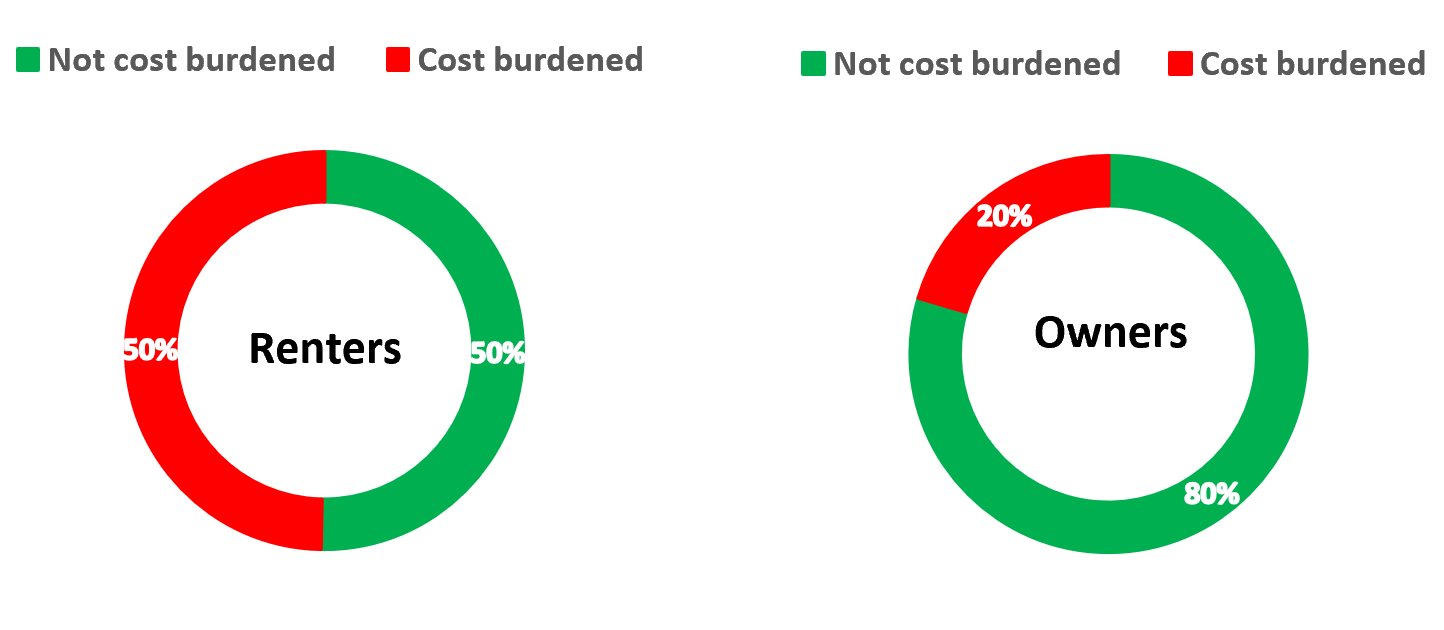

More Renters are Burdened by Housing Costs Than Homeowners

November 8, 2023

Households are considered housing cost burdened when they spend more than 30% of their income on costs such as rent or mortgage payments. Data from the Census Bureau indicates that as of 2022 about 50% of renters were housing cost burdened in the Commonwealth of Virginia. At the same time, only 20% of homeowners were housing cost burdened. This serves as proof for the trend of income not keeping up with rising housing costs. Moreover, data shows that renters tend to have lower household income than homeowners. So, the housing cost burdens are more prevalent for renters since rental costs are more likely to fluctuate and amount to a bigger share of household income as compared to housing costs for homeowners.

Figure 1: Housing costs as a percentage of income for renters and homeowners in Virginia

