5 Ways COVID-19 Has Changed the Housing Market

March 19, 2021

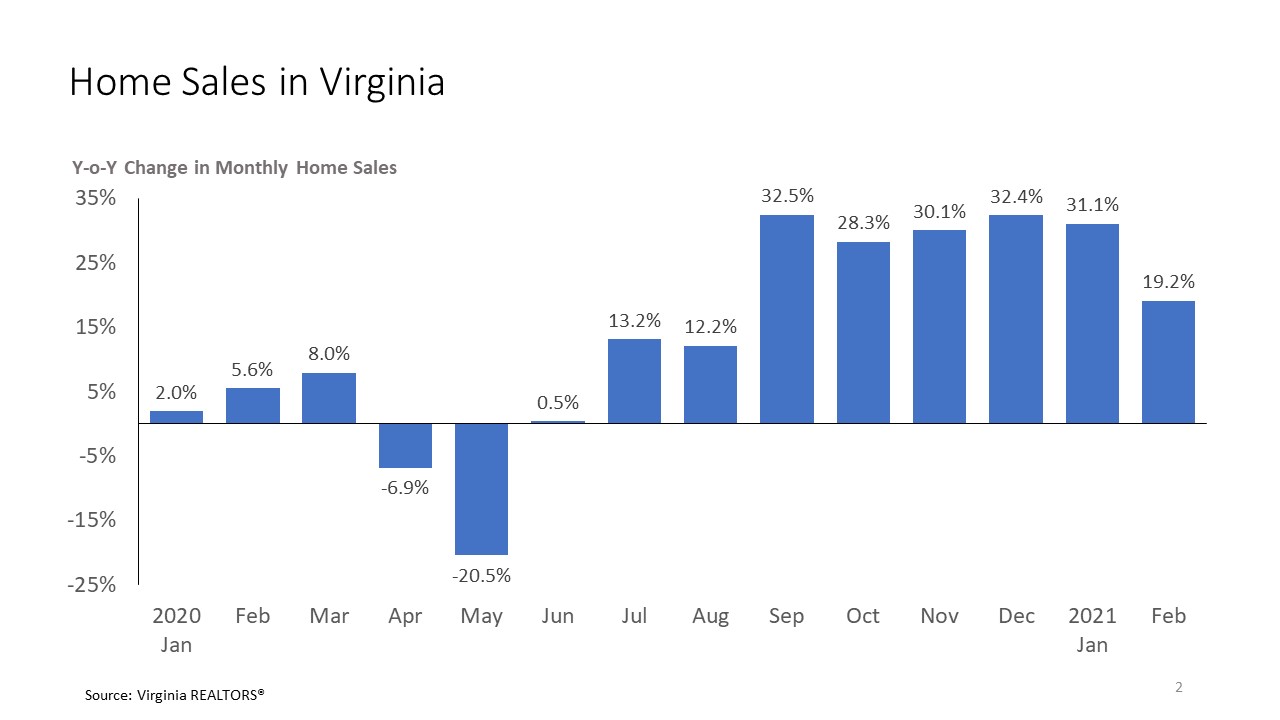

A year ago, the residential real estate market was chugging along nicely in Virginia, with prices rising by between two and four percent, and sales rising steadily year-over-year. Then, the announcement of the first cases of COVID-19 in Virginia and the Governor’s stay-at-home directive brought the real estate industry—and just about every other industry in Virginia—to a halt. In April, the number of home sales in Virginia was down 6.9% year-over-year. Sales dropped by more than 20% in May.

But then the turnaround began. Since last summer, the housing market has been on a tear. Spring sales were pushed into summer, as was anticipated. But the demand for homeownership surged beyond expectations for both economic reasons (e.g, historically low mortgage rates) as well as emotional reasons (e.g, weariness with our existing homes, the desire for more space in which to quarantine.)

How COVID-19 Changed the Housing Market

- Residential real estate became a key driver of the economy. The real estate industry has always been important to Virginia’s economy. According to a 2016 GMU/Virginia REALTORS® report, the real estate industry was the second largest sector of the state’s economy. However, during the COVID-19 recession, residential real estate boomed while many other parts of the economy stagnated. The Governor recently issued a press release praising the solid gains in the state’s economy. Revenue from recordation taxes, the fees levied upon the sale of a home, were up faster than any other source of revenue, demonstrating the important role the active home sales market has had in the state’s economic recovery.

- Mortgage rates fell to historically low levels. In 2020, the average 30-year fixed rate mortgage rate fell to a new historic low 15 times. In February, 30-year rates were averaging 2.81%, down from about 3.5% last February. In 2020, the Federal Reserve took a broad set of actions to help minimize the damage of the economic recession. These actions included keeping the Federal funds rate near zero and purchasing massive amounts of securities, which supported extremely low mortgage rates. While rates have edged up slightly in recent weeks, most forecasts suggest rates will remain around three percent for the rest of the year.

- Home equity has surged. Rising home prices have led to huge gains for homeowners. According to Black Knight, at the end of 2020, total housing equity hit a record level, with homeowners nationally holding $7.3 trillion in tappable equity. (“Tappable equity” is the amount of housing equity homeowners could access before going below an 80% loan-to-value ratio.) In Virginia, the median home price surged 10.8% in 2020, the fastest increase since the last housing boom. Compared to five years ago, the median price of a home in the state is nearly $60,000 higher.

