In Most Virginia Markets, Apartment Rents Have Been Rising

May 18, 2021

Over the past year, the apartment market has performed better than many had expected, but there have been upheavals in some parts of the country, and in most Virginia markets, apartment rents have been rising. National media reports have focused in particular on declining rents in the nation’s biggest cities, including New York and San Francisco. However, in most markets—including in most neighborhoods in Virginia—demand for rental housing has remained strong and rents have been rising throughout the pandemic.

Urban Flight?

While there certainly have been stories of renters leaving big cities and landlords offering concessions to keep tenants, overall, the exodus from cities has been significantly overstated. The pandemic has offered an important reminder that every market is different.

In Virginia, there has been no widespread flight from urban neighborhoods. But it is clear that in a few urban markets, there was a softening in the market, particularly in some Northern Virginia submarkets where there had been an overbuilding of luxury apartment buildings before COVID-19 hit. In other neighborhoods, the multifamily rental housing market fared well during the past 12 months.

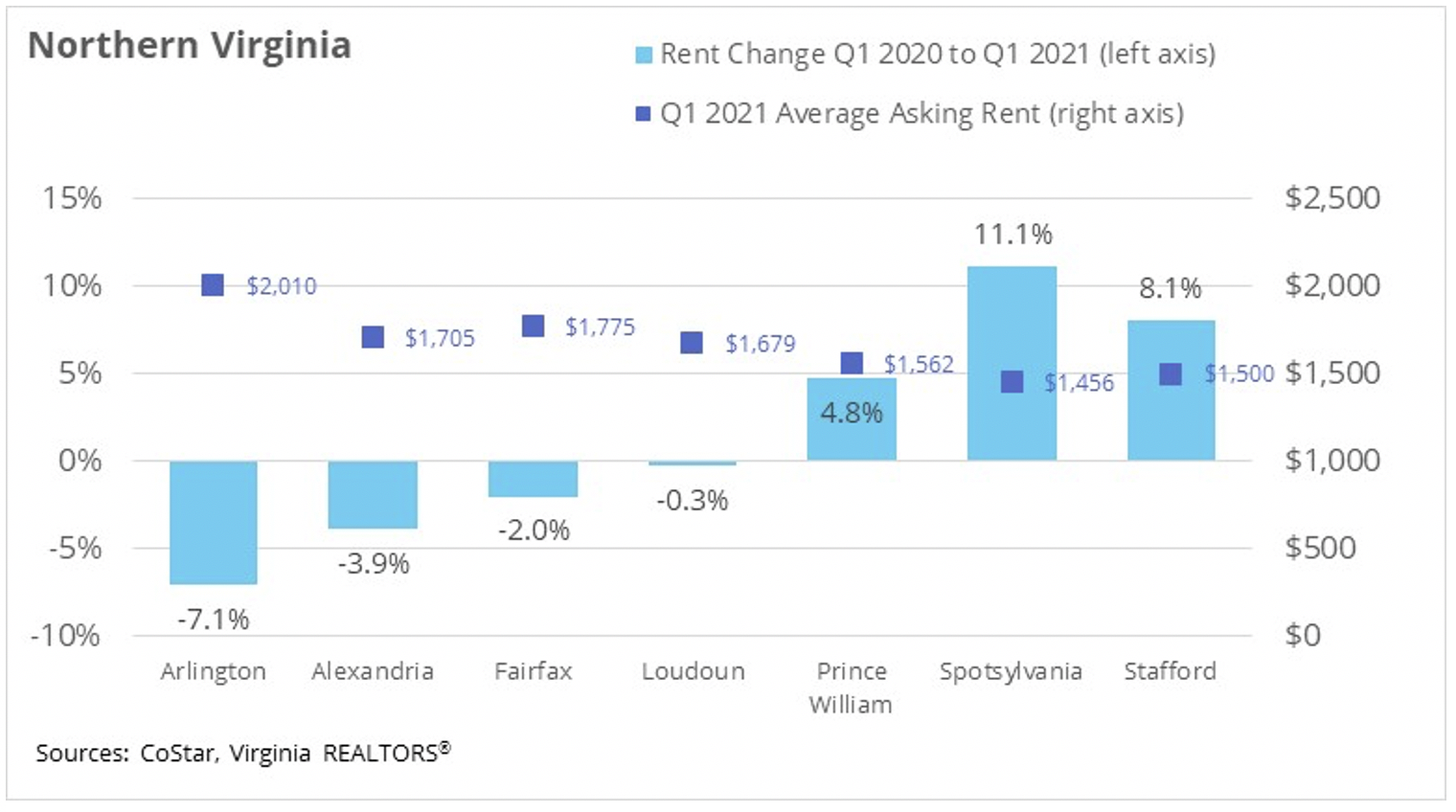

In Northern Virginia, there were declines in the average asking apartment rents in the highest-cost markets. In Arlington County, the 1st quarter 2021 average rent for units in large multifamily buildings (i.e., buildings with 50 or more units) was over $2,000. Between Q1 2020 and Q1 2021, the average rent in Arlington County declined 7.1%. Average rents declined in the City of Alexandria (-3.9%) and Fairfax County (-2.0%) and were basically flat in Loudoun County (-0.3%). In suburban markets in Northern Virginia, where rents were somewhat lower, average rents in multifamily rental buildings increased over the past 12 months. For example, the average rent in Spotsylvania County increased by 11.1% between Q1 2020 and Q1 2021, while the average apartment rents in Stafford County was 8.1%.

