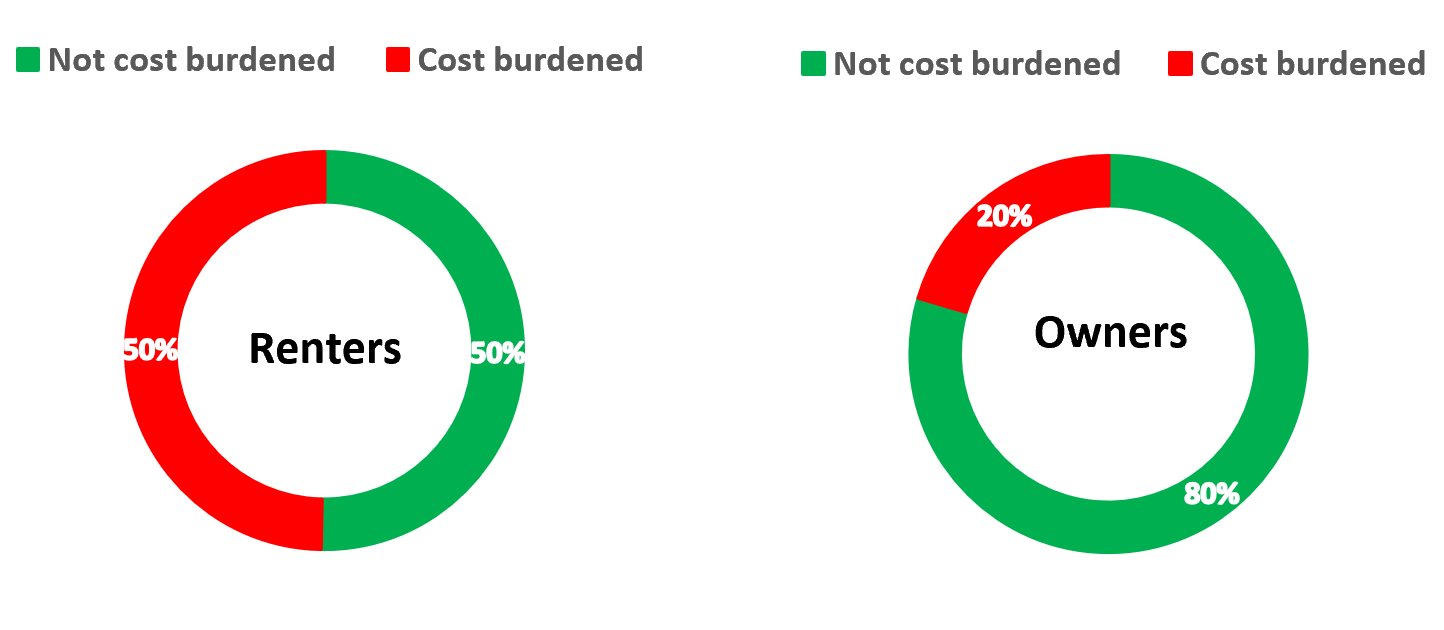

More Renters are Burdened by Housing Costs Than Homeowners

November 8, 2023

Households are considered housing cost burdened when they spend more than 30% of their income on costs such as rent or mortgage payments. Data from the Census Bureau indicates that as of 2022 about 50% of renters were housing cost burdened in the Commonwealth of Virginia. At the same time, only 20% of homeowners were housing cost burdened. This serves as proof for the trend of income not keeping up with rising housing costs. Moreover, data shows that renters tend to have lower household income than homeowners. So, the housing cost burdens are more prevalent for renters since rental costs are more likely to fluctuate and amount to a bigger share of household income as compared to housing costs for homeowners.

