How Presidential Elections Impact Virginia’s Housing Market

February 27, 2020

During a presidential election year, there can be greater uncertainty about the housing market, which can impact sales, inventory, and prices. Potential changes to tax policies and housing regulations could make some would-be buyers and sellers take a “wait and see” approach in the run up to the election, particularly if the outcome of the election is hard to predict. However, research on what a presidential election means for the national housing market is pretty unclear.

In Virginia, particularly in Northern Virginia, national elections can potentially have a much more direct impact than in other parts of the country, as people move into and out of the state with the change in administration. A change from a Republican to a Democratic administration, and vice versa, theoretically should have a more noticeable effect on the market as a new wave of appointed officials move into the nation’s capital.

So, what impact should we expect the 2020 election to have on Virginia’s housing market? One way to gauge the potential impact is to examine what happened in prior presidential election years. Housing market data for 2016, the last presidential election year, were compared to trends in the years just before and just after 2016. In addition to analyzing data for Virginia as a whole, the Northern Virginia market was analyzed separately.

Here’s what we found….

Home Sales

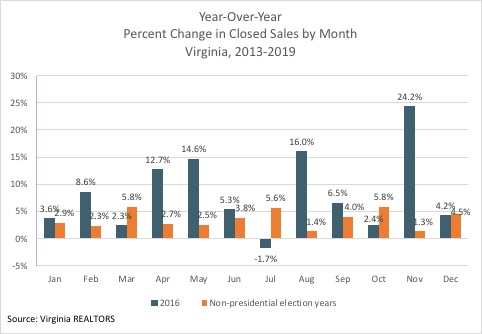

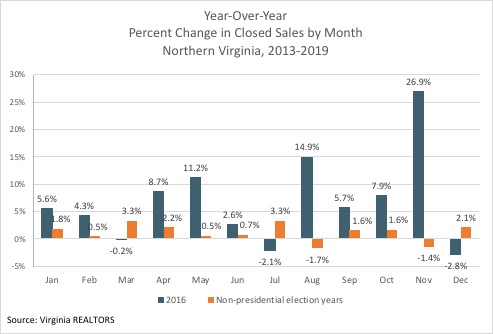

Virginia did not see a big boost in home sales overall in 2016 compared to the year prior, and neither did Northern Virginia.[1] What was different is that the timing of sales appeared to shift during the election year. There was a big boost in closed sales in November of the election year, with sales up 24.2% in Virginia and up 26.9% in Northern Virginia. By comparison, in the non-presidential election years, the November-to-November change in sales averaged 1.3% in Virginia and -1.4% in Northern Virginia.

There was also a shift to a greater number of sales in August, a time when homebuyers are looking to move into their new home before the start of the school year. However, the August bump was more pronounced outside of Northern Virginia, which suggests that something other than a direct impact of the election was at play.

Another important boost in sales in Virginia may actually come after the inauguration of a new president, when the executive branch may be staffing up and lobbying firms may be recruiting. Potential homebuyers and sellers may also be feeling more certain about the policies of the new administration, increasing their confidence in the outlook for the housing market. In March 2017, three months after the inauguration, the number of closed sales was up 15.7% in Virginia and up 13.6% in Northern Virginia, year over year. In fact, the March 2017 gain in sales was the greatest year-over-year change for any month in 2017.

New Listings

According to housing market data from 2016, a presidential election does not appear to incentivize homeowners to list their homes for sale. The number of new listings was down in 2016 compared to 2015. However, there was evidence of a surge of new listings in March 2016, potentially a reaction to increased talk about the presidential election around Super Tuesday. The number of new listings was up by 12.5% in March 2016 over March 2015 statewide, and there was a 15.6% increase in new listings in Northern Virginia. The number of new listings right before the election, in October, appear to be off compared to non-election years.

There also was a bump in new listings in the first part of 2017 in Northern Virginia, though not in the rest of the state. In January 2017, the number of new listings in Northern Virginia was 11.5% higher than in January 2016, with sellers potentially anticipating demand associated with the turnover in administration.

Home Prices

While it appears as though the presidential election has a timing effect on home sales during the year, there does not appear to be a notable impact on prices. In fact, if anything, the presidential election could have a dampening effect on prices.