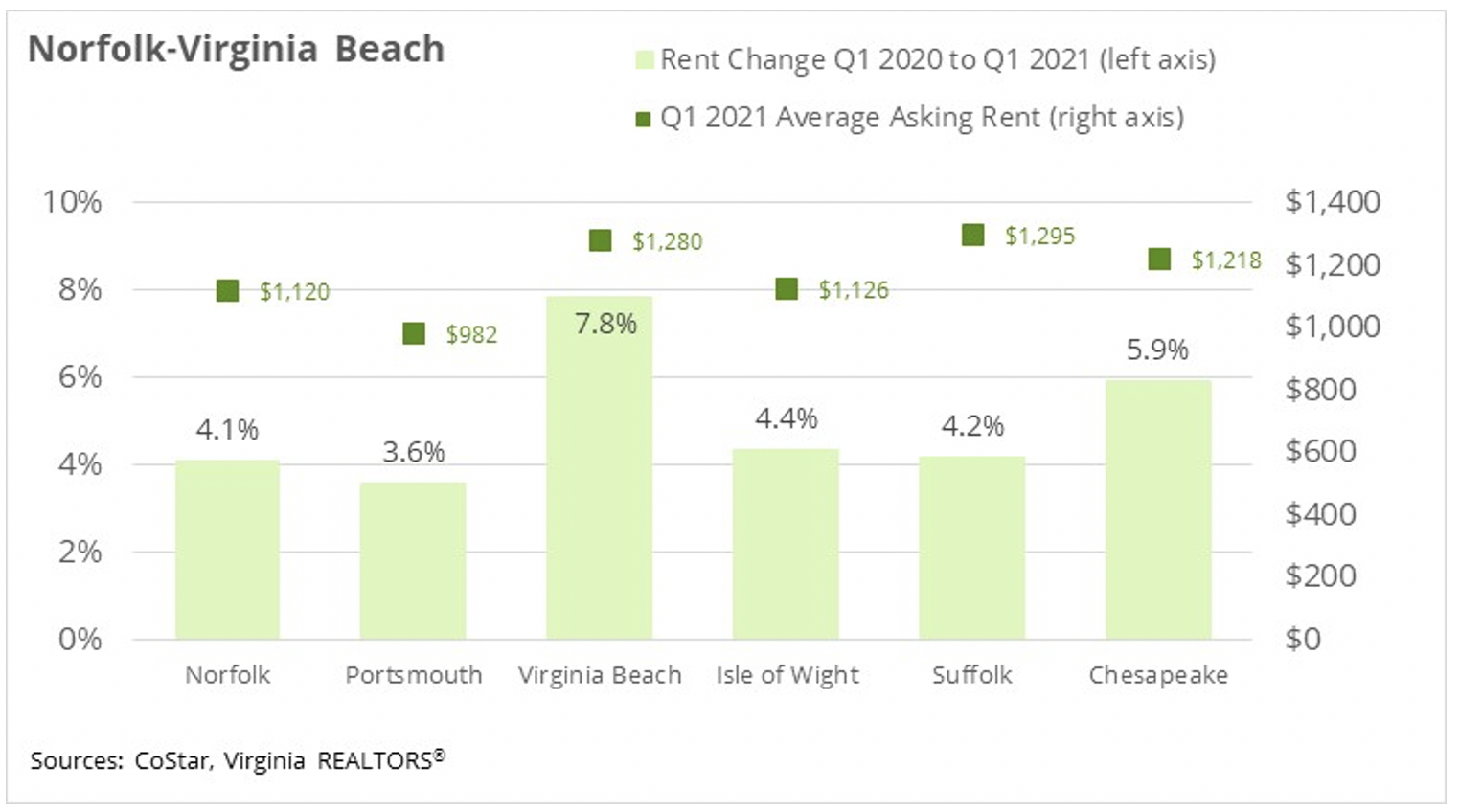

Northern Virginia is the only part of the state where rents in large multifamily buildings have declined during the COVID-19 pandemic. In the Norfolk-Virginia Beach region, average rents increased across local markets. Rent growth was fastest in the City of Virginia Beach (+7.8%) and the City of Chesapeake (+5.9%). Based on data on rents in multifamily buildings, there is no evidence of urban flight in this region of the state.

