NAREB 2024 State of Housing in Black America

February 19, 2025

In 1926, a historian named Carter G. Woodson started Black History Week, which would expand to Black History Month in 1976. Its purpose is to highlight the achievements and contributions of Black Americans while also acknowledging the challenges they have faced throughout history. Recently, the National Association of Real Estate Brokers (NAREB) put out their 2024 State of Housing in Black America (SHIBA) report showing how the housing market has impacted Black people; here are some of the key takeaways from the SHIBA analysis.

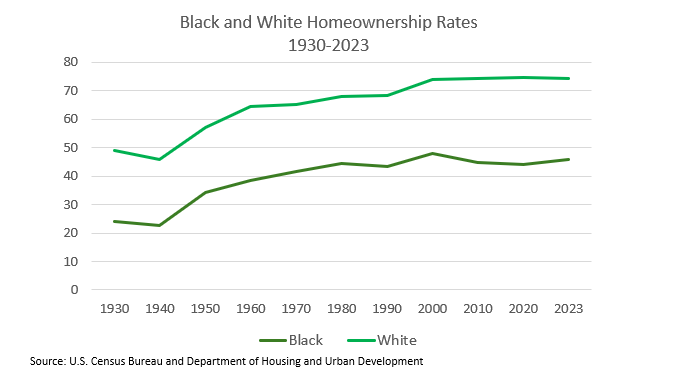

Black Homeownership Remains Stagnant

There has been little movement in Black homeownership rates, an issue that was further exacerbated by higher mortgage rates and home prices over the last few years. According to the report, in 2023, the homeownership rate for Black Americans was 45.7%, slightly higher than last year at 45% but well below that of White households with a rate of 74.3%. Two key home buying demographics, Black women and Black Millennials have recently experienced declines in mortgage application rates. Black women who make up 38% of all Black applicants saw loan originations fall by 24%. Black Millennials, who were the fastest growing demographic of Black home buyers, saw applications and loan approvals drop 21% in 2023. Both groups impact the future of Black homeownership and generational wealth.

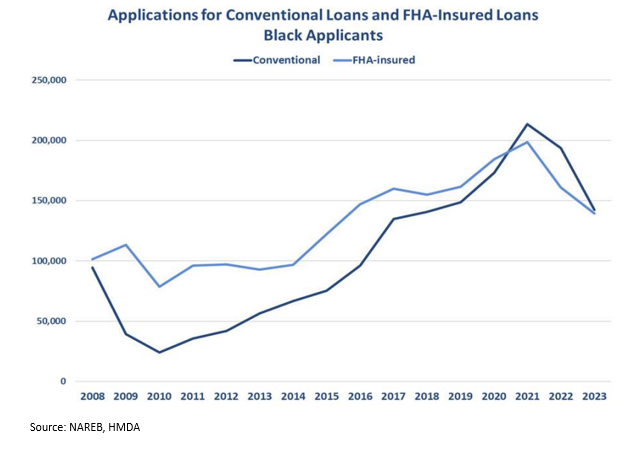

Non-Conventional and Conventional Loan Applications Fell

For Black borrowers, 58% of loan originations were from non-conventional loans but recently the number of applications fell by 16%. The denial rates for non-conventional loans were also higher for Black applicants at 17% compared to White applicants at 9%. There was also a significant decrease in conventional loan applications with 42% of Black applicants applying for them, down 26% from 2022 to 2023. Denial rates for conventional loans were higher for Black applicants (17%) in comparison to White applicants (6%).

Appraisal Bias and the Undervaluing of Black Properties

Despite protections such as the Equal Credit Opportunity Act of 1974 which bans lenders from discriminating based on age, sex, race and disability, properties are still undervalued in Black neighborhoods. A report commissioned by NAREB found that 12% of homes in Black neighborhoods were appraised below the contract price compared to 9% of homes in White neighborhoods. In metro areas with a Black population of 50,000 or more, homes in Black communities were appraised at $262,000 while similar homes in White neighborhoods were valued at $629,000. Lower appraisal rates can lead to disparities in wealth accumulation and reduced equity for Black households.

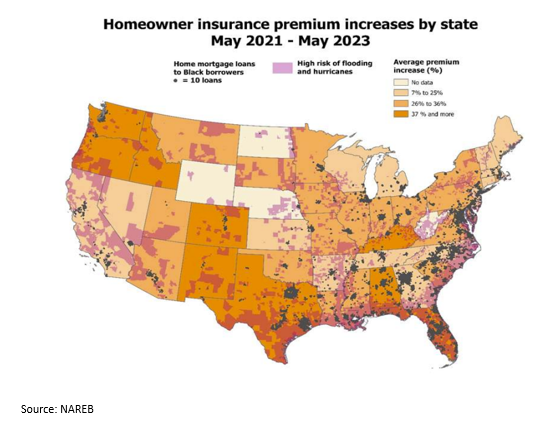

Black Communities Live in Areas More Vulnerable to Climate Change

Historic discriminatory practices have contributed to Black families living in areas that are more susceptible to extreme weather events and natural disasters. The SHIBA report found that 20% of mortgages given to Black borrowers were in areas susceptible to hurricanes, and 29% were given in areas exposed to heat waves. Living in these areas not only impacts the health of Black residents but can also cause economic strains, with 19% of Black homeowners financially affected by natural disasters or extreme weather events in 2023. Home insurance premiums can also impact Black communities with many insurers either limiting or terminating coverage in high-risk zones.

Although there is still much work to be done, there have been positive steps taken to move the needle for Black people in the housing market. The National Association of Real Estate Appraisers and NAREB have partnered up to create the Black Appraisers Program (BAP) to help reduce appraisal bias and increase the number of Black professionals in the industry. NAREB is also in the second year of their Building Black Wealth Tour, aimed at educating and providing resources for Black people on homeownership and building wealth.

For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Key Takeaways: February 2025 Virginia Home Sales Report

By Virginia REALTORS® - March 25, 2025

Key Takeaways There was a pullback in closed sales in February. There were 6,129 homes sold statewide this month, down 9% from last February, a reduction of 604… Read More

March Madness Meets Market Madness: Construction Trends in Virginia’s College Towns

By Abel Opoku-Adjei - March 18, 2025

Ongoing economic concerns are impacting both single-family and multifamily construction across the country. According to the National Association of Home Builders, multifamily construction starts are expected to decline… Read More

See It, Want It, Buy It: Single Female Homeownership

By Dominique Fair - March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a… Read More