2022 Homeownership Trends in Virginia

June 24, 2022

In June, we celebrate National Homeownership Month and reflect on the key role homeownership plays in communities throughout our nation, including right here in Virginia. The benefits of homeownership have been well documented, from better education and health outcomes, to stronger civic engagement, and generational wealth building, among others. We know the benefits are there, but we also know that homeownership is becoming increasingly difficult to achieve for many Virginians. Soaring home prices, fewer and fewer homes on the market, and rising mortgage rates are making it a challenge for those who are not currently homeowners to achieve the goal of homeownership. As we reflect on National Homeownership Month, let’s take a look at homeownership trends in Virginia, and importantly, how these trends could be shifting in the current market environment we have in front of us.

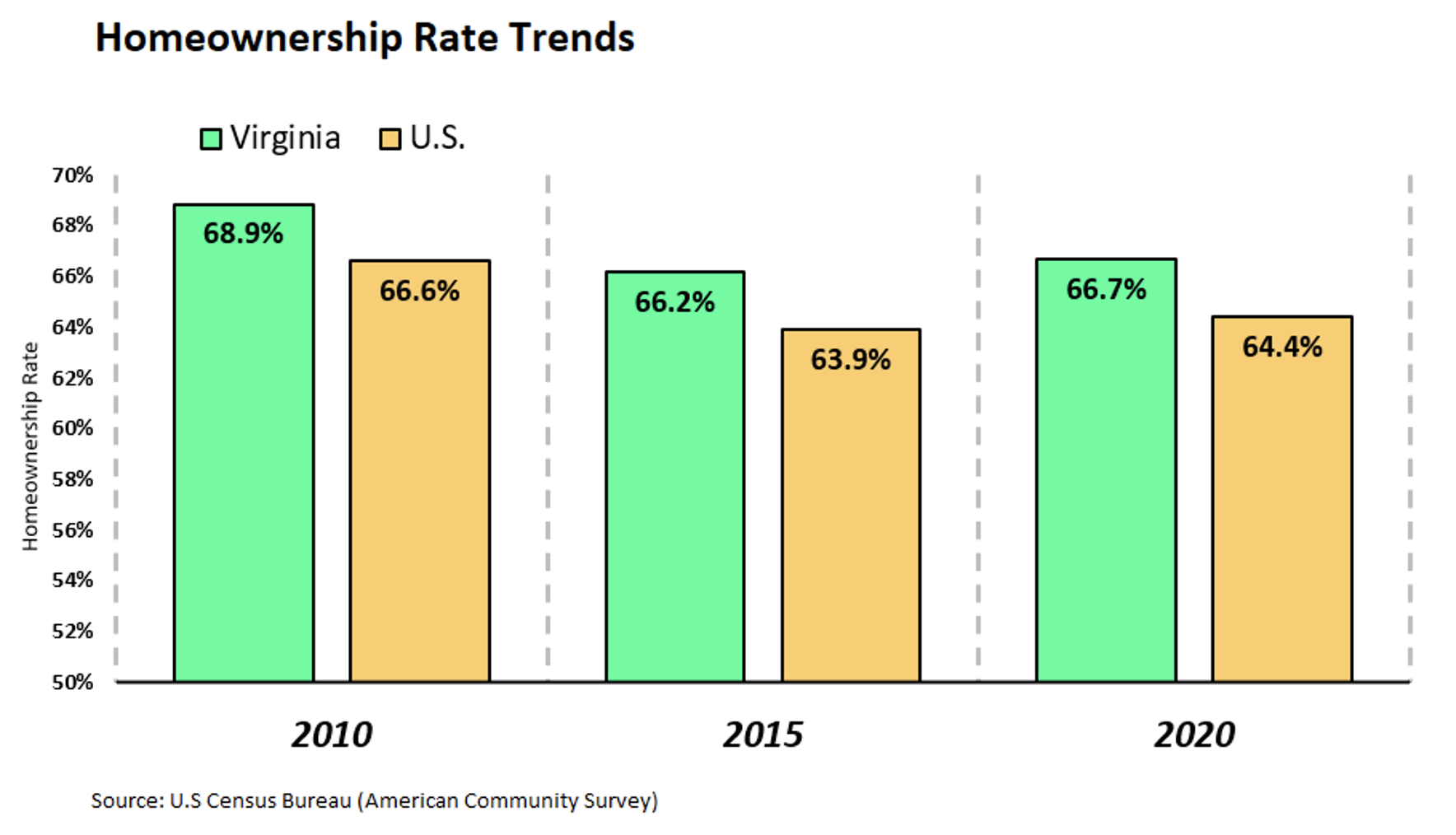

Homeownership in Virginia continues to be higher than the nation as a whole. About two out of every three households in Virginia were homeowners in 2020 (66.7%), which is higher than the national homeownership rate of 64.4%. Virginia has consistently outpaced the nation in homeownership rate by about 2.3%. Homeownership dipped both here in Virginia and nationally between 2010 and 2015, but then picked up again between 2015 and 2020.

