Where Rents Are Rising and Where They Are Falling

November 18, 2020

The rental landscape has been changing, with widespread reports about declining rents and rising vacancies in big cities and growing demand for rental housing in smaller cities and suburban markets. According to data from Apartment List, suburban rents are outpacing city rents in 27 out of 30 major metros. The National Association of Home Builders reports that multifamily construction in low-density, suburban areas has increased during the pandemic.

Recent home sales data here in Virginia has shown a notable shift to demand for homeownership in exurban and rural markets. Are we seeing a similar suburban shift in the rental market? The short answer is “in some places, but not in others.”

The dramatic rental patterns being seen in New York City, San Francisco, and other large cities in the country are not typical in Virginia’s regions. While there is some evidence of strengthening in the suburban rental market in Virginia, the urban rental market remains relatively strong in most regions. The one exception is some high-cost markets in Northern Virginia, where rents have fallen slightly during the COVID-19 pandemic.

Rents in Virginia’s Metro Areas

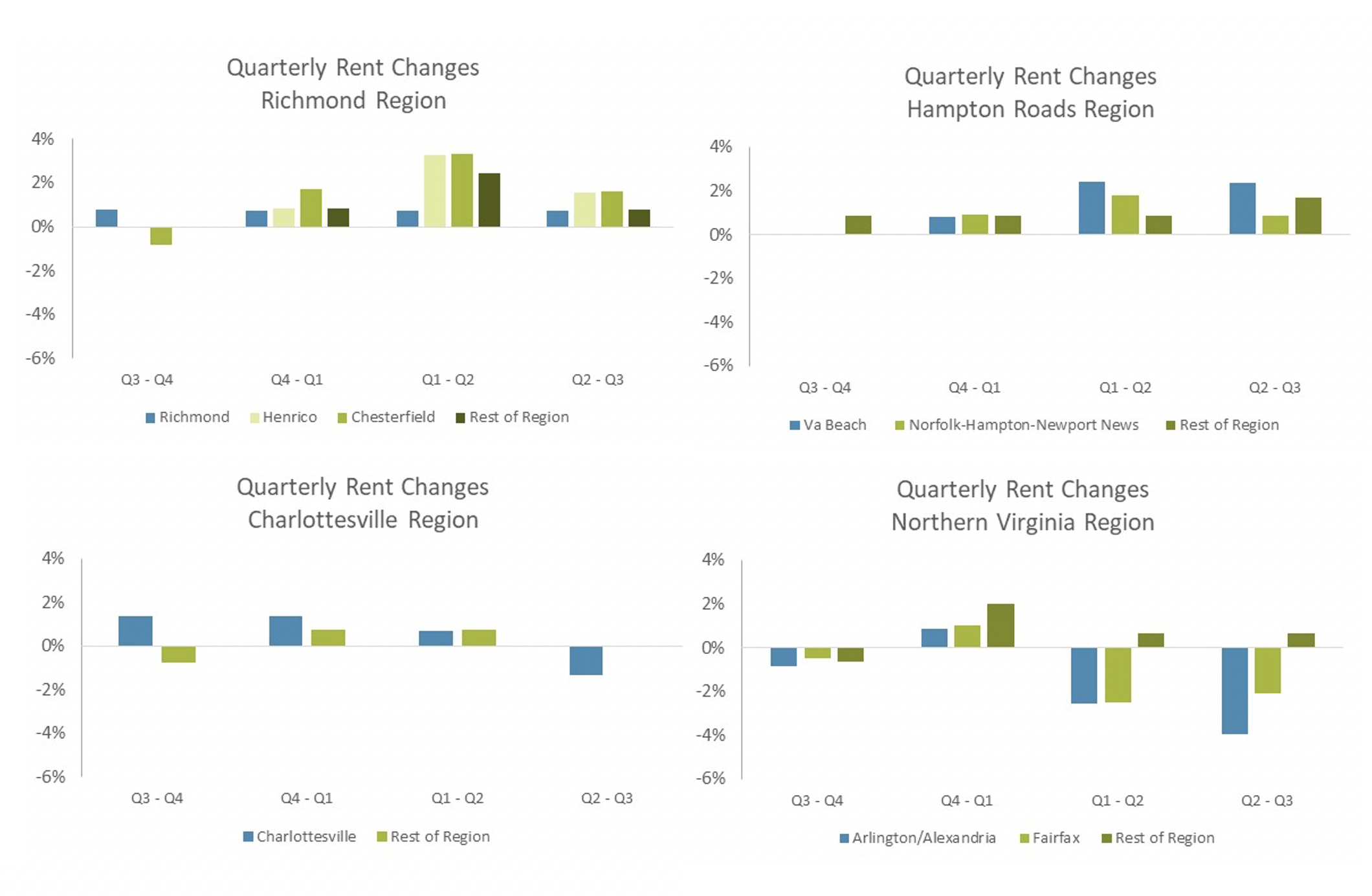

In the Richmond area rental market, average rents have increased between 1 and 3 percent each quarter in recent years. This year, however, that signs that rents are rising have been a little stronger in some of the region’s suburban markets. Between the 2nd and 3rd quarters of this year, the average rent in the City of Richmond increased by 1 percent while rents were up 2 percent in Henrico and Chesterfield counties. However, rents in jurisdictions further out have not risen faster than those in the urban core.

The situation is similar in the Hampton Roads region. Average quarterly rents are rising up between 1 and 2 percent across the region in 2020. Rent growth has been faster in the City of Virginia Beach than in the communities of Norfolk, Hampton, and Newport News. Rents in more suburban jurisdictions, including York County and James City County, have increased at roughly the same rate as in the City of Virginia Beach.

In the Charlottesville area, rent growth has slowed in the 3rd quarter. After quarterly rent growth of 1 percent earlier this year, the 3rd quarter average rent declined by 1 percent in the City of Charlottesville. Average rents held steady in the surrounding counties between the 2nd and 3rd quarters.