- Homeowners have re-evaluated their housing preferences. In the wake of the lockdown in March, and the following 12 months of varying levels of quarantining, many individuals and families had a lot of time to think about where and how they wanted to live. Working from home and learning virtually have allowed homebuyers to move further from downtown areas. The desire for more space during the COVID-19 pandemic has led to growing demand for single-family homes with home offices and outdoor space. These patterns of home buying will likely be with us, at least through 2021.

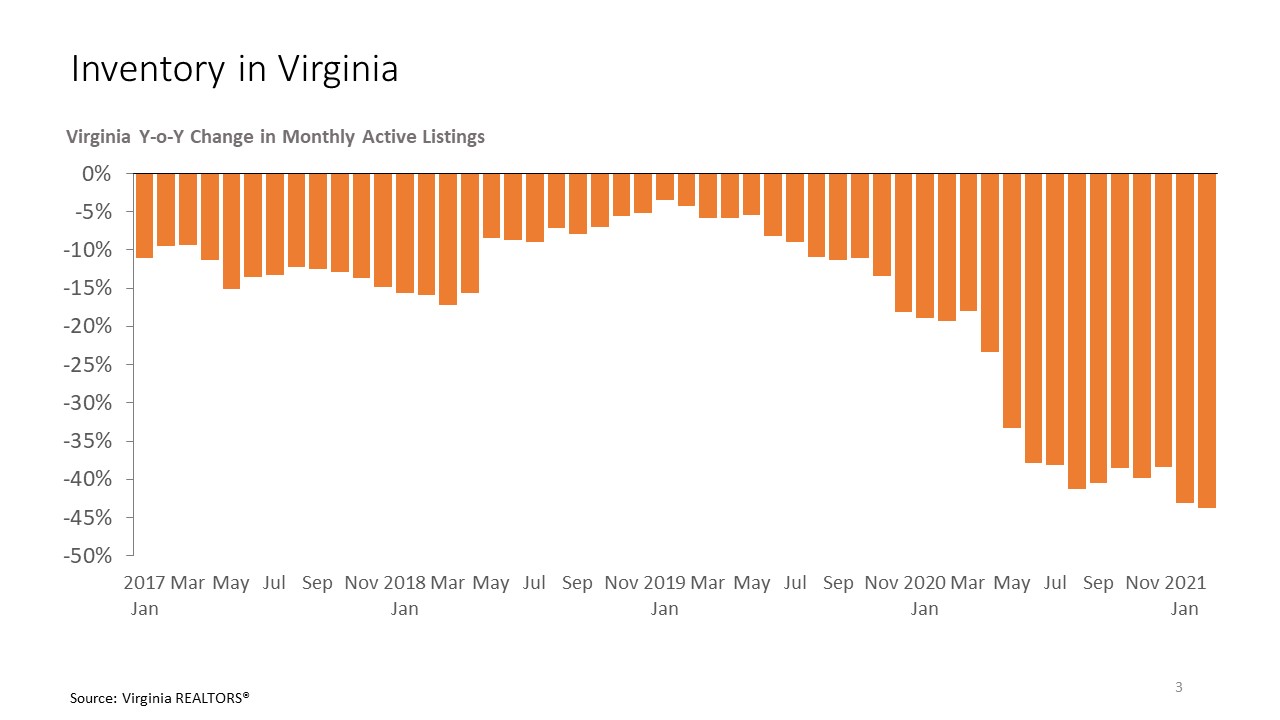

- There is an epic housing shortage. Before the COVID-19 pandemic forced school closures and led to stay-at-home directives, the inventory of available homes for sale was already low, but the pandemic and recession accelerated the shortage. At the end of February 2021, there were about 15,700 total listings statewide, which is down 43.7% compared to a year ago and is only about a third of the inventory that was available five years ago. While new construction increased in 2020, material prices skyrocketed during the pandemic. According to the National Association of Home Builders, these higher prices have added about $26,000 to the construction cost of the typical new home. Materials costs could come down as the economy continues to open up, but the home building industry will continue to face headwinds and will not be able to keep up with demand.

Where Do We Go From Here?

As COVID-19 vaccines get widely distributed, children go back to school, and employees go back to the office, life will begin to feel more normal in 2021. It is expected that the residential real estate market will continue to be strong this year. Our forecasts are for statewide home sales to be up two percent in 2021, while the median sales price in Virginia is expected to rise 9.5%.

During this unprecedented market, REALTORS® can be an invaluable resource to prospective home buyers and sellers. To demonstrate that value, find out ways to help buyers navigate a market with extremely low inventory, educate them about how payments received via Venmo or Apple Pay can slow down the home sales transaction, and talk about the risks and benefits of removing the “sale of home contingencies.”

In addition, REALTORS® can stay current on statewide and local housing market and economic conditions to provide guidance to prospective clients and to colleagues. Virginia REALTORS® has up-to-date data and analysis available to support Virginia’s real estate industry and to provide vital information to REALTOR® members during this remarkable market.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More