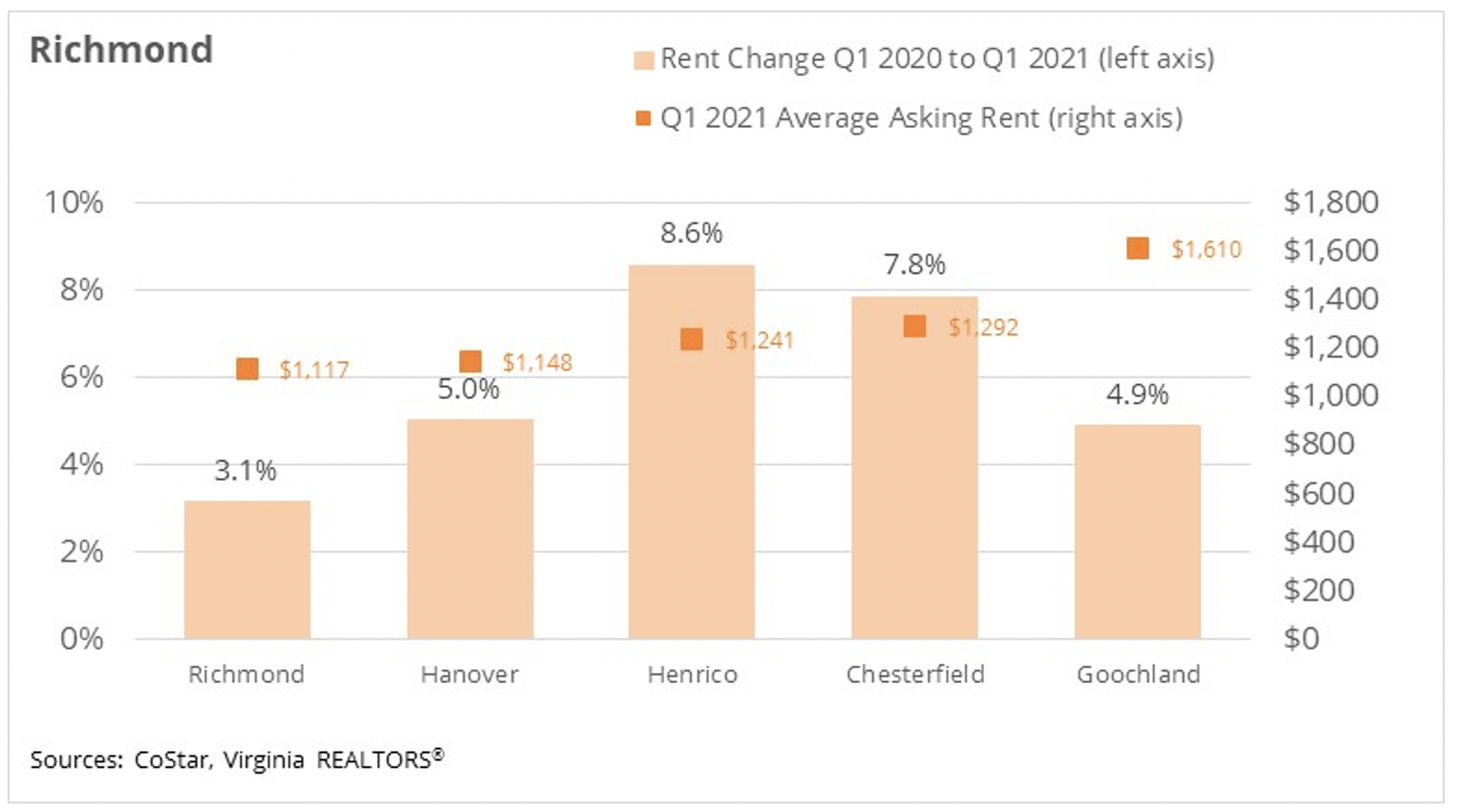

There was similar strong rent growth in the Richmond region. While average rents increased most quickly in suburban markets, rents were up in the city, as well. Between Q1 2020 and Q1 2021, the average rent in Henrico County increased by 8.6%, while the average rent in Chesterfield County increased by 7.8% over that same time period. In the City of Richmond, the average rent climbed 3.1%, which was lower than suburban rent growth but still indicative of strong demand for rent housing in the city.