The Northern Virginia rental market looks a little different than the other regional markets in Virginia. An oversupply of rental housing in the close-in, urban markets, along with the economic recession and COVID-19 pandemic, has led to downward pressure on rents. However, the declines in rent in Northern Virginia are much more modest than in the larger, city markets reported in the national media.

Between the 2nd and 3rd quarter, the average quarterly rent in Arlington County and the City of Alexandria declined by 4 percent. The average rent in Fairfax County was down by 2 percent. However, rents continued to rise in the further-out suburbs of Northern Virginia in the 3rd quarter of 2020.

Outlook for Virginia’s Rental Market

Looking ahead, there could be a surge in demand for rental housing across Virginia’s metropolitan areas. Escalating home prices and rapidly declining inventories have made it harder for individuals and families to buy a home, even with historically low mortgage rates. As a result, there could be more discouraged homeowners looking to the rental market. These prospective renters may include a growing number of families looking for suburban rental housing, which could continue upward pressure on suburban rents.

Some urban areas could experience a softening of the rental market. Demand for luxury, high-end, multifamily rental housing may have peaked, with the expectation that rents will remain flat or continue to fall in some select high-cost markets.

For more information on Virginia’s Rental Market, check out our most recent presentation.

You might also like…

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Annual Building Permit Trends for Multifamily Housing Units

By Sejal Naik - June 24, 2024

The latest annual building permits data indicates fewer multifamily units are in the pipeline in Virginia’s housing market. In 2022, multifamily residential building permits in Virginia were at… Read More

Congratulations to These PM Certified Graduates!

By Virginia REALTORS® - May 15, 2024

PM Certified is a property management certification featuring coursework that enhances your knowledge of property management law, regulations, agency, leases, rental maintenance as well as provides YOU tools… Read More