2021 Economic and Housing Market Outlook: A Look into the Cloudy Crystal Ball

December 4, 2020

Virginia REALTORS® Chief Economist looks ahead to 2021 with a forecast of economic and housing market conditions in Virginia.

Most of us are ready to put 2020 behind us and to look ahead to 2021. While the crystal ball is cloudy, there are some glimmers of hope that offer optimism for the year to come. Economic conditions in Virginia will continue to improve, and housing market fundamentals will remain strong. The biggest risks relate to the ability to bring COVID-19 under control so that the economy—and life—can return to more normalcy.

A Look Back at 2020

This past year has brought unprecedented economic losses but also a resilient and surging housing market here in Virginia. When the news of COVID-19 first hit, no one knew how the public health crisis would impact the economy or how long we would be coping with its effects.

REALTORS® in Virginia have been remarkably innovative in using technology tools and social distancing measures to comply with public health guidelines while also keeping the real estate industry moving. Virginia REALTORS® partnered with state leaders to help keep real estate open as an essential business during the pandemic, and the real estate industry has been a bright spot in the state’s economy.

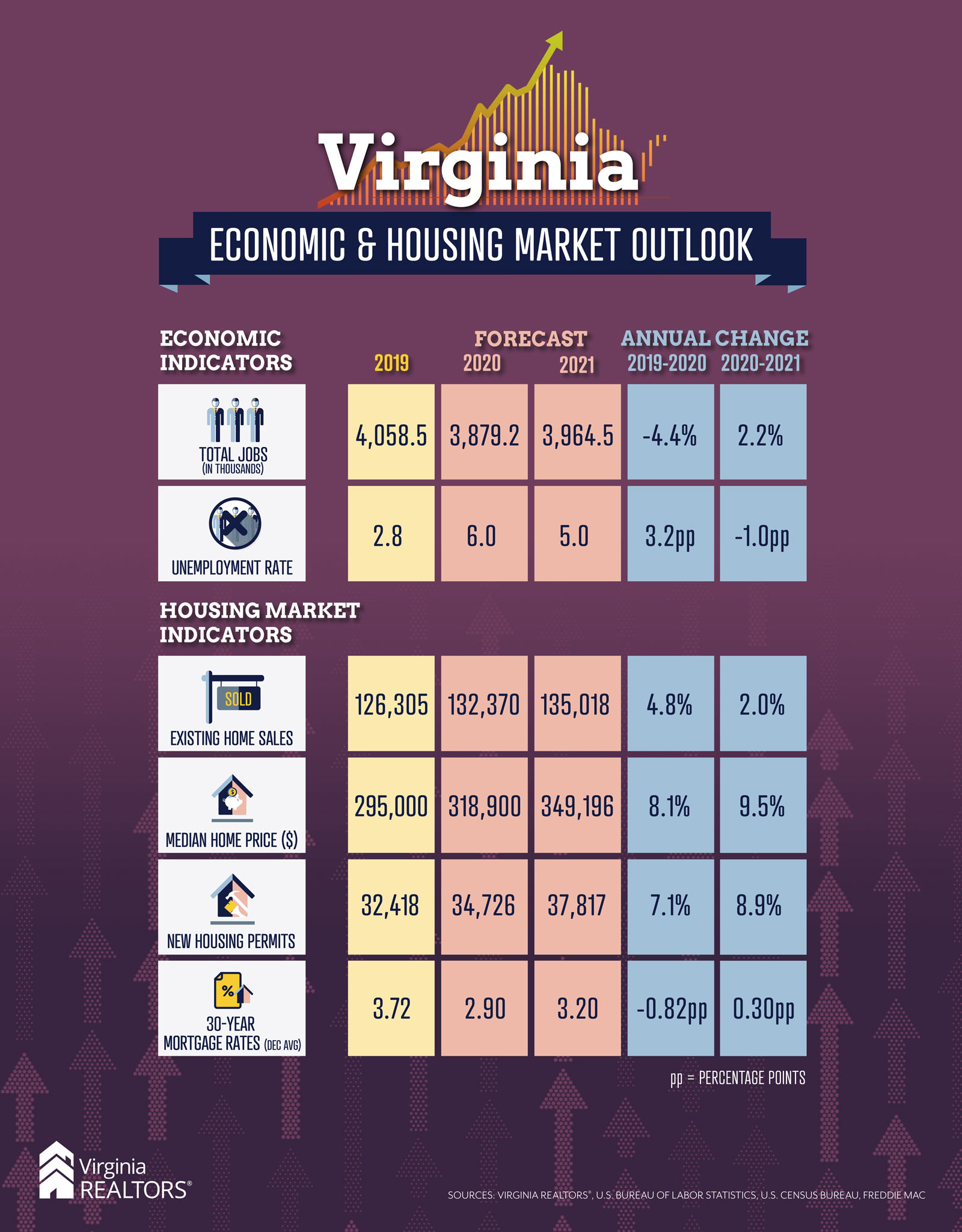

The number of total home sales in 2020 will top 2019 sales, despite the economic recession and spring market slowdown. There are projected to be a total of 132,370 home sales statewide in 2020, up 4.8% compared to 2019 sales. Home prices, which have been rising at double-digit rates in recent months, will end 2020 at a record high. It is expected that the 2020 median home sales price in Virginia will be $318,900, up 8.1% from 2019.

A Look Ahead to 2021

Forecasting economic conditions is tricky under the best of circumstances. In these extraordinary times, it is even more difficult to paint a conclusive picture of what to expect in the year to come. A rise in COVID-19 cases, uncertainties in the political process, and a stalling national economy offer reasons to be cautious when forecasting the performance of the economy and housing market in the year to come. Other factors, however, including demographic factors and persistently low mortgage rates point to a strong 2021 for housing market activity.

Economic Factors

Employment

At the end of 2020, it is expected that there will be 3.88 million jobs in Virginia, which is up significantly from the summer, but still remains below pre-recession levels. Job gains will continue into 2021, although the pace of job creation could slow without a new federal stimulus measure.

At the end of 2021, employment in Virginia will total 3.96 million jobs, up 2.2% over the 2020 year-end number. However, employment levels will remain below 2019 levels, and it could be well into 2022 before all the jobs lost during the recession are re-gained.

Unemployment Rate

