Apartment Landlords May Have Offered Rent Concessions Last Year, But Those Days Are Over

July 21, 2021

Rent concessions, or rent incentives, are when landlords offer a month or more of free rent, waive the deposit, or give other perks in order to keep or attract tenants. According to Apartments.com, across the U.S., the share of landlords offering concessions is way down. Last November, about 60% of downtown apartments listed on Apartments.com offered concessions. In June of 2021, that share had dropped to 35%. We are seeing similar trends in Virginia markets, though the pull back in rent concessions this summer is most dramatic in higher-end apartment buildings in Northern Virginia.

Apartment Demand is Surging

Apartment rents are on the rise and vacancy rates are falling as the economy re-opens and young people are looking for rental housing in urban communities. Despite dire warnings about people deserting the cities, in Virginia, most urban apartment markets performed relatively well during the pandemic. This summer, there is a strong resurgence of apartment demand, which is being driven by several factors:

- As COVID-19 vaccination rates are rising and many people are heading back to the office, at least part-time, there is renewed interest in rental housing near jobs.

- College graduates and young workers who moved back home during the pandemic are back on the rental market at the same time as this year’s college graduates. As a result, demand from this young cohort could be nearly double what is typical.

- Double-digit home price appreciation and a super competitive for-sale market have pushed homeownership out of reach for many individuals and families, leading them back to the rental market.

According to Apartments.com, nationwide, rents are up 7.5% percent so far this year, three times faster than normal. In Virginia, average rents are expected to grow by double-digit rates in 2021.

Landlords Pull Back on Concessions

Many landlords had either cut or frozen rents during the COVID-19 pandemic. Some also offered concessions or incentives to keep tenants in their units as more renters stopped renewing leases. However, as economic conditions have been improving, landlords are pulling back on those incentives and are beginning to raise rents.

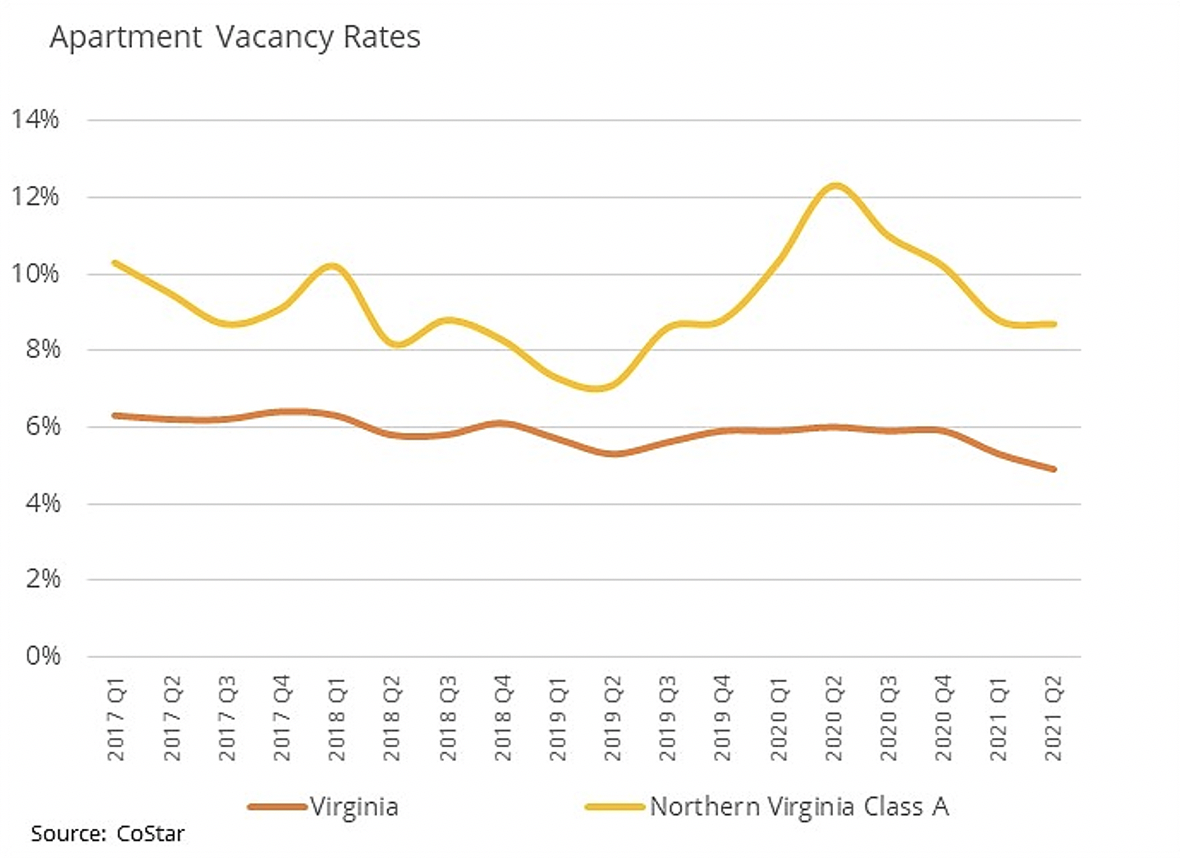

In Virginia, the biggest impacts of COVID-19 on the rental market occurred in Northern Virginia, particularly among Class A properties—that is, buildings with the most amenities and highest rents. While apartment vacancy rates overall stayed fairly stable in Virginia, Northern Virginia Class A vacancy rates skyrocketed from about 7% pre-pandemic to more than 12% in the second quarter of 2020.

