A Deep Dive Into Virginia’s Shallow Inventory

December 31, 2020

Virginia’s housing market has been a bright spot in an otherwise challenging year even with Virginia’s shallow inventory. Despite a slowdown in market activity this spring, home sales rebounded over the summer and remained strong throughout the end of the year. We will end 2020 with more home sales transactions than in 2019 and with total sold volume of more than 50 billion dollars. With an improving economy, low mortgage rates, and strong demand, the housing market will continue to perform well in 2021.

A Lack of Inventory is a Major Challenge

The biggest constraint on the state’s housing market is a lack of available inventory. While there are eager buyers out there, they face limited options and stiff competition in most local markets across the state. Multiple offers and offers over list price are becoming more common. A lack of options and rising prices are discouraging some would-be buyers, particularly first-time buyers.

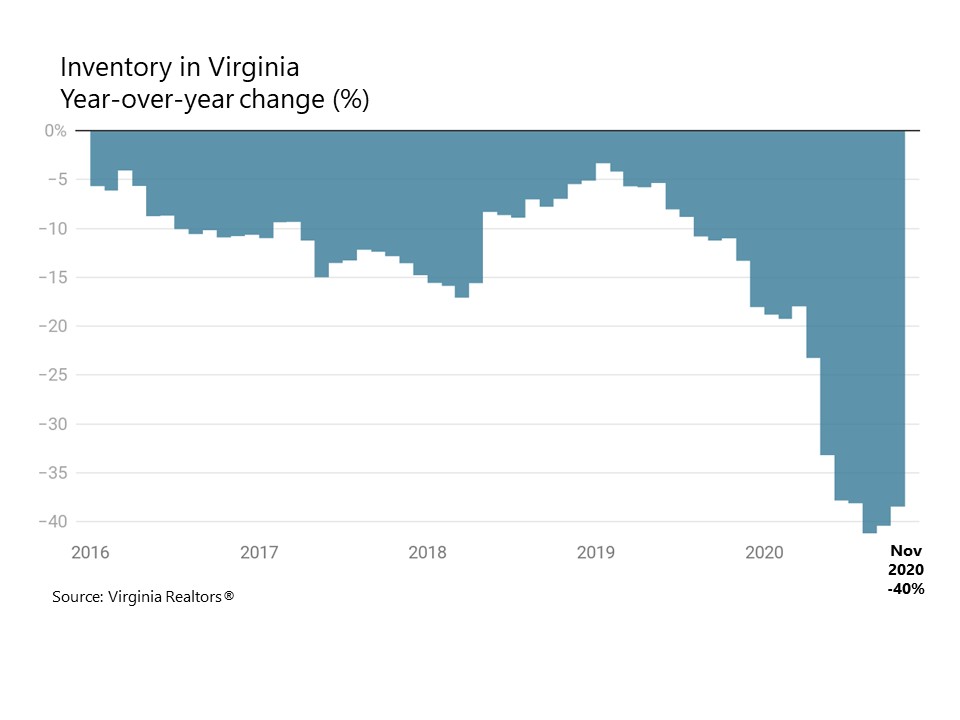

At the end of November 2020, there were an estimated 20,493 homes listed for sale in Virginia, which is down 40% from a year ago. Think about that – in a state of more than 8.5 million people with more people moving in than moving out of the state, there are only 20,493 homes available for sale and inventory has declined rapidly during the COVID-19 pandemic.

