2022 Homeownership Trends in Virginia

June 24, 2022

In June, we celebrate National Homeownership Month and reflect on the key role homeownership plays in communities throughout our nation, including right here in Virginia. The benefits of homeownership have been well documented, from better education and health outcomes, to stronger civic engagement, and generational wealth building, among others. We know the benefits are there, but we also know that homeownership is becoming increasingly difficult to achieve for many Virginians. Soaring home prices, fewer and fewer homes on the market, and rising mortgage rates are making it a challenge for those who are not currently homeowners to achieve the goal of homeownership. As we reflect on National Homeownership Month, let’s take a look at homeownership trends in Virginia, and importantly, how these trends could be shifting in the current market environment we have in front of us.

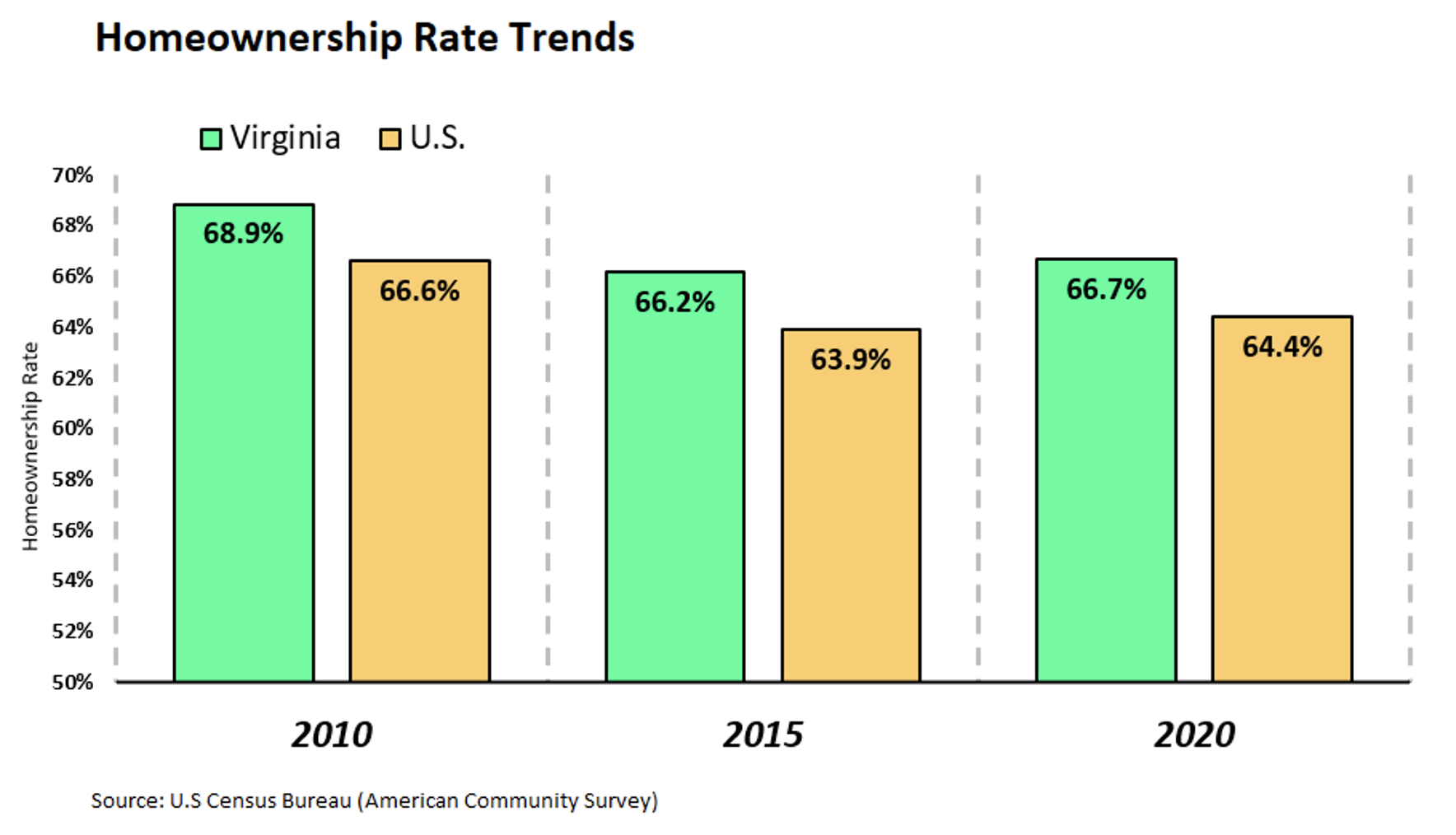

Homeownership in Virginia continues to be higher than the nation as a whole. About two out of every three households in Virginia were homeowners in 2020 (66.7%), which is higher than the national homeownership rate of 64.4%. Virginia has consistently outpaced the nation in homeownership rate by about 2.3%. Homeownership dipped both here in Virginia and nationally between 2010 and 2015, but then picked up again between 2015 and 2020.