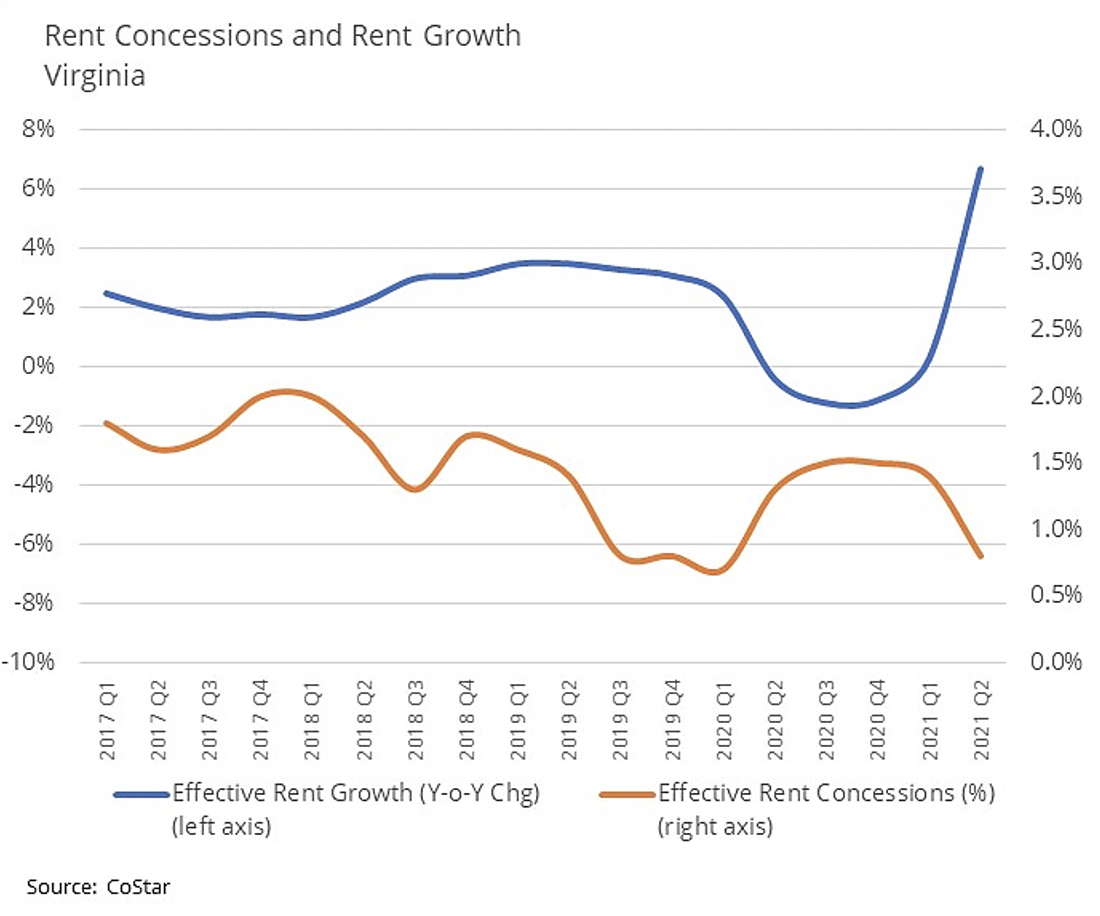

Statewide, rents fell and rent concessions rose slightly in 2020. During the height of the pandemic, the average effective rent for an apartment in Virginia fell by about 1%. Concessions, which amounted to about 0.8% of total rent, on average, before the pandemic, more than doubled in 2020. Even at their peak, however, the average rent concessions statewide totaled just 1.5% of asking rent. In the first half of 2021, concessions have returned to pre-pandemic levels and the average statewide rent has climbed sharply.

