia, we have seen a shift in both homebuying activity and new single-family construction to suburban and rural counties over the past six months. Has there been a “suburban shift” in the multifamily rental market, as well?

Nationally, New Apartment Construction Is Following Consumers Away from the Cities

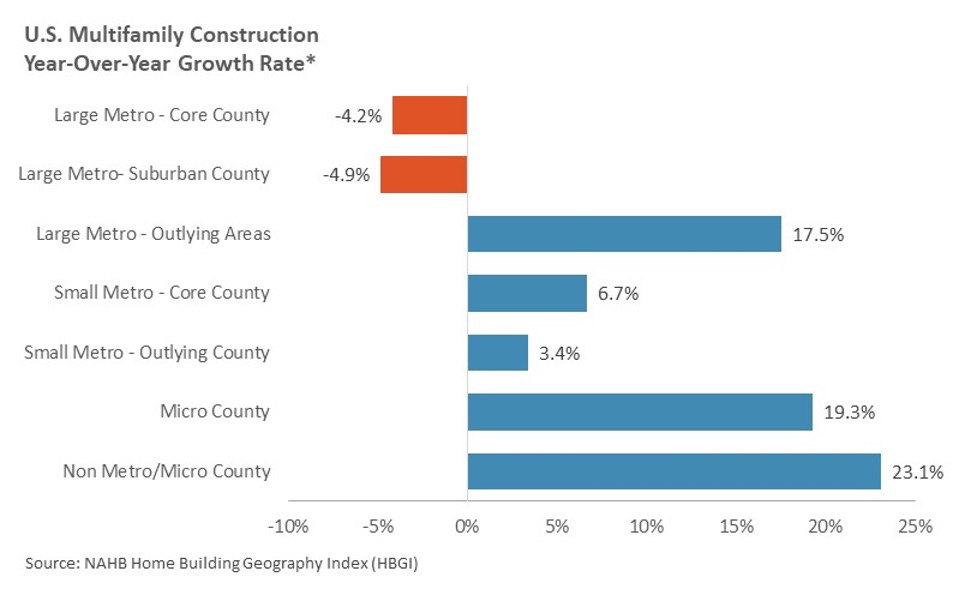

According to the National Association of Home Builders’ (NAHB) Home Building Geography Index (HBGI), in the 3rd quarter of 2020, there was a decline in new apartment construction in the nation’s largest cities and close-in suburbs. By comparison, apartment construction was up strongly in the outlying areas of large metro areas, as well as in small metro areas and non-metro areas (i.e., rural counties).

Despite uncertainty about overall economic conditions, builders’ confidence in the multifamily market rose in the 3rd quarter. Therefore, at the national level, new apartment construction appears to be following consumer demand to less dense areas.

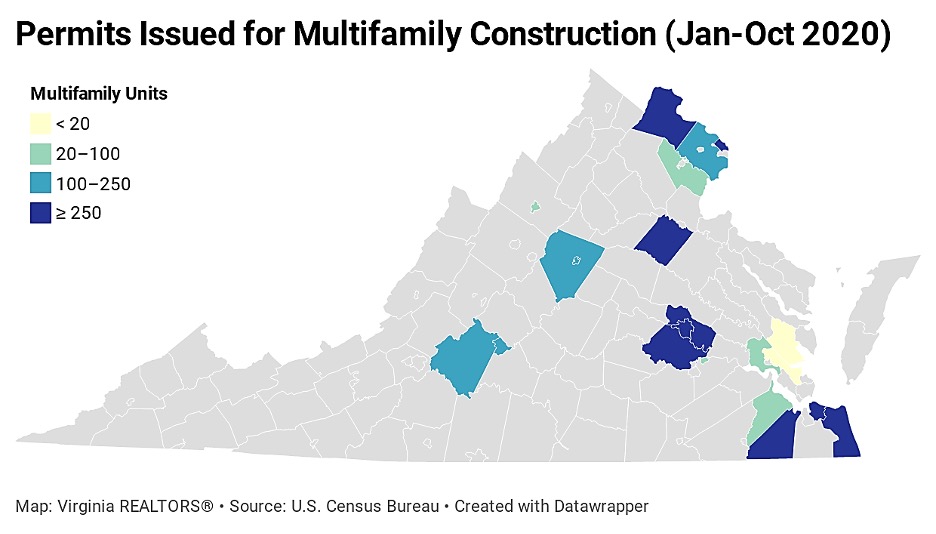

In Virginia, Apartment Construction Remains Concentrated in Metro Areas

While there may be growing demand for rental housing in outlying suburbs and rural communities, multifamily construction in Virginia continues to be occurring primarily in the state’s largest metro areas. Through October, there has been a total of 5,511 permits issued for the construction of new multifamily housing units, which is down from nearly 8,000 over the same period last year. Nearly a quarter of new multifamily units (23%) were being built outside of the major metro areas of Northern Virginia, Richmond, and Hampton Roads, which is about the same share as last year.

In Virginia, even though the is growing demand for housing in smaller markets, it appears as though apartment construction has remained relatively concentrated in major metropolitan areas.

Single-Family Rentals Might be Seeing a Boom

The analysis above focused on multifamily rentals, which includes large apartment buildings that are most common in urban areas. However, there is evidence suggesting that the demand for single-family rental housing is accelerating, which could lead to more suburban and rural rental housing options.

According to the National Home Rental Council’s 3rd quarter index, the single-family rental market remains strong nationally, reflecting more renters moving to the suburbs. In addition, CoreLogic is reporting that in September, single-family rentals experienced the fastest rent growth in years.

Therefore, the suburban rental shift could be showing up in an expansion in the single-family rental market in Virginia, even as the demand for large, multifamily rental housing, particularly workforce rental housing, remains strong in the state’s large metros.

You might also like…

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Annual Building Permit Trends for Multifamily Housing Units

By Sejal Naik - June 24, 2024

The latest annual building permits data indicates fewer multifamily units are in the pipeline in Virginia’s housing market. In 2022, multifamily residential building permits in Virginia were at… Read More

Congratulations to These PM Certified Graduates!

By Virginia REALTORS® - May 15, 2024

PM Certified is a property management certification featuring coursework that enhances your knowledge of property management law, regulations, agency, leases, rental maintenance as well as provides YOU tools… Read More