Stimulus Payments = Down Payments?

March 24, 2021

Last week, stimulus payments were sent out to about 100 million households across the country. This stimulus marks the third round of Federal government payments to households to help reduce the financial pain brought on by the COVID-19 pandemic and recession. Some prospective home buyers in Virginia may be able to parlay these checks into a down payment, particularly in markets where home prices are still relatively low.

Stimulus Payments to Households

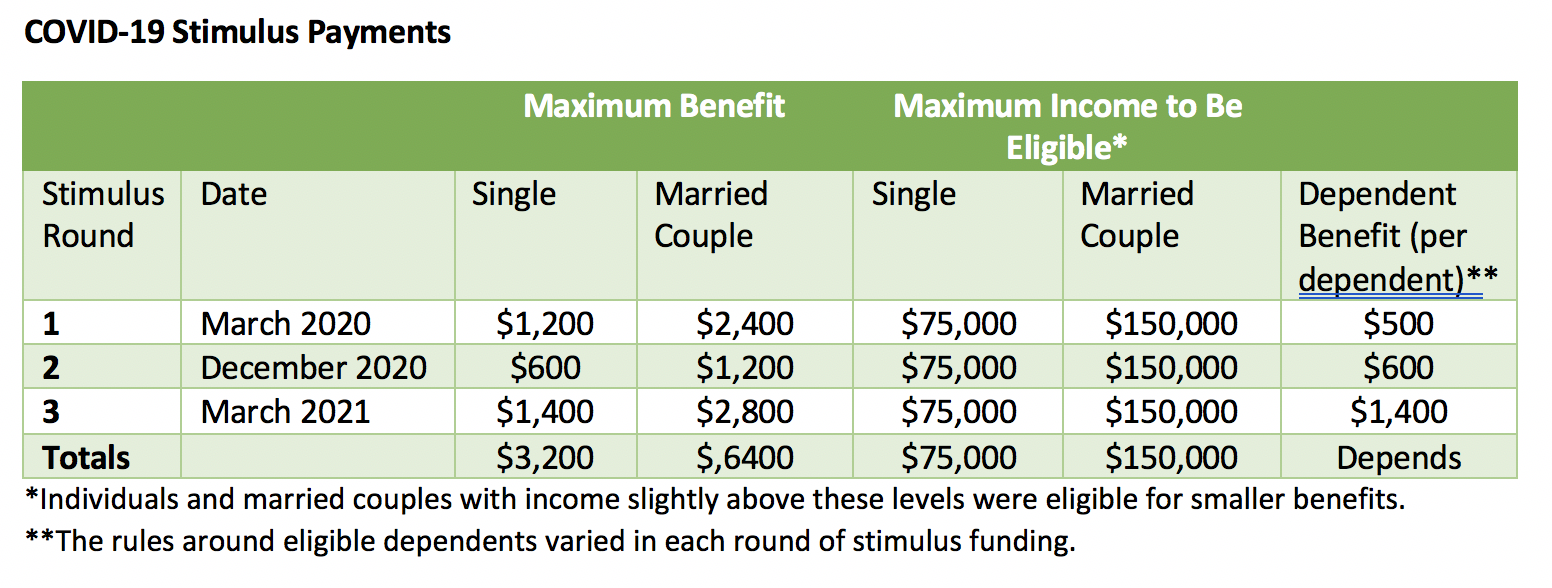

Since March 2020, Congress has passed legislation authorizing three rounds of payments to households. These stimulus packages also included loans and grants for businesses, funding to state and local governments, and resources for public health initiatives.

Individuals with incomes up to $75,000 will have received $3,200 in direct stimulus checks over the past 12 months. Married couples with incomes up to $150,000 will have received $6,400. (Individuals and married couples with somewhat higher incomes received smaller payments.) During each round of stimulus, families also were eligible for additional dependent benefits.

In Virginia, nearly three quarters of individuals and families had incomes that meant they were eligible to receive full stimulus checks over the past year. Therefore, an estimated 2.3 million households in Virginia should have received the maximum COVID-19 stimulus benefits.

Using Stimulus Benefits for a Down Payment

Financial experts are generally in agreement that there are some smart ways people should use their stimulus benefits. The most important advice is to use the government payment to cover urgent needs (e.g, rent, food, health care expenses, urgent car repairs). Other recommendations are to use stimulus checks to pay down credit card debt, start an emergency fund, or invest in an IRA or 529 plan.