Inventory is Low Across the State

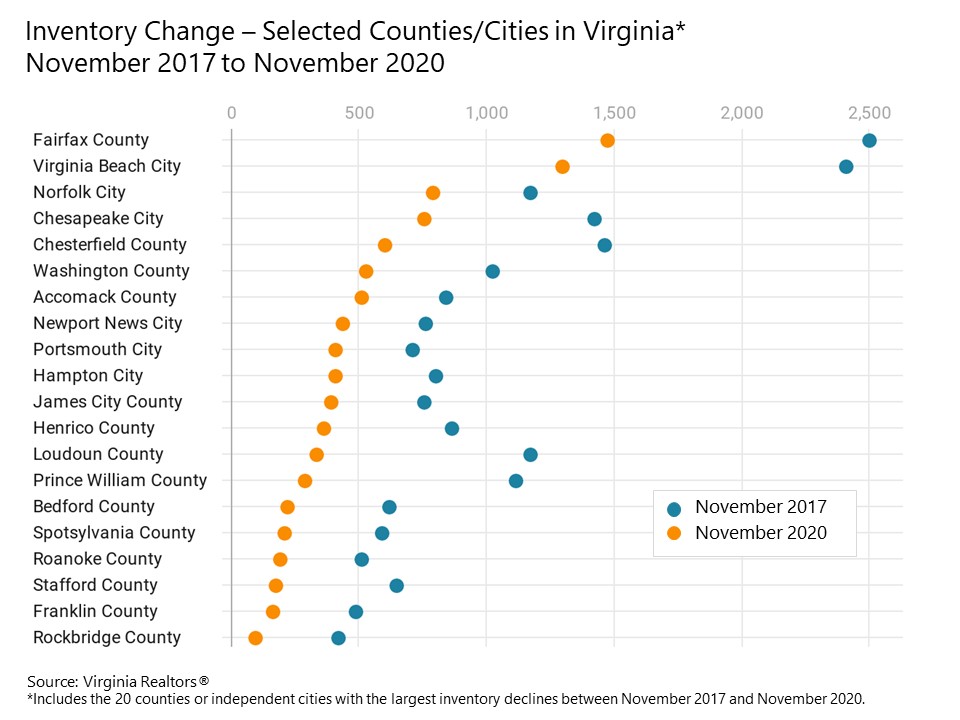

Every local market across Virginia has experienced a dramatic decline in available inventory over the past few years. Over the past three years, the number of homes available for sale has declined by more than 40% in many of the state’s largest markets. For example, in Fairfax County, there were an estimated 1,477 homes available for sale at the end of November 2020 compared to 2,506 at the end of November 2017, a 41% drop. Available inventory is down by more than 70% in Loudoun County and has dropped by nearly 75% in Prince William County.

In southeastern Virginia, inventory declined more than 46% in the City of Virginia Beach; there were just 1,299 active listings at the end of November 2020, compared to 2,412 at the end of November 2017. Over the past three years, inventory has declined by more than 46% in the City of Chesapeake and is down by 33% in the City of Norfolk.

In the Richmond area market, at the end of November 2020, there was a total of just 605 active listings in Chesterfield County, down about 58% from three years earlier. Inventory levels have also dropped by about 58% in Henrico County since November 2017.

There have also been significant declines in available inventory in some of the state’s medium and smaller markets. For example, Washington County, in southwest Virginia, has seen inventory levels cut by half over the past three years. In the Roanoke region, inventory in Bedford County is just one third of what it was three years ago.

Homes on the Market Do Not Necessarily Meet Buyers Needs

The inventory shortfall may be even more extreme than these numbers suggest. The homes that are available for sale tend to be on the market for a long time, indicating that these homes are in locations or have characteristics that buyers are not looking for. In particular, it is likely that the existing inventory includes many homes that are “fixer uppers” or need significant repairs.