Figure 1: Housing costs as a percentage of income for renters and homeowners in Virginia

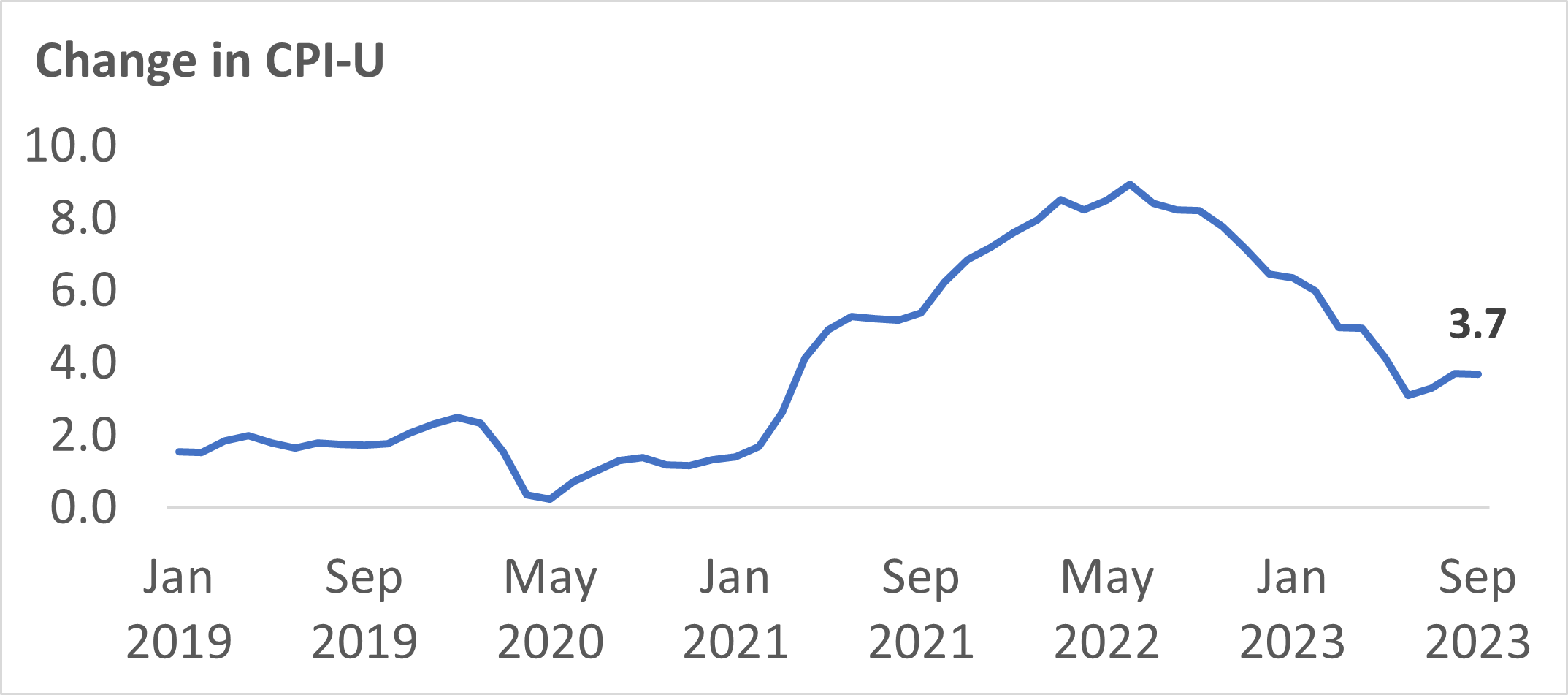

Rising prices have been causing affordability concerns across the board. After peaking in summer 2022, inflation rates have been trending down. The latest Consumer Price Index (CPI) data shows that as of September 2023, the inflation rate was 3.7%, which means that prices increased by 3.7% this September as compared to a year ago.