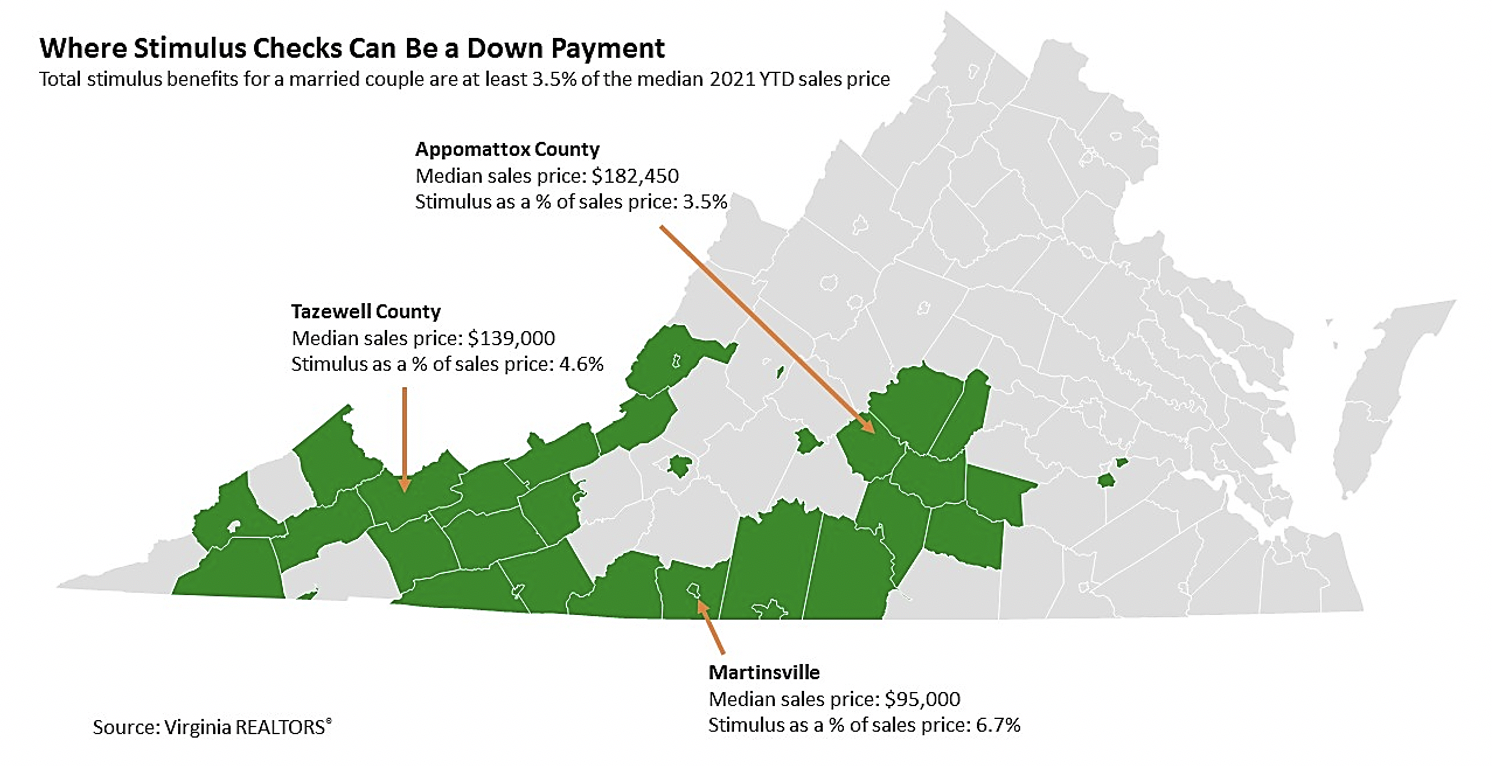

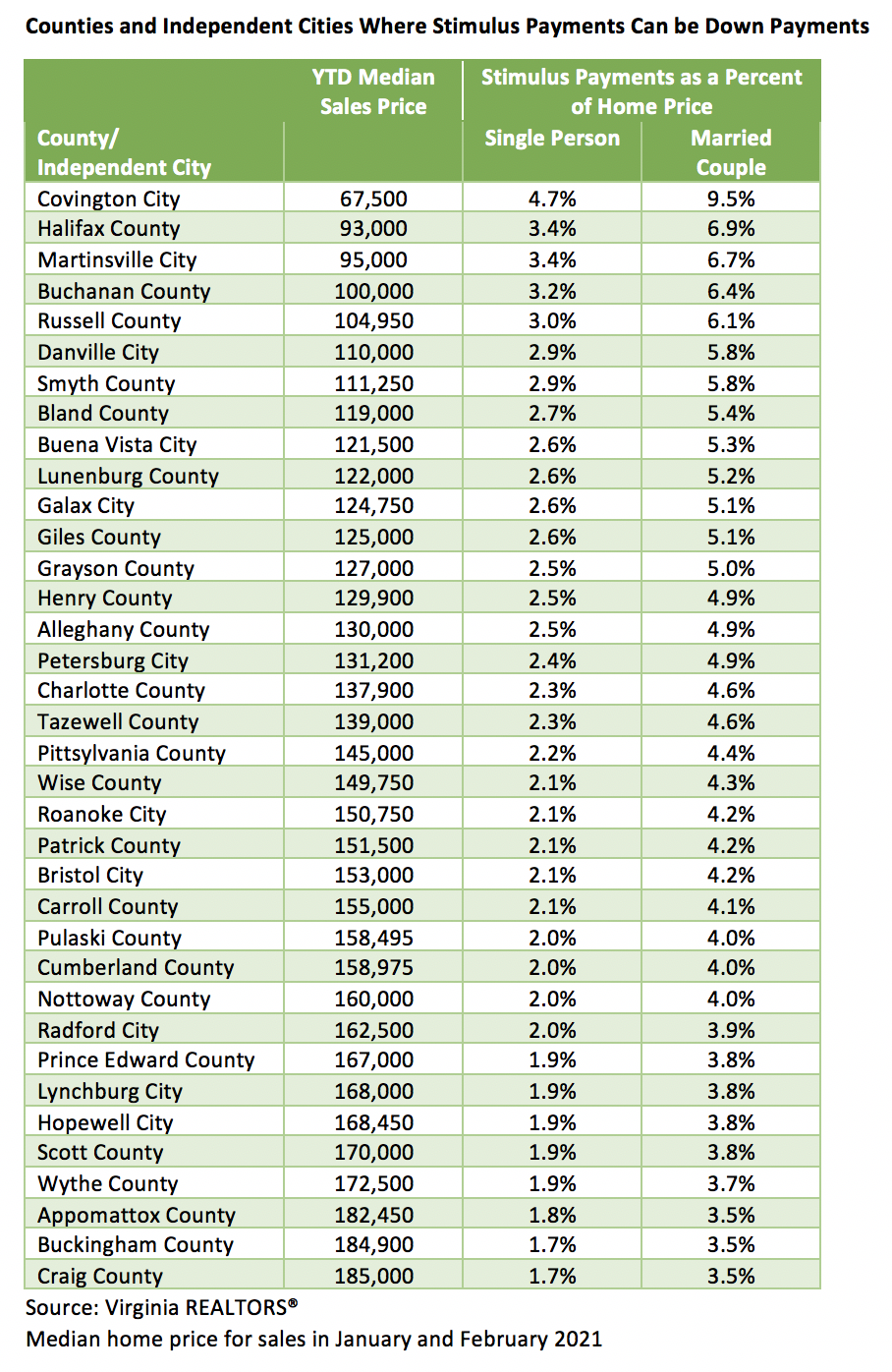

Some households may also find that the extra income they have received this year will make it possible to purchase a home. There are 36 counties and independent cities in Virginia where the total stimulus payments received by a married couple household is sufficient to cover a 3.5% down payment on the typical home. For example, in Appomattox County, the year-to-date (YTD) median sales price is $182,000. The total stimulus payment a married couple would have received totals exactly 3.5% of that sales price. In Tazewell County, stimulus payments total 4.6% of the YTD median sales price. In the City of Martinsville, where home prices are lower, the three rounds of stimulus payments sum to 6.7% of the YTD median home price.

Home ownership is a good investment. Home ownership also brings other benefits to individuals, families, and local communities. REALTORS® working with prospective buyers should always counsel them to ensure their financial situations are in order before buying a home. For those who are ready to purchase a home, stimulus payments could be an important source of a down payment in many local markets across Virginia.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More