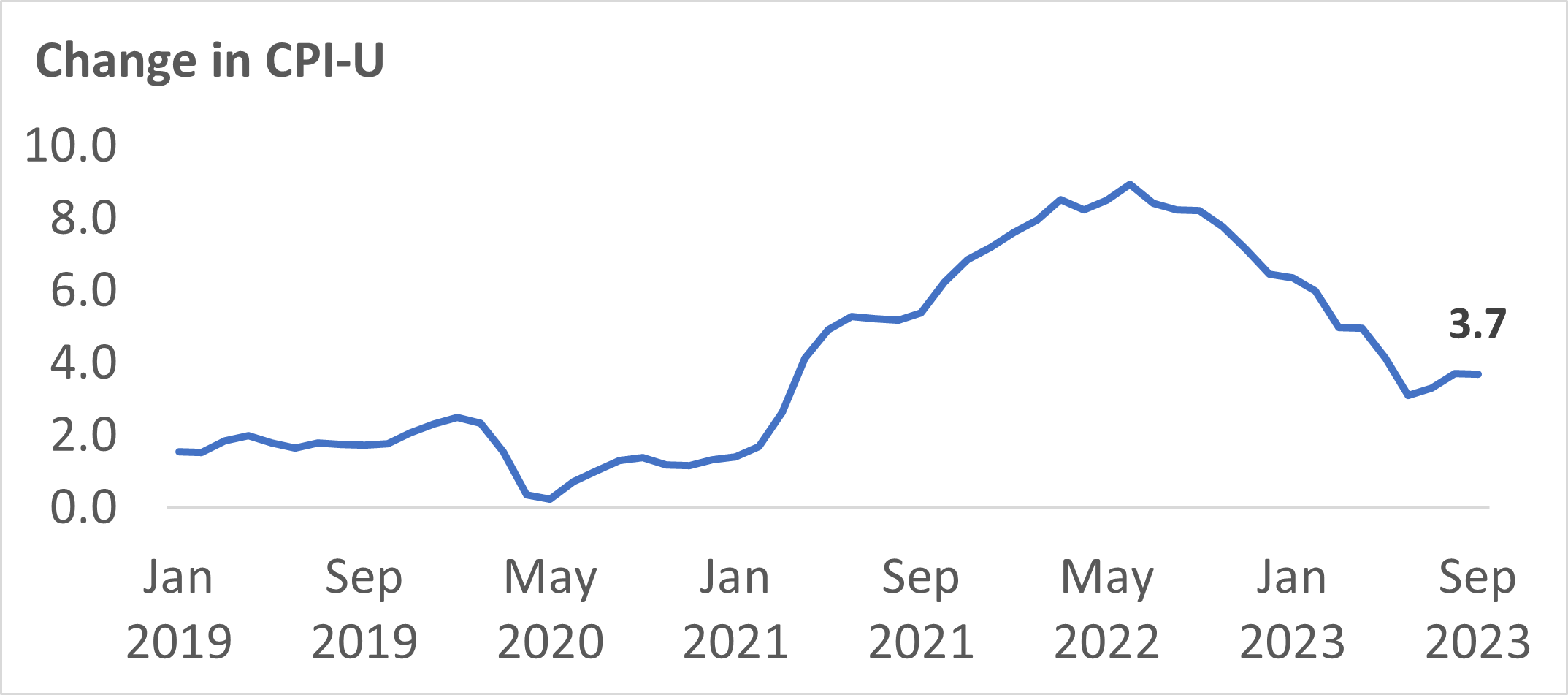

Rising prices have been causing affordability concerns across the board. After peaking in summer 2022, inflation rates have been trending down. The latest Consumer Price Index (CPI) data shows that as of September 2023, the inflation rate was 3.7%, which means that prices increased by 3.7% this September as compared to a year ago.