Figure 2: Change in CPI from January 2019 through September 2023

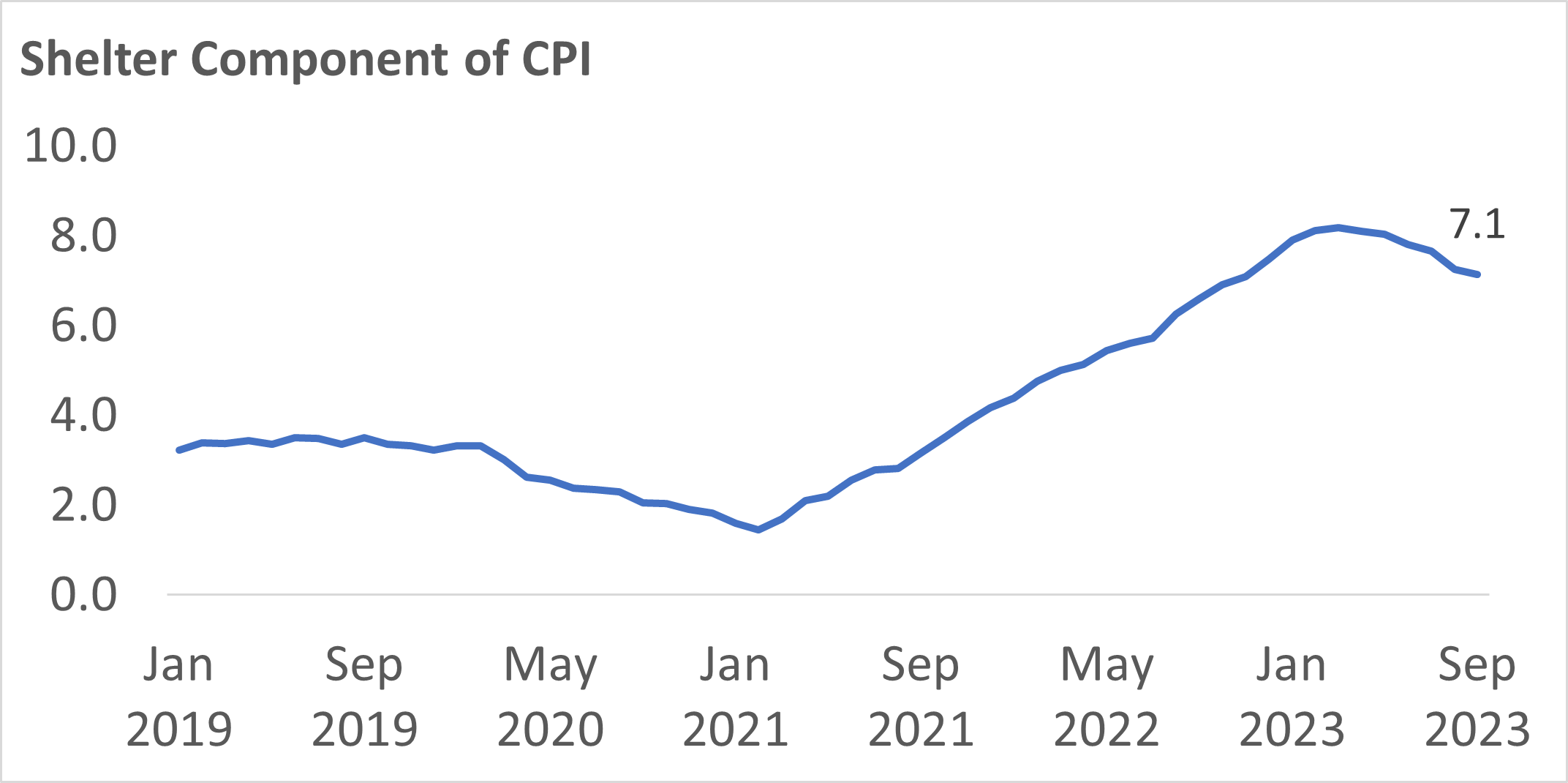

As of September 2023, the shelter component of CPI rose at 7.1%, meaning that the shelter costs were 7.1% higher than a year ago. Neither renters or owners are immune to the effects of rising prices. However, mortgage payments, which make up a majority chunk of the monthly expenses of owning a property, are less likely to fluctuate. A homeowner’s monthly payments, once they have finalized the terms of their fixed-rate mortgage, are well set. There is limited room for surprise increases in monthly costs. However, renters are subject to changes in rent payments or other costs such as amenity fees at the end of their lease terms, which are usually renewed on an annual basis. This explains why the effect of inflationary pressures has become more apparent in the housing cost burdens among renters.

Figure 3: Change in the shelter component of CPI from January 2019 through September 2023

There is a silver lining to this data and potential respite in sight for renters. Even though the shelter component of CPI has increased recently, it is worth pointing out that the shelter component tends to lag the market. The increase in rent prices last year has been shown in the CPI measure only recently. So, given the recent slowdown in rent prices, this shelter component of CPI is expected to decline. This is a welcome change for renters and it will likely ease somewhat the housing cost burdens that the renters have faced over the last couple of years.

For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More