See It, Want It, Buy It: Single Female Homeownership

March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a home. Homeownership for women has continued to grow over time but it hasn’t been without its challenges. As we celebrate Women’s History Month, let’s explore how women continue to impact and shape the housing market.

Homeownership

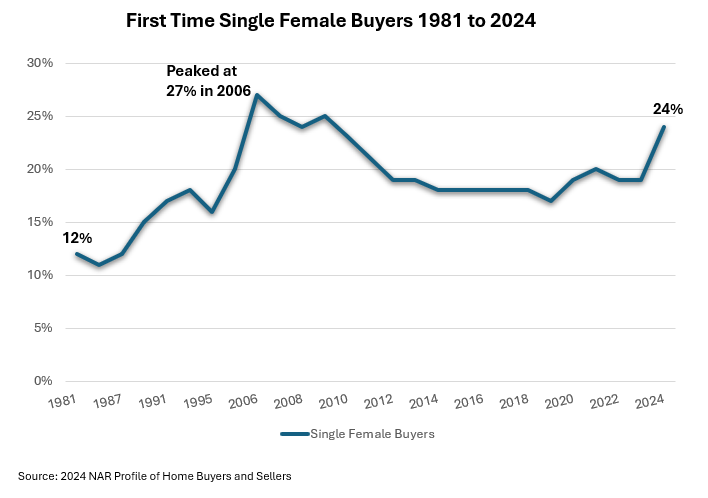

In 1981, single women accounted for 11% of buyer households, second only to married couples and had a higher homeownership rate than single men. Since then, those numbers have increased, with women making up 20% of home buyers last year, up 1% from 2023 and 12% higher than the share of single male buyers. They have also become a key demographic among first-time buyers with their share rising from 19% to 24% in 2024, the biggest increase across all other first-time buyer households.

Gender Pay Gap and Education

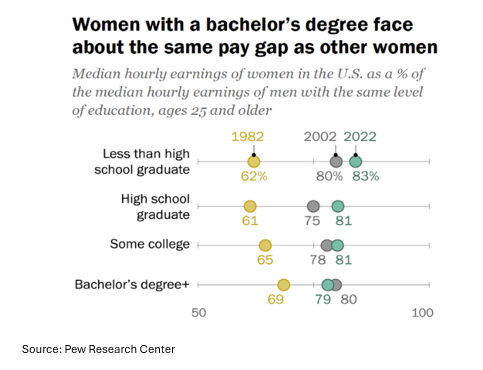

Historically women have always made less than men even with protections such as the Equal Pay Act of 1963 in place. The median weekly earnings for a woman was 62 cents for every dollar a man made in 1979, that metric has since improved to 83.2% in 2024. Even though the numbers went up, the difference between what men and women make—the gender pay gap—persists. Education also plays a role in earnings, with many people seeing their wages go up with the addition of a degree. Women outpace men in college completions and as a result have seen a 38% increase in earnings since 1979, but continue to be out-earned by men. In 2022, women who had at least a bachelor’s degree earned 79% of what male college graduates made. The gap narrowed slightly for women with high school diplomas who made 81% of what male high school graduates earned. Despite lower earnings, women are still purchasing homes, with single women owning 11.14 million homes while single men own 8.42 million according to an analysis by LendingTree.

Age

Women tend to be older when purchasing their first home with the median age of single female buyers going from 55 years old in 2023 to 60 years old in 2024. The age of first-time female buyers also went up from 38 to 40 years old last year. Income and affordability play significant roles in why women delay home buying. A recent Bankrate survey found that 55% of women didn’t have enough income to purchase a home and 47% said they couldn’t afford a down payment. Another reason female homeownership skews older is societal factors; women 40 and older are more likely to be unpartnered and life expectancy, which can leave widowed women as single homeowners. Single female buyers may tend to be older but younger generations are also starting to leave their mark on the housing market. Per the 2024 NAR Home Buyers and Sellers Generational Trends report, 31% of single Gen-Z females (18 to 24 years old) owned a home last year, the highest share of single female buyers across all generations.

The path to homeownership hasn’t been easy for women, especially in today’s market with elevated mortgage rates and home prices. Despite these challenges, they continue to persevere and create new opportunities for themselves and future generations of women.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

Impact of Infrastructure Projects on Residential Markets

By Sejal Naik - February 27, 2025

“Location, location, location” is often quoted in the real estate market and emphasizes the importance of location-based features in people’s housing market decisions. While many locational characteristics stay… Read More

Key Takeaways: January 2025 Virginia Home Sales Report

By Virginia REALTORS® - February 26, 2025

Key Takeaways Virginia’s housing market saw a slight uptick in activity at the beginning of 2025. There were 5,758 home sales across the commonwealth in January 2025, 104… Read More

NAREB 2024 State of Housing in Black America

By Dominique Fair - February 19, 2025

In 1926, a historian named Carter G. Woodson started Black History Week, which would expand to Black History Month in 1976. Its purpose is to highlight the achievements… Read More