Housing Programs for Millennial First-time Home Buyers

July 8, 2022

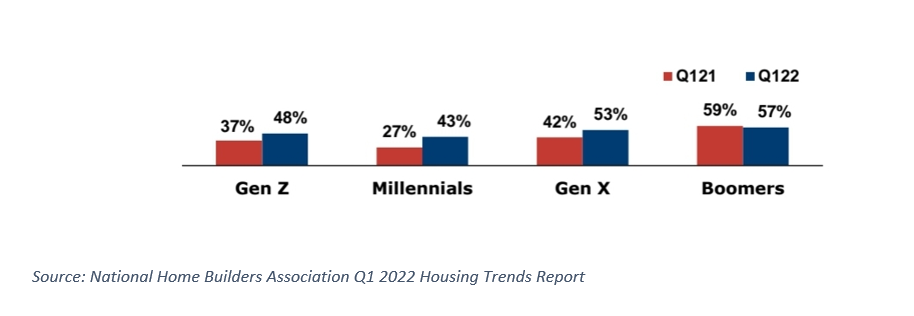

Housing affordability has been an issue in the U.S. for many years, but in this current market millennial first-time home buyers have been some of the hardest hit. The National Association of Realtors reported that millennials make up 43% of home buyers across all generations. Despite this jump in homeownership among millennials, many still feel that they cannot afford a home. A report by the National Association of Homebuilders showed that in the first quarter of 2022, 43% of active millennial buyers listed difficulty finding affordable housing as the main reason they stopped looking, up from 27% last year.

With mortgage rates rising and housing prices continuing to climb, many millennials looking for their first home have been priced out of the market. What can help relieve the financial burden of home buying for millennials? One of those relievers is taking advantage of housing programs designed to aid those buying a house for the first time. Virginia has several state programs, the two most notable being Virginia Housing and Virginia Department of Housing and Community Development. Below is a breakdown of each program’s benefits and requirements for each initiative.

Virginia Housing was created in 1972 with the intent of providing affordable housing to Virginians. They have three major programs:

- Down Payment and Closing Cost Assistance Grant gives borrowers 2% of the purchase price to apply towards a down payment or closing costs on a home.

- The benefits of these grants are that each offers a Mortgage Credit Certificate (MCC), a dollar-for-dollar credit toward your federal income tax. In addition, neither grant must be repaid.

- There are requirements for both grants though. The Down Payment Assistance Grant must be used with an eligible loan from Virginia Housing, and the home must be your primary residence. The Closing Cost Assistance Grant must be used with a Rural Housing Service or Veterans Affairs loan and the mortgage must be locked down prior to receiving the grant.

- A conventional loan from Virginia Housing is a 30-year fixed loan used by first-time and repeat home buyers. With this loan, less cash is needed at closing. Some of the requirements are a 3% down payment, a 640 credit score, and a debt-to-income ratio of 45%.

- Virginia Housing Plus Second Mortgage combines the first Virginia housing mortgage with a second mortgage to cover down payment costs. This loan requires borrowers to have 1% of the purchase price available at closing and have a conventional or FHA loan from Virginia Housing.

The second state program is Virginia DHCD, a state agency with several programs including the Homeownership Down Payment Assistance Program (DPA) and Virginia Individual Development Accounts (VIDA).

- DPA provides gap financing for first-time home buyers below 80% of the area median income. Buyers can receive up to 10% of the sale price and an additional $2,500 towards closing. Program applicants must use the property as their primary residence, receive homeownership counseling, and put 1% of the sales price toward the home.

- VIDA helps potential buyers save for a down payment matching eight dollars for every one dollar saved. Individuals applying must complete 14 hours financial management training in 6 to 24 months and meet income and household limits.

There are also regional and local housing programs in Virginia that can be found on the US Department of Housing and Urban Development site.

You might also like…

Top Paint Color Trends for 2025

By Stephanie Flynn - January 29, 2025

We know you’re busy helping your clients get their homes ready for the market. Check out the latest paint trends for this new year, how to make the… Read More

Heat Up Your Business with Virginia REALTORS® Member Benefits

By Stephanie Flynn - January 23, 2025

It may be a dark and frigid time of year, but don’t let that stop your business from moving right along! If the winter temperatures are keeping you… Read More

Winter Curb Appeal: From Frosty to Fabulous

By Stephanie Flynn - December 10, 2024

The market doesn’t stop for the weather! This winter season, your clients may be hosting everything from open houses to holiday gatherings. Provide them with some tips on… Read More