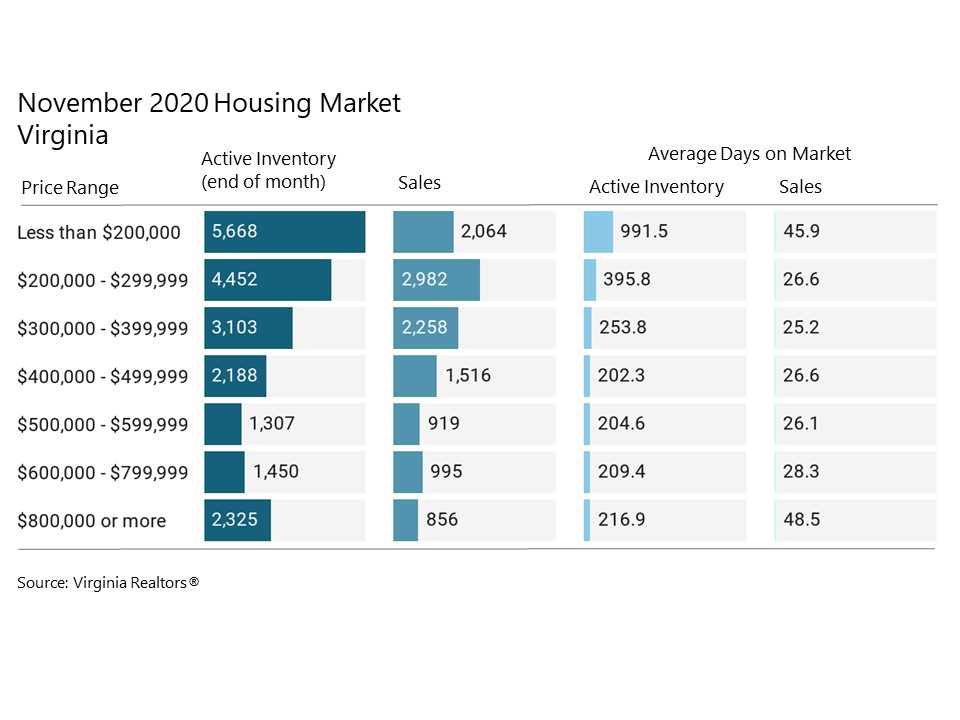

In November 2020, there were 2,064 homes that sold for less than $200,000, which accounted for about 18% of monthly sales. These homes sold in an average of 45.9 days.

At the end of the month, there were 5,668 homes priced under $200,000 listed for sale, comprising 28% of the available inventory. On average, the homes that remain available for sale in this price range were listed 991.5 days ago, meaning they have been on the market for nearly three years.

Across price points, the homes that remain for sale have been on the market for a long time. Homes that are well priced and are in good condition are being snapped up quickly, leaving an available inventory of homes for sales that includes many “hard-to-sell” homes.

At the other end of the price spectrum, homes priced at $800,000 or higher account for 11% of total available inventory and only 7% of November 2020 home sales. Higher-priced homes tend to take somewhat longer to sell. However, the higher-priced homes that remain available for sale have been on the market an average of 216.9 days, far greater than the 48.5 days that it takes for these homes to sell, on average.

Inventory Outlook

According to a recent survey, nearly nine out of ten Virginia REALTORS® say that Virginia’s shallow inventory is the one biggest constraint on the housing market. With low mortgage rates expected throughout 2021, housing demand will continue to be strong. However, there are no signs that inventory levels will improve significantly next year. While new construction has increased this year, the number of new homes being built is far below what is needed to make up the housing shortfall across the state.

REALTORS® need to help prospective buyers be as prepared as possible to act when they find a home they love. Thinking it over for a few days or needing time to pull together financing information may not always be possible. Helping buyers understand housing market conditions and Virginia’s shallow inventory will also be very important to ensuring a successful home buying experience.

For more information on local economic and housing market conditions, please contact Dr. Lisa Sturtevant.

You might also like…

RESPA & Joint Ventures: What Is Allowed?

By Laura M. Murray - March 6, 2023

We have heard reports that state Attorneys General may be taking an increased interest in certain joint venture arrangements between real estate licensees and settlement companies. Agents may… Read More

DPOR Update: Death or Disability of a Broker

By Laura M. Murray - December 5, 2022

In the 2022 Session, the General Assembly passed a law updating what happens in the event of the death or disability of a sole proprietor or sole broker… Read More

What Do Federal Reserve Rate Hikes Mean for the Housing Market and for Your Business?

By Dr. Lisa Sturtevant - April 4, 2022

In March, the Federal Reserve raised the short-term federal funds rate by 0.25 percentage points. This rate hike was the first time the Fed has raised rates since… Read More