The unemployment rate in Virginia peaked at 11.2% in April, below the national rate but a surge from the below-three-percent unemployment rates we had all throughout 2019. The unemployment rate has declined steadily over the year, and it is expected that the unemployment situation will continue to improve in 2021. At the end of 2021, the unemployment rate in Virginia will hit 5.0%, a percentage point lower than the 2020 year-end rate.

Housing Market Indicators

Home Sales

While demand for homeownership will continue to be strong in Virginia in 2021, a lack of inventory will be a major constraint on the market. There are no indications that inventory is going to increase in any significant way over the next year. Some would-be homebuyers, discouraged at a limited number of options, may decide to put off their home search. Escalating home prices create growing challenges for some homebuyers, particularly first-time buyers, to get into the market.

The home sales forecast suggests that in 2021 there will be a total of 135,018 sales in Virginia, which is up just 2.0% from the 2020 total.

Home Prices

A lack of supply, growing demand, and low mortgage rates have pushed prices up in Virginia. It is expected that those factors will continue to put upward pressure on home prices in 2021. Increased demand in smaller markets, where there is potential for greater price growth, ultimately will lead to a very strong increase in the median statewide home sales price in 2021.

These forecasts indicate that the 2021 median home sales price statewide in Virginia will be $349,196, an increase of 9.5% over 2020.

New Housing Permits

Permits for new housing construction began to increase during the second half of 2020, in response to rising demand for single-family homes. While the costs of lumber, a lack of labor, and regulations remain constraints on the new residential construction business, it is likely that the upward trend in new home construction will continue into 2021.

Our forecasts indicate that in Virginia, there will be a total of 37,817 permits issued for the construction of new housing units in 2021, which reflects an 8.9% rise over the 2020 total.

Mortgage Rates

The rate on a 30-year fixed-rate mortgage hit historic lows more than 13 times over the summer and fall of 2020. Even as the economy improves in 2021, there are no signs that mortgage rates will move higher in the months to come. The Federal Reserve has given every indication that rates will be held low into next year and beyond. The change in Presidential administration should have no impact on the general trajectory of rates in the new year.

Our forecasts are for the 30-year fixed-rate mortgage rate to end 2021 at 3.2%, which would be 0.3 percentage points higher than the 2020 year-end rate.

While the future may not be crystal clear, the outlook for the economy and housing market in 2021 tends to be positive. Pent-up demand for homeownership and the desirability of Virginia communities, along with the resourcefulness of Virginia REALTORS®, will keep the real estate industry an important part of the state’s economic recovery in the year to come.

Stay connected with Virginia REALTORS® to get updated data and analysis on the state’s economy and housing market.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More