DPA One® – Freddie Mac’s “One-Stop Shop” for Down Payment Assistance Programs

November 14, 2023

Last month, Freddie Mac launched DPA One® aimed at serving as a matching tool for borrowers to a variety of down payment assistance programs nationwide. Down payment is one of the biggest hurdles on first-time home buyers’ path to homeownership. By providing access to a standardized way of comparing down payment assistance programs across the nation for free, Freddie Mac’s DPA One® aims to ease that hurdle. Virginia home buyers and housing professionals are expected to find immediate benefits of this tool. This is because, as of right now, Virginia is one of four states whose state-level housing finance authorities and local and municipal programs have all been added to DPA One®. By the end of 2023, seven states in the country will be a part of the DPA One® network list, with plans to add more states over the next few years.

DPA One® has a pretty simple interface with two main options for comparing the various programs in its network list. All you need is to set up login credentials which can be done easily.

Figure 1: Freddie Mac DPA One® landing page

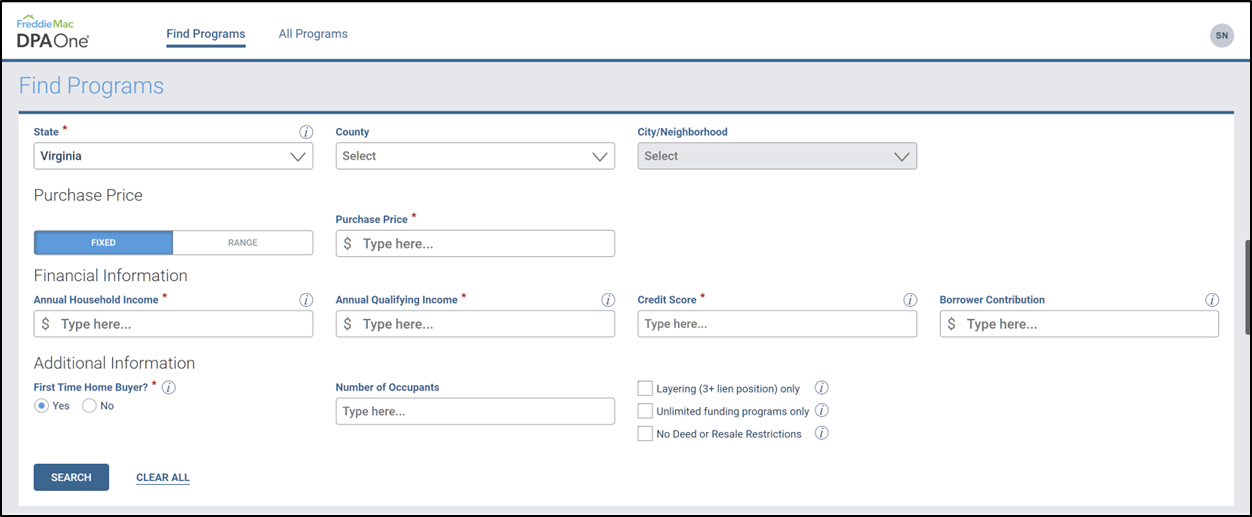

Through the first way, housing professionals or potential home buyers can enter their individual criteria such as geographic information, purchase price of the home, and personal financial information. Based on the specified criteria, the search results will provide a list of eligible programs that users can compare to find the best suited option.

Figure 2: Interface to find programs on DPA One® by entering home buyer’s information.

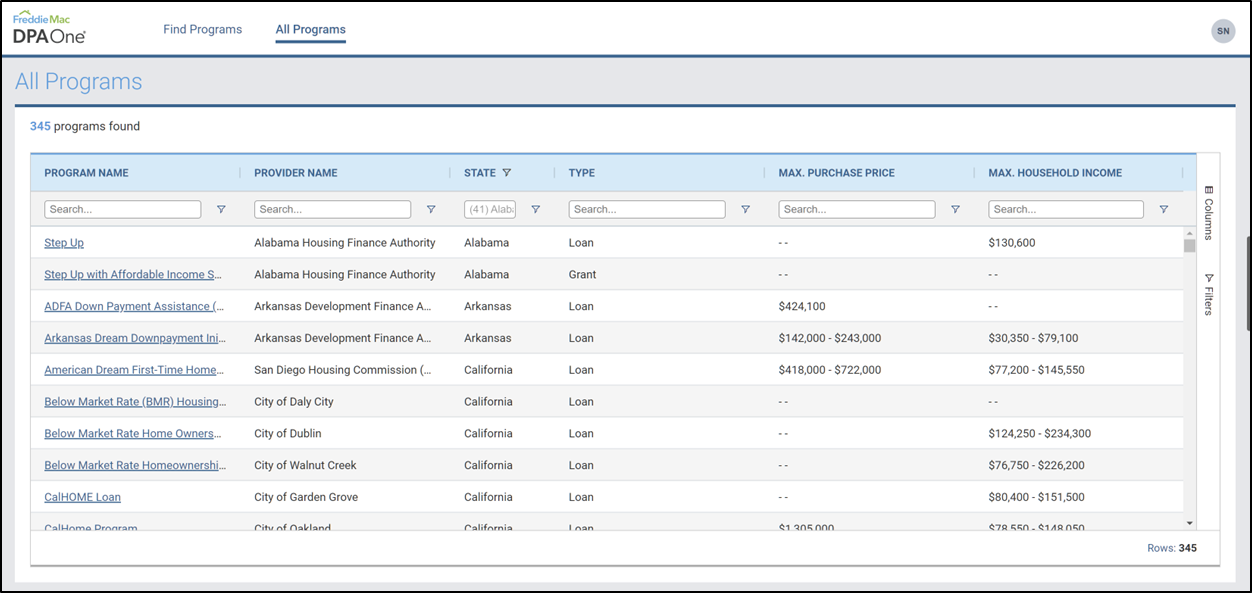

The second option of accessing the programs is sorting through a list of all available programs in the database. As of this article’s release date, there were 345 programs in the nationwide database. Users can sort this list using different criteria such as program name, provider name, state, program type, purchase price, and household income.

Figure 3: Interface to sort through all listed programs in the DPA One® network using different criteria.

Having a single database of down payment assistance programs, in the form of DPA One®, is expected to provide potential home buyers an opportunity to utilize all the resources at their disposal as well as help housing professionals present all possible options to their clients.

For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Follow Virginia REALTORS® on Social Media & Stay Updated

By Stephanie Flynn - August 8, 2024

New to the Virginia REALTORS® social media pages? We have four reasons why you should give us a follow on Facebook, Instagram, and LinkedIn! Get the Latest Virginia Housing… Read More

Your Guide to the 2024 Sales Tax-Free Weekend

By Maura Pratt - July 31, 2024

This weekend is a Sales Tax Holiday and who doesn’t love saving money? From Friday, August 2nd to Sunday, August 4th, consumers across Virginia can purchase select items… Read More

Managing Your Business and Clients While on Vacation

By Sean Olk - June 5, 2024

Memorial Day has passed, the kids are out of school, and all the signs of summer are here. Traditionally, summer is a busy time in real estate, and… Read More