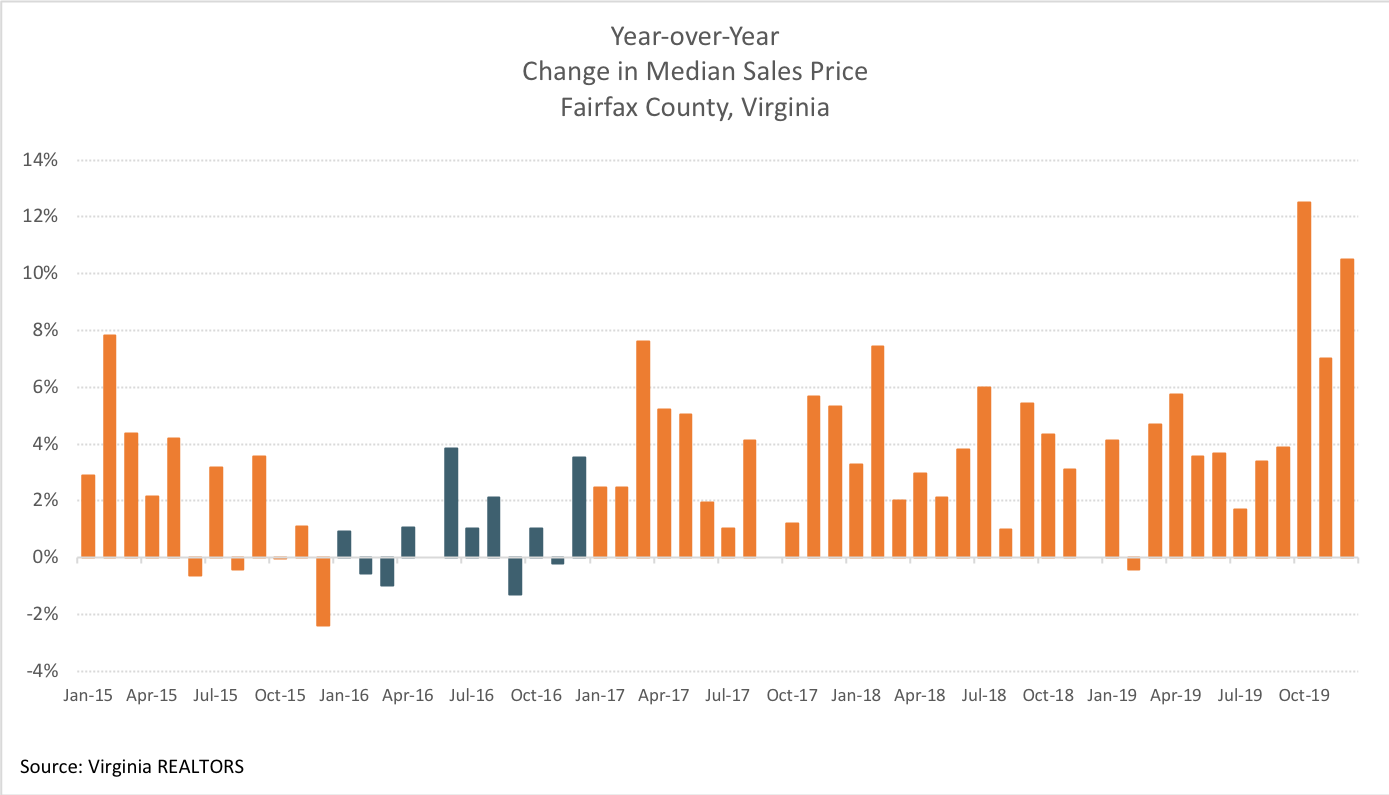

Home prices in Fairfax County were analyzed to assess the potential effect on home prices. Given the proximity to Washington DC and the size of the housing market, any significant change in demand for housing related to the presidential election should be noticeable in this market.

Overall, in 2016, the median sales price in Fairfax County was up less than 1% over 2015. By comparison, annual price growth was 2 to 5% in the years before and after 2016. While there was a bump in closed sales in November of 2016, there was a decline in the median sales price in Fairfax County in November.

The impact on prices appears to be associated with sales that closed in the March following the presidential election. In Fairfax County, the median sales price in March 2017 was up 7.6% compared to March 2016, which was one of the biggest year-over-year increases for any month throughout the 2014 through 2019 period.

Key Takeaways

While all presidential election years will be different, based on this analysis of trends during the 2016 election year, we probably will not see significantly more –or less—sales activity this year, even in the Northern Virginia market. There could be more demand during two key points in the year—late summer as families move before the school year and the month or two leading up to the election.

The biggest potential effect of the presidential election actually appears to materialize the following spring. Based on trends during the 2016 presidential election cycle, listings increase just after the first of the year, particularly in Northern Virginia. The number of closed sales surged in Northern Virginia and the rest of the state in March, with a significant impact on home sales prices, at least in the Fairfax County market.

How might 2020 be different from 2016?

It is difficult to predict what might happen in a presidential election year based on analysis of just one prior election year. Unfortunately, data are not complete enough to go back to earlier years.

In Virginia, along with Washington DC and Maryland, the presidential election potentially has a more direct impact in the form of turnover in personnel in the executive and legislative branches. However, that effect will be muted if there is no change in party. In 2016, there was a shift in the executive branch from Republican to Democrat, though Congress did not switch parties. Predictions for 2020 are still up in the air; however, in 2016, with a change in party, there was a pretty noticeable impact in the Northern Virginia market in the spring following the inauguration.

There are some ways in which 2020 is definitely different than 2016. The biggest difference in the market is the extremely low inventories of homes for sale. At the end of January 2020, there were 4,035 total active listings in the Northern Virginia region, down 55.7% from 2019 and about half the number that was available at the end of January 2016. Statewide, January 2020 active listings were down 26.1% from January 2019 and are just at 60% of the number available at the end of January 2016.

Therefore, the tight inventory and the strong overall demand will continue to be the story in Virginia in 2020, having a bigger impact on the market than potential shifts that might result from direct or indirect impacts from this being a presidential election year.

[1] For this analysis, Northern Virginia is defined as the counties of Arlington, Fairfax, Loudoun, Prince William, Spotsylvania and Stafford; and the cities of Alexandria, Falls Church, Fairfax, Manassas and Manassas Park.

You might also like…

Impact of Infrastructure Projects on Residential Markets

By Sejal Naik - February 27, 2025

“Location, location, location” is often quoted in the real estate market and emphasizes the importance of location-based features in people’s housing market decisions. While many locational characteristics stay… Read More

Virginia’s Thriving Labor Market in 2024

By Abel Opoku-Adjei - February 3, 2025

The labor market in the U.S. showed resilience in 2024 despite the looming economic uncertainty amongst many Americans. According to the recent Bureau of Labor Statistics data, approximately… Read More

Are HOA Communities Becoming More Popular?

By Abel Opoku-Adjei - January 6, 2025

Homeowner association communities (HOAs) have been gaining popularity in recent years, and there’s no sign that this trend is slowing down. In 2024, there were approximately 369,000… Read More