Northern Virginia’s Apartment Market Took a Hit During COVID-19

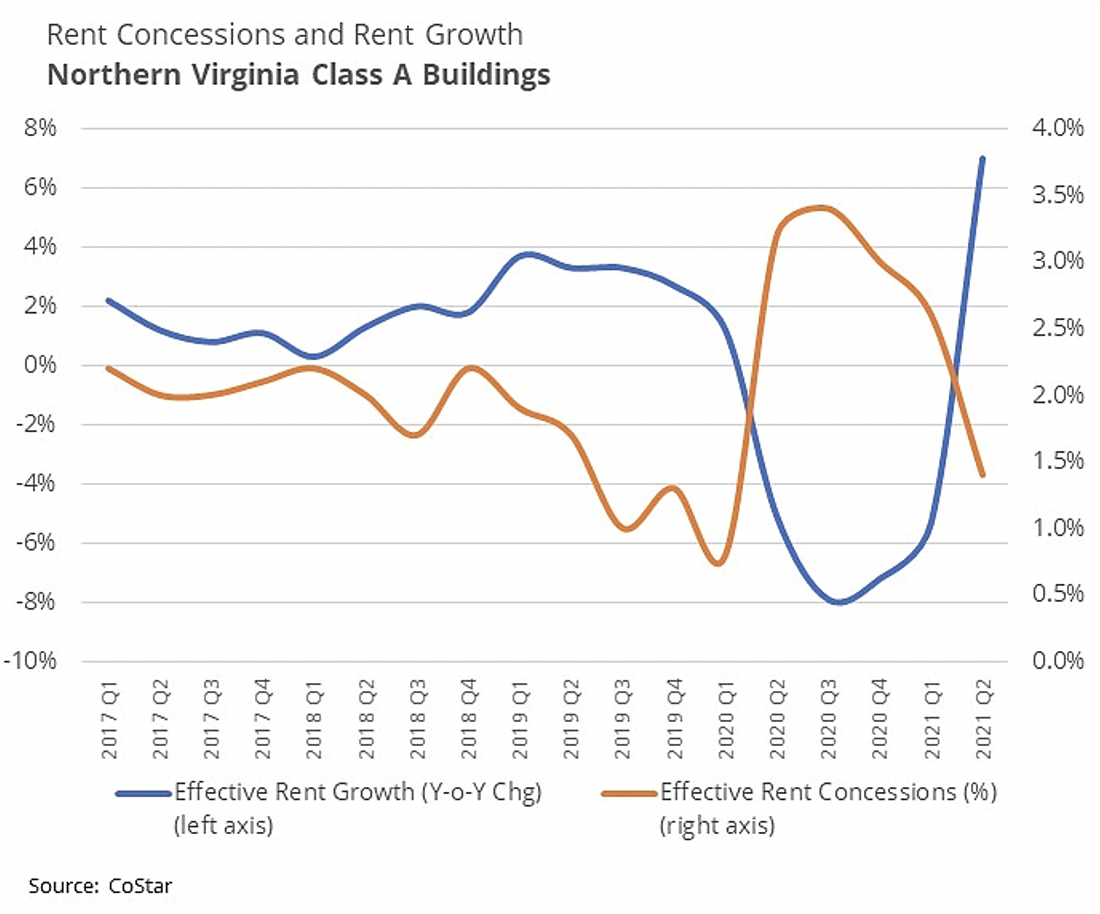

Much of the movement in the apartment market during the pandemic has been driven by the Northern Virginia market. Before the pandemic, average Class A rents in Northern Virginia were rising by about 2% annually. But in 2020, average rents plummeted by nearly 8% as a result of the COVID-19 pandemic.

Rent concessions surged in these higher-end properties, as landlords scrambled to keep existing tenants and tried to attract reluctant new tenants. Average rent concessions rose from about 1% of total rent before the pandemic to 3.4% last summer.

While rents recovered in Q1 2021 in other markets in Virginia, average rents in Class A buildings in Northern Virginia did not begin to rise until the second quarter of this year, but they were up strongly. Concessions have also fallen back dramatically in Northern Virginia Class A properties, returning to levels that are near pre-pandemic levels and are actually lower than what concessions were back in 2017 through 2019.

Goodbye to Concessions, Hello to Fast Rent Growth

In 2021, apartment demand is expected to surge throughout the country, including across Virginia. Renters can expect to face more competition for units and will have less bargaining power. Landlords will be testing the extent to which they can push rents up and find willing tenants.

To find out more about trends in Virginia’s apartment market and an outlook for 2021, check out our Q2 2021 Multifamily Market Report.

Click here to send any comments or questions about this piece to Virginia REALTORS® Chief Economist Lisa Sturtevant, PhD.

*Information as of 07/21/21

You might also like…

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Annual Building Permit Trends for Multifamily Housing Units

By Sejal Naik - June 24, 2024

The latest annual building permits data indicates fewer multifamily units are in the pipeline in Virginia’s housing market. In 2022, multifamily residential building permits in Virginia were at… Read More

Congratulations to These PM Certified Graduates!

By Virginia REALTORS® - May 15, 2024

PM Certified is a property management certification featuring coursework that enhances your knowledge of property management law, regulations, agency, leases, rental maintenance as well as provides YOU tools… Read More