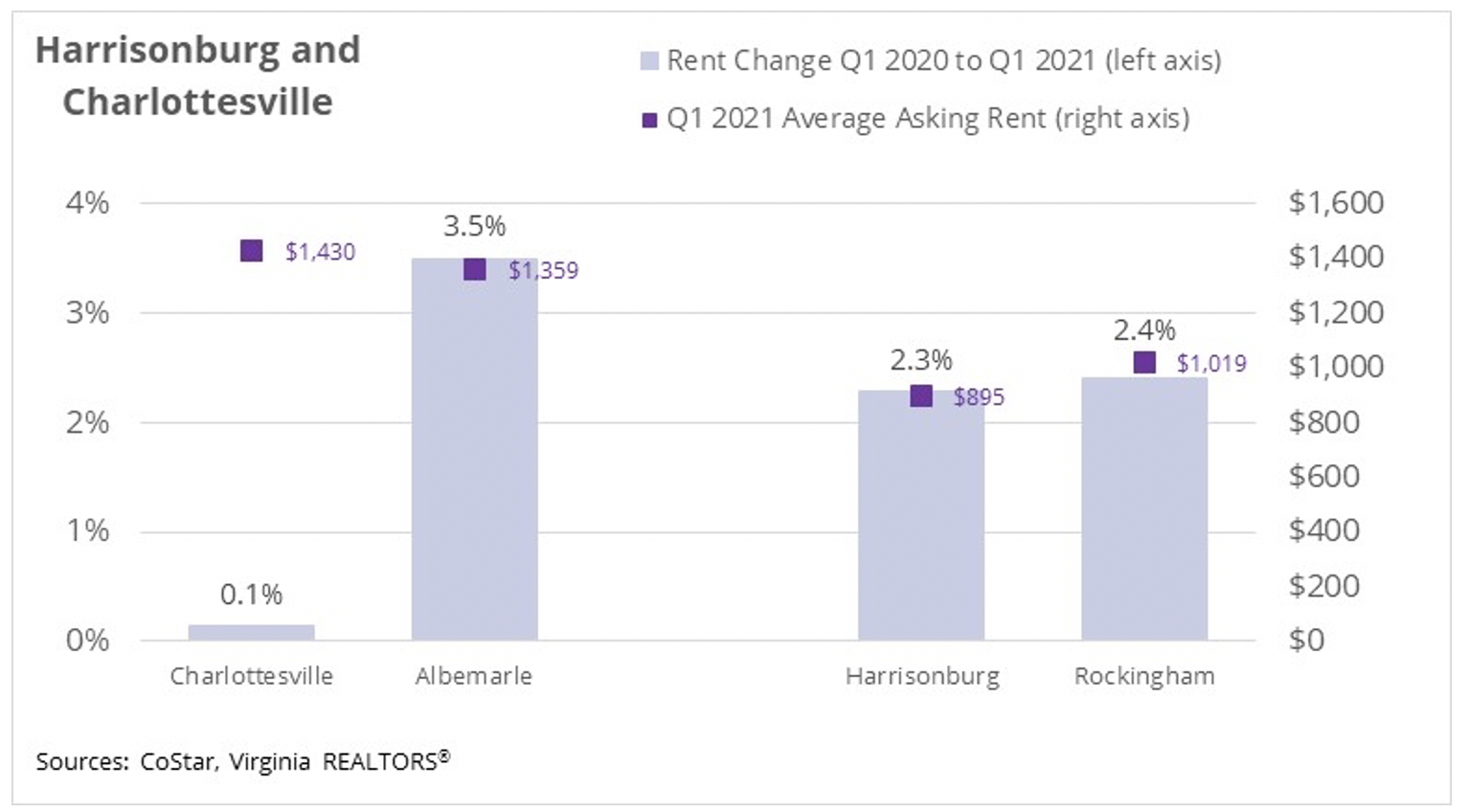

Rents were generally up in the state’s smaller markets as well. In Charlottesville, the average multifamily rent was basically unchanged between Q1 2020 and Q1 2021, but the average rent grew 3.5% in Albemarle County over that same time. Slower rent growth in the City of Charlottesville could indicate stronger demand for rental housing outside of the city but could also indicate a strong shift to homeownership in the City.

In the Harrisonburg market, rents were up between 2.3% and 2.4% in the City of Harrisonburg and in Rockingham County.

Outlook for Rents

The multifamily rental market in most places around Virginia has been very resilient during the downturn. There are several key reasons why the outlook for multifamily rents in Virginia is positive for 2021.

- As the economy continues to improve, young adults who have moved back in with their parents or who remained living with roommates during the pandemic will be looking to move into their own place. Some will be ready for homeownership, but the majority will be looking for rental housing, which will keep demand high.

- The frenzied for-sale market has pushed home prices up, keeping homeownership out of reach for some prospective homebuyers, particularly first-time buyers. Many individuals and families that want to buy in 2021 may find themselves left out and will remain in the rental market.

- Remote work will continue to fuel demand for suburban housing, including rental housing in the suburbs. However, as the economy opens up, more people will be returning to the office. Even if a majority of workers only return to the office part-time, there will be renewed interest in housing near employment centers.

For more information on the residential real estate market in Virginia, be sure to check out the information and resources available on Virginia REALTORS® website.

Click here to send any comments or questions about this piece to Virginia REALTORS® Chief Economist Lisa Sturtevant, PhD.

*Information as of 05/18/21

You might also like…

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Annual Building Permit Trends for Multifamily Housing Units

By Sejal Naik - June 24, 2024

The latest annual building permits data indicates fewer multifamily units are in the pipeline in Virginia’s housing market. In 2022, multifamily residential building permits in Virginia were at… Read More

Congratulations to These PM Certified Graduates!

By Virginia REALTORS® - May 15, 2024

PM Certified is a property management certification featuring coursework that enhances your knowledge of property management law, regulations, agency, leases, rental maintenance as well as provides YOU tools… Read More