Figure 2: Change in CPI from January 2019 through September 2023

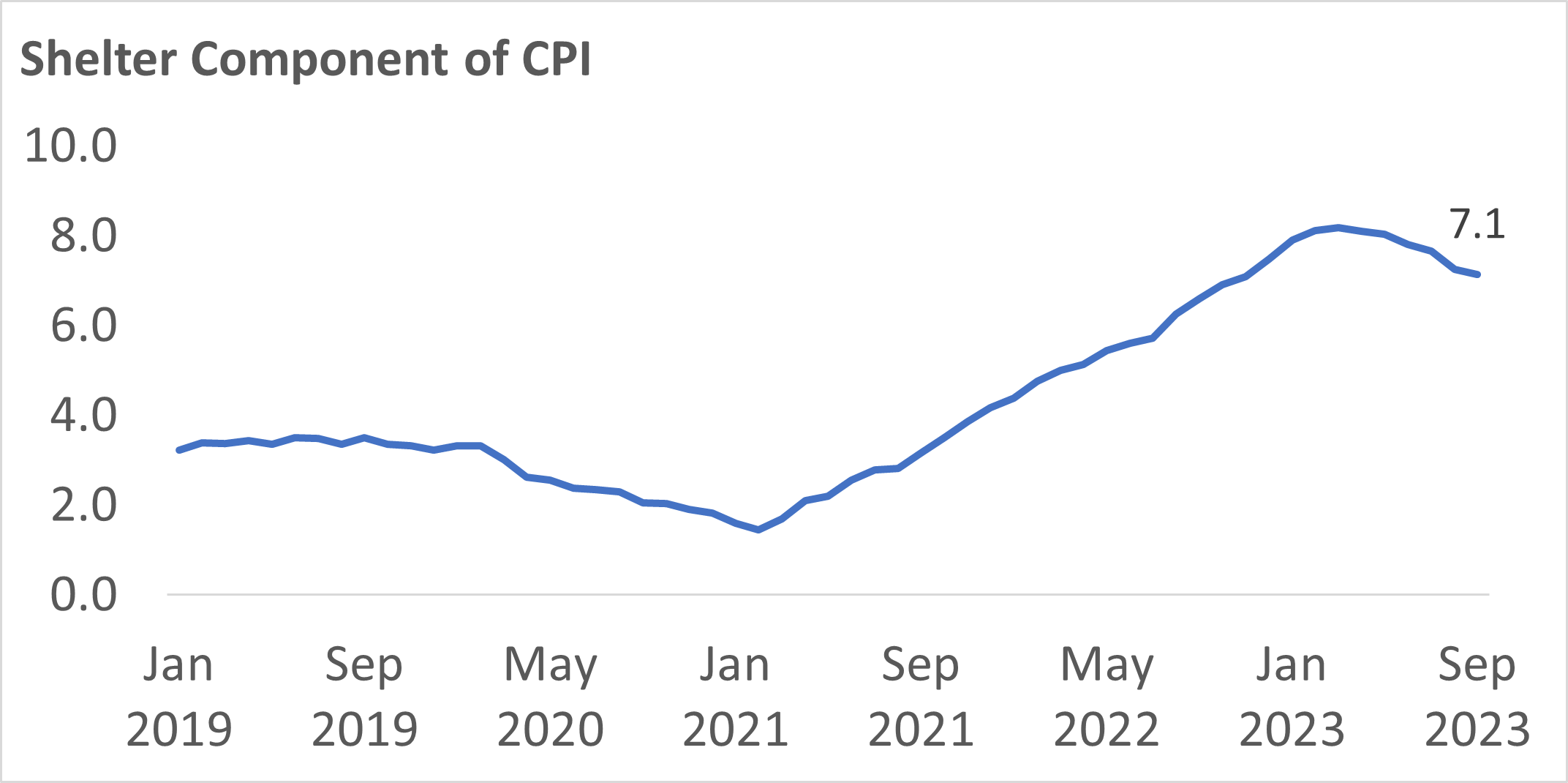

As of September 2023, the shelter component of CPI rose at 7.1%, meaning that the shelter costs were 7.1% higher than a year ago. Neither renters or owners are immune to the effects of rising prices. However, mortgage payments, which make up a majority chunk of the monthly expenses of owning a property, are less likely to fluctuate. A homeowner’s monthly payments, once they have finalized the terms of their fixed-rate mortgage, are well set. There is limited room for surprise increases in monthly costs. However, renters are subject to changes in rent payments or other costs such as amenity fees at the end of their lease terms, which are usually renewed on an annual basis. This explains why the effect of inflationary pressures has become more apparent in the housing cost burdens among renters.

Figure 3: Change in the shelter component of CPI from January 2019 through September 2023

There is a silver lining to this data and potential respite in sight for renters. Even though the shelter component of CPI has increased recently, it is worth pointing out that the shelter component tends to lag the market. The increase in rent prices last year has been shown in the CPI measure only recently. So, given the recent slowdown in rent prices, this shelter component of CPI is expected to decline. This is a welcome change for renters and it will likely ease somewhat the housing cost burdens that the renters have faced over the last couple of years.

For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Key Takeaways: February 2025 Virginia Home Sales Report

By Virginia REALTORS® - March 25, 2025

Key Takeaways There was a pullback in closed sales in February. There were 6,129 homes sold statewide this month, down 9% from last February, a reduction of 604… Read More

March Madness Meets Market Madness: Construction Trends in Virginia’s College Towns

By Abel Opoku-Adjei - March 18, 2025

Ongoing economic concerns are impacting both single-family and multifamily construction across the country. According to the National Association of Home Builders, multifamily construction starts are expected to decline… Read More

See It, Want It, Buy It: Single Female Homeownership

By Dominique Fair - March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a… Read More