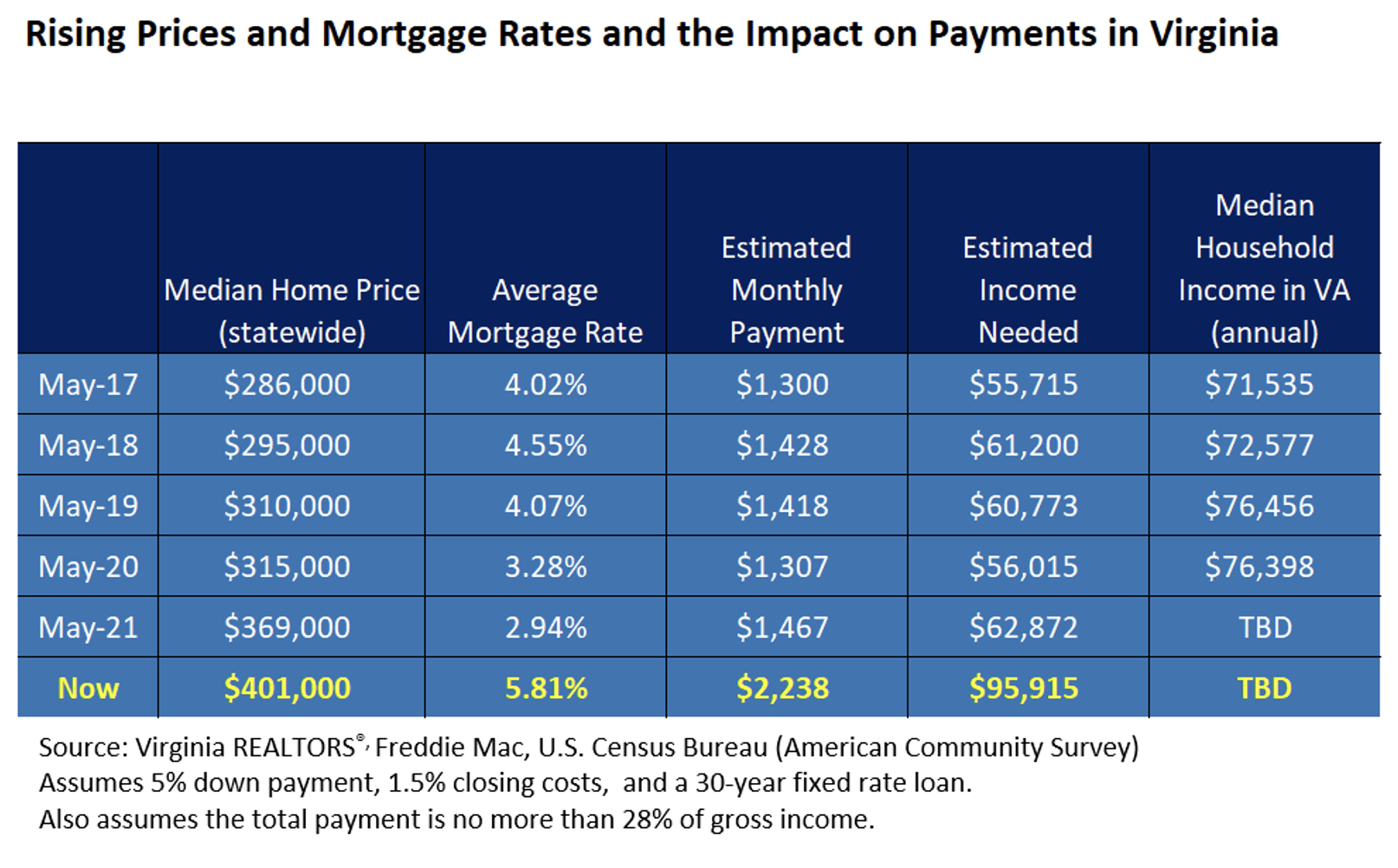

Recent market trends and low inventory are likely putting homeownership out of reach for many Virginians. It’s been a competitive market for prospective buyers for years, but conditions have become much more challenging recently. The chronically low inventory, very strong demand, and attractive interest rates have pushed up price points in Virginia’s housing market rapidly in recent years. Based on the current 30-year fixed mortgage interest rates and the median home price in the state, the estimated monthly payment has sky-rocketed up by about $770 since May of 2021. This will likely leave many buyers on the sidelines, and there is little indication that prices will fall, but rather the growth will slow down in the coming months. Based on the estimated payment today, a buyer household would need approximately $95,900 of annual income for the mortgage payment to be affordable. While we do not have data on median household income for 2022 or even 2021, it is very likely that the income needed to afford a home in Virginia’s housing market has exceeded the median household income. This is a new development in our housing market and will likely have a dampening effect on homeownership in the coming years.

As buyers are faced with more financial hurdles, fewer options to choose from, and increased competition, REALTORS® play a critical role in guiding, educating, and advising individuals and families on their homeownership journey. From navigating the complexities of local housing markets, to connecting prospective homebuyers with the tools and resources to make their dream a reality, REALTORS® help create opportunities for future homeowners.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More