Key Takeaways: February 2025 Virginia Home Sales Report

March 25, 2025

Key Takeaways

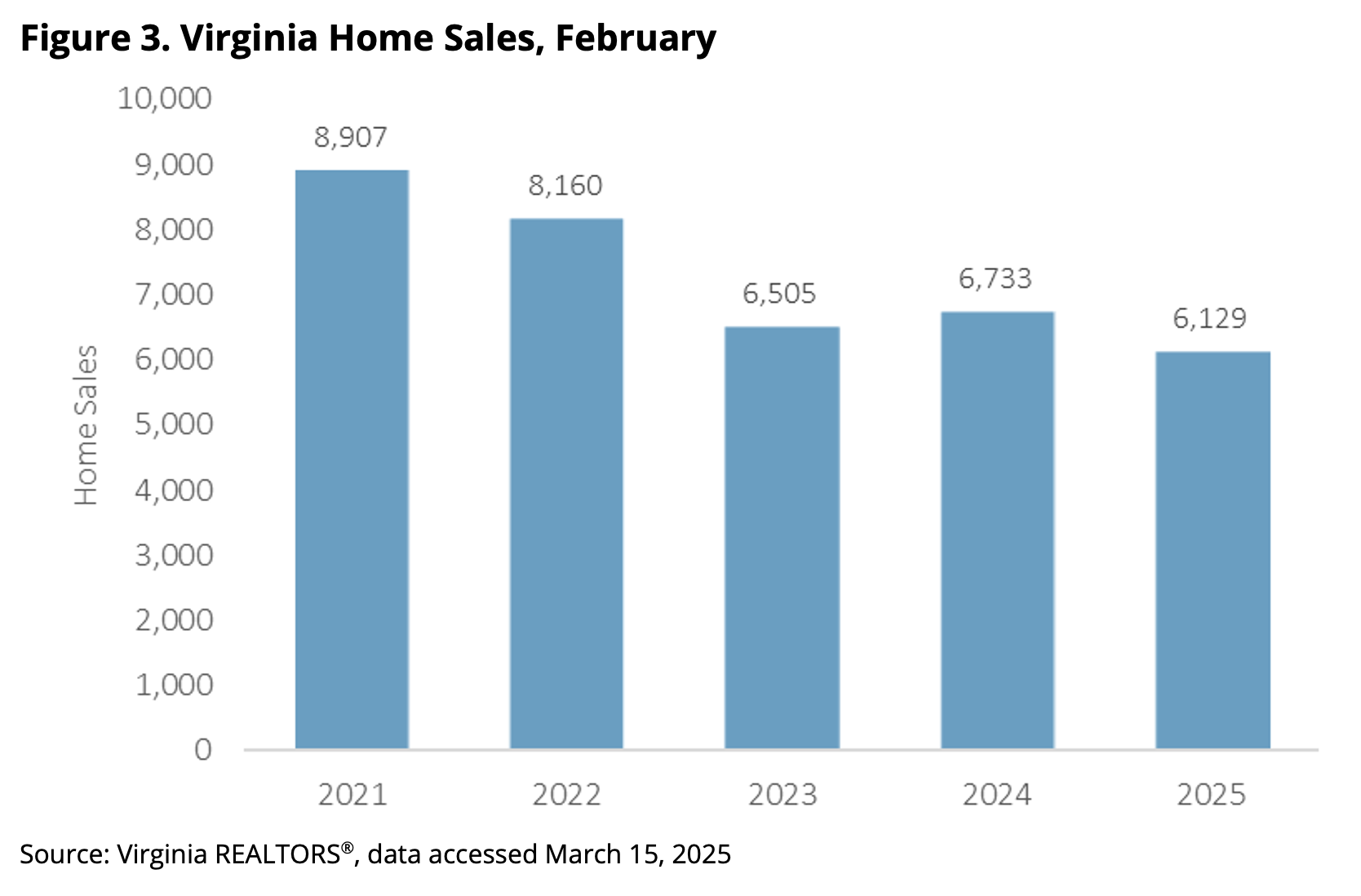

- There was a pullback in closed sales in February. There were 6,129 homes sold statewide this month, down 9% from last February, a reduction of 604 sales. Some of this was likely due to winter weather impacts in January on pending sales, but there is also a lot of uncertainty in several regions around the state from federal job cuts, and mortgage rates have seen very little improvement.

- Home prices continue to trend upward in most parts of the commonwealth. The February median sales price in Virginia was $403,500. This is nearly $19,000 higher than it was a year ago, a 4.9% increase.

- The slowdown in sales brought down the total sold dollar volume in Virginia’s housing market despite climbing price points. There was about $3.1 billion of sold volume statewide in February, about $148 million less than this time last year, which is a 4.6% dip.

- At the end of February, there were 17,529 active listings on the market throughout Virginia. This is more than 3,100 additional listings than there were a year ago, reflecting a 21.6% influx.

Outlook

The 2025 housing market slowed down in February, but will this trend hold as we head into the spring market? Here are some key things to watch in the coming months:

- The impacts of federal job cuts on housing markets around the state are being monitored closely, and it’s still early to tell what the full scope could be. The markets with the largest federal employment footprint, Northern Virginia and Hampton Roads, continue to show patterns that have been underway for quite some time, tight supply and strong price growth. Transaction volume in both of these markets has been slower in 2025 (through February), but the same is true for most regions around Virginia. There is a lot of uncertainty looming, and the spring market could be the first concrete gauge that we have on potential impacts to the housing market from the shifting federal employment landscape.

- Consumer sentiment has taken a hit in recent months, and this became more apparent in February. Most sentiment surveys showed a big drop in February, as consumers are increasingly worried about inflation, the job market, and the direction of the economy amid tariffs and policy changes. The souring mood of the consumers could very well spill over into the housing market which would dampen the spring market. There is still a lot of pent up demand out there, but there is also a lot of uncertainty.

Click here to view the full February 2025 Virginia Home Sales Report.

You might also like…

March Madness Meets Market Madness: Construction Trends in Virginia’s College Towns

By Abel Opoku-Adjei - March 18, 2025

Ongoing economic concerns are impacting both single-family and multifamily construction across the country. According to the National Association of Home Builders, multifamily construction starts are expected to decline… Read More

See It, Want It, Buy It: Single Female Homeownership

By Dominique Fair - March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a… Read More

Impact of Infrastructure Projects on Residential Markets

By Sejal Naik - February 27, 2025

“Location, location, location” is often quoted in the real estate market and emphasizes the importance of location-based features in people’s housing market decisions. While many locational characteristics stay… Read More