When Fixed-Rate Mortgage Rates Go Up, Adjustable-Rate Mortgages Rise in Popularity

December 28, 2023

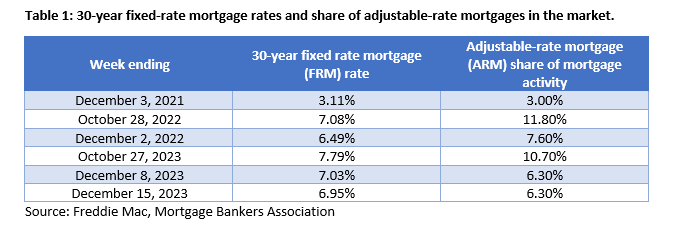

The interest rate for a 30-year fixed mortgage has been on the downward trend for the past few weeks after peaking at an almost 23-year high in October 2023. As of December 14, 2023, the average 30-year mortgage rate had simmered down to 6.95 percent. In response to such changes in the fixed-rate mortgage rates, what happens to the share of adjustable-rate mortgages in the market?

In table 1, we list the 30-year fixed-rate mortgage rate and the share of adjustable-rate mortgages at different points in time. As can be seen, when fixed-rate mortgage rates go up, the share of adjustable-rate mortgages goes up as part of the overall mortgage market activity. Conversely, when fixed-rate mortgage rates go down, the share of adjustable-rate mortgages goes down as well. In the two-year period from December 2021 through December 2023, the average 30-year fixed-rate mortgage (FRM) rate more than doubled. In the same period, adjustable-rate mortgages (ARM) gained an increased interest as seen in their rising share of total mortgage market activity.

In an adjustable-rate mortgage, the interest rate is set for a period, and then adjusts over time based on the market. Initially, ARMs typically have lower interest rates than FRMs and allow home buyers to experience significant monthly savings in the beginning. For example, a 5/1 ARM has a fixed rate for the first five years, followed by a variable rate that adjusts every year for the rest of the loan term. People opting for an ARM hope that rates will go down in the future and prioritize flexibility instead of predictability that comes with a fixed rate mortgage. As FRM rates went up over the past couple of years, ARMs became more appealing to home buyers who want to keep their initial mortgage costs as low as possible. However, it is worth noting that there is no guarantee that rates will drop in the future. Consequently, a homeowner could end up spending more on monthly payments during the loan term. This will also require a more frequent reassessment of their budget that goes towards home payments.

To summarize, when fixed rates are low, ARMs become less popular. While, as fixed rates go up, ARMs regain popularity. In the coming weeks, we expect the fixed rate mortgage rates to continue their downward trajectory. However, it is always prudent to stay informed about the different mortgage options available for potential home buyers and determine how to best utilize them based on the current interest rate environment.

For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Key Takeaways: November 2025 Virginia Home Sales Report

By Virginia REALTORS® - December 22, 2025

Key Takeaways In November, home sales activity was slower than the previous year, likely due to a combination of the beginning of holiday season along with overall economic… Read More

Look Who is Renting: 2024 Profile of Virginia Renters

By Dominique Fair - December 16, 2025

The rental market has shifted over the last year with both construction and rental prices slowing down, but even with these changes, the cost of housing remains high… Read More

Key Takeaways from NAR’s 2025 Profile of Home Buyers and Sellers

By Sejal Naik - December 8, 2025

The National Association of REALTORS® recently released its annual profile of home buyers and sellers. This report summarizes the results from a survey of home buyers and sellers… Read More