Housing Affordability: What Does it Mean for Buyers in 2021?

January 7, 2021

While this will be another strong year for the housing market, rising prices have led to greater affordability challenges for buyers in 2021. Historically low mortgage rates have made it easier for some homebuyers, but those low rates—along with strong demand and low inventory—have led to the biggest housing affordability challenge that we have seen in 12 years, according to an analysis by Attom Data Solutions. Their report found that households that earn local average wages cannot afford to buy a home in more than 70% of counties across the U.S. Home prices continue to increase faster than wages, and some families feel like they have to defer or even give up on their dream of homeownership.

Home Prices Have Risen Quickly in Virginia

The housing market in Virginia has surged in 2020, with annual sales transactions on pace to be nearly 5% higher than 2019. The statewide median price in November 2020 was $328,000, and home prices in the state have increased at double-digit rates for three consecutive months.

The pandemic and economic downturn did not inhibit buyers. In fact, higher levels of savings, more time spent at home, and low mortgage rates drove buyer demand. Between February 2020—before the COVID-19 pandemic really hit Virginia—and the end of the year, home prices had been increasing steadily. While this price growth is good for sellers, it has meant buyers are encountering competing offers, escalation clauses, and fewer and fewer options.

Higher-Priced Homes Are a Larger Share of the Market

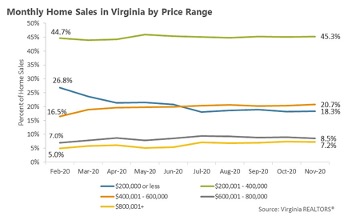

In February 2020, homes priced between $600,001 and $800,000 accounted for 7.0% of all home sales statewide. By November 2020, that share had increased to 8.5%. Homes priced above $800,000 were 5.0% of February 2020 home sales but accounted for 7.2% of November 2020 home sales.

In February 2020, homes priced between $600,001 and $800,000 accounted for 7.0% of all home sales statewide. By November 2020, that share had increased to 8.5%. Homes priced above $800,000 were 5.0% of February 2020 home sales but accounted for 7.2% of November 2020 home sales.

At the other end of the market, it has become much harder to find a home priced below $200,000 in Virginia. Before the pandemic hit, homes in this price range tended to be around 25 to 27 percent of all home sales. In November, the number of homes that sold for less than $200,000 was just 18.3% of all homes sold that month.

This trend has meant that first-time homebuyers and buyers with moderate incomes are having an increasingly hard time finding a home they can afford.

Prices Grew Fastest in Virginia’s Mid-Sized Metros

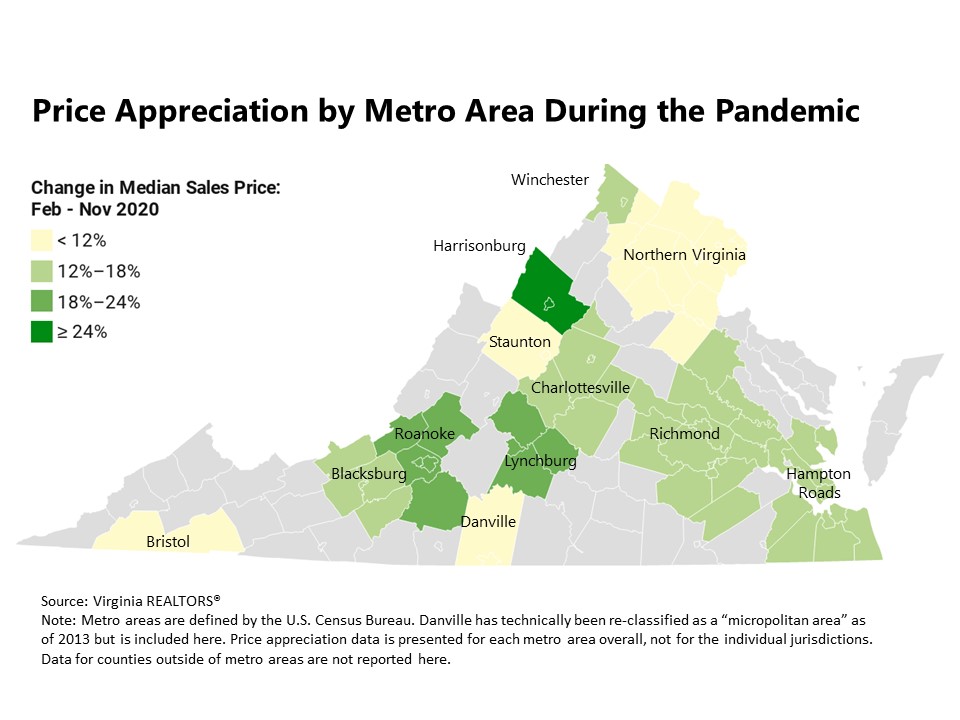

Statewide, between February and November 2020, the median sales price increased by 12.3%. Price growth was not the same across local markets. In Northern Virginia, the region-wide median sales price ticked up 8.9% over that period. Prices also were up at a slower rate in some smaller markets, including Staunton and Bristol. (Note that these price trends are at the metropolitan area level. Prices at the county or city level could have grown more quickly.)

Statewide, between February and November 2020, the median sales price increased by 12.3%. Price growth was not the same across local markets. In Northern Virginia, the region-wide median sales price ticked up 8.9% over that period. Prices also were up at a slower rate in some smaller markets, including Staunton and Bristol. (Note that these price trends are at the metropolitan area level. Prices at the county or city level could have grown more quickly.)

The biggest price gains—and where affordability challenges have increased the fastest during the pandemic—have been in the state’s mid-sized metropolitan areas. In the Harrisonburg market, homes that sold in November were priced an incredible 34.8% higher than those sold in February. Home prices were up 22.3% in the Lynchburg area market and increased 17.3% in the Charlottesville region.

Higher prices in these markets reflect the underlying fundamentals of strong local demand and low inventory. However, these markets are also seeing growing interest from buyers coming from other areas, including higher-cost markets in Virginia, as well as those moving from out of state.

Affordability is a Key Challenge for Buyers in 2021

In all markets across the Commonwealth, home prices have been increasing faster than incomes, which has worsened the housing affordability challenge. Even with historically low mortgage rates, the continued escalation of prices will erode affordability even further, putting homeownership out of reach for some individuals and families and slowing the overall housing market.

Some help may be on the way in the form of a $15,000 first-time homebuyer tax credit that has been floated by President-elect Biden. However, the biggest driver of the affordability challenge is a lack of supply. New construction has ramped up this past year, but the number of new homes being built is still not sufficient to meet demand in most markets. Furthermore, new-build homes tend to be higher priced, which puts them out of the price range of many of those potential homebuyers who are being shut out.

With no major increase in supply to help to ease price pressures, home prices will continue to rise steadily in 2021. REALTORS® should be ready to talk with clients about financing options, downpayment assistance programs, and financial planning to help them be prepared to make an offer in this challenging market.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More