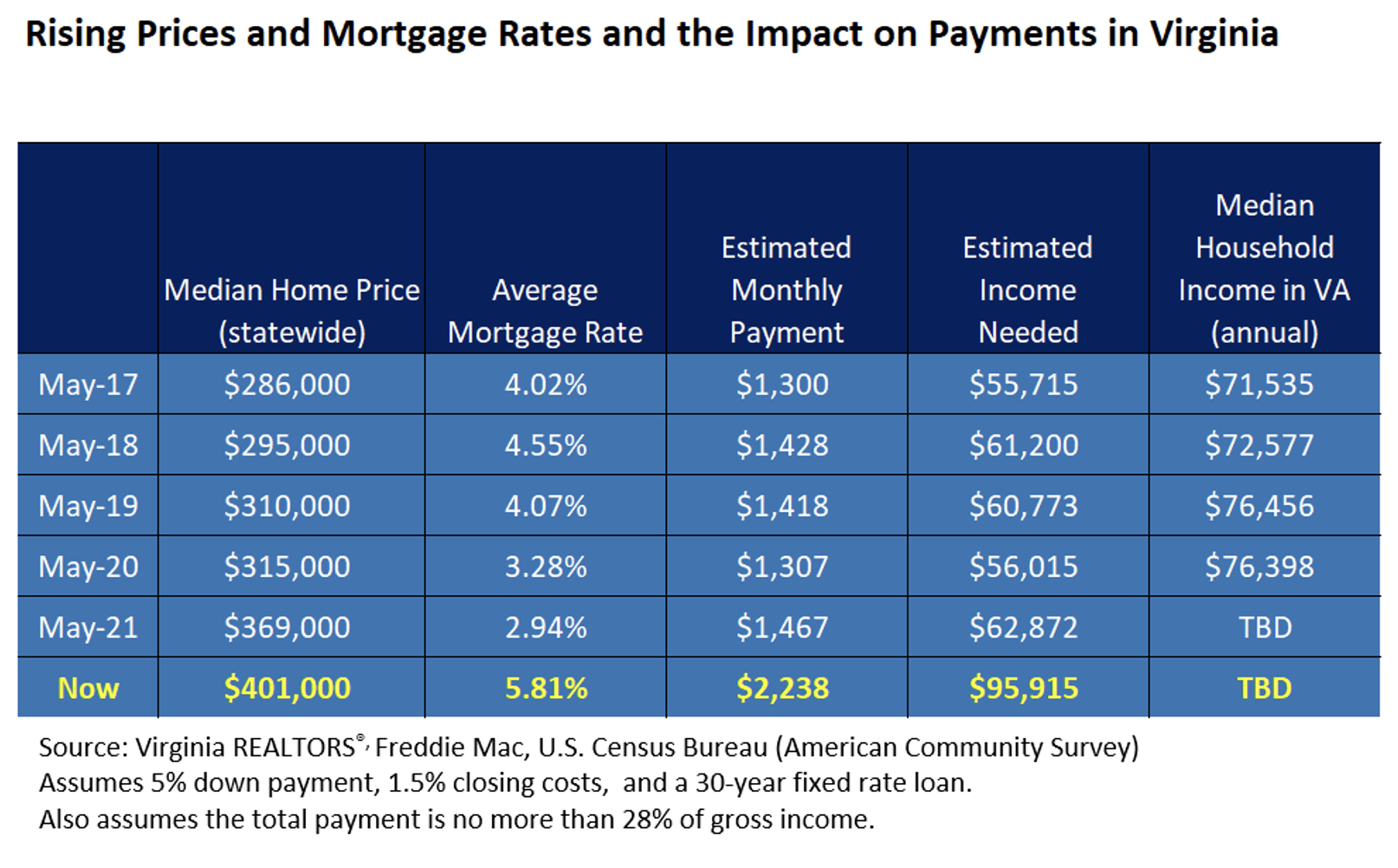

Recent market trends and low inventory are likely putting homeownership out of reach for many Virginians. It’s been a competitive market for prospective buyers for years, but conditions have become much more challenging recently. The chronically low inventory, very strong demand, and attractive interest rates have pushed up price points in Virginia’s housing market rapidly in recent years. Based on the current 30-year fixed mortgage interest rates and the median home price in the state, the estimated monthly payment has sky-rocketed up by about $770 since May of 2021. This will likely leave many buyers on the sidelines, and there is little indication that prices will fall, but rather the growth will slow down in the coming months. Based on the estimated payment today, a buyer household would need approximately $95,900 of annual income for the mortgage payment to be affordable. While we do not have data on median household income for 2022 or even 2021, it is very likely that the income needed to afford a home in Virginia’s housing market has exceeded the median household income. This is a new development in our housing market and will likely have a dampening effect on homeownership in the coming years.

As buyers are faced with more financial hurdles, fewer options to choose from, and increased competition, REALTORS® play a critical role in guiding, educating, and advising individuals and families on their homeownership journey. From navigating the complexities of local housing markets, to connecting prospective homebuyers with the tools and resources to make their dream a reality, REALTORS® help create opportunities for future homeowners.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Key Takeaways: October 2024 Virginia Home Sales Report

By Virginia REALTORS® - November 22, 2024

Key Takeaways There was a surge in closed sales activity in October in Virginia’s housing market. The influx of sales was driven by a jump in pending sales… Read More

A Profile of Renters in Virginia Over the Last Decade

By Dominique Fair - November 14, 2024

Renters have experienced a series of ups and downs in the rental market over the last 10 years. The U.S. Census Bureau has released their American Community Survey… Read More

More People Moved to Virginia Than Out of the State Last Year

By Sejal Naik - November 6, 2024

Each year since 2005, the U.S. Census Bureau determines whether respondents of its surveys lived in the same residence a year ago. If people have moved, then the… Read More