A Profile of Renters in Virginia Over the Last Decade

November 14, 2024

Renters have experienced a series of ups and downs in the rental market over the last 10 years. The U.S. Census Bureau has released their American Community Survey estimates for 2023 breaking down demographic and housing changes across the country. Let’s look at the data on renters in Virginia and how things have changed over the last decade.

Demographics

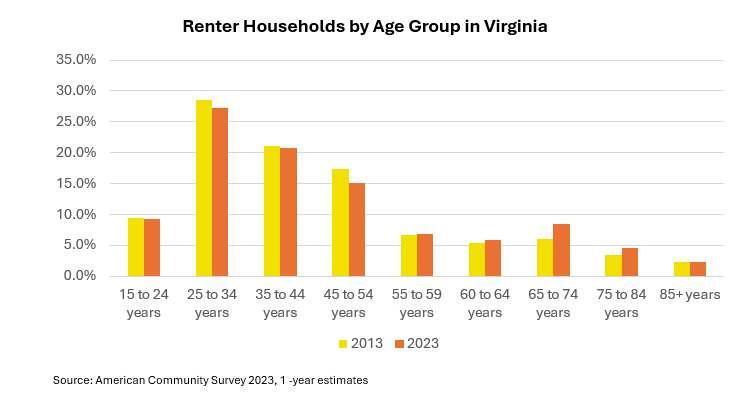

The largest cohort, those 25 to 44 years old, made up most of the renter population in Virginia in 2023 at 47.9%. Renters are typically younger, but there has been an uptick in older generations, who are looking for more convenience and fewer maintenance and home repairs. The shares of renters aged 65 to 74 years old went up from 6.0% to 8.5% between 2013 and 2023, representing the largest growth among all age groups. Renter occupied housing has also become more racially diverse with the number of Black, Hispanic/Latino and Asian households increasing over the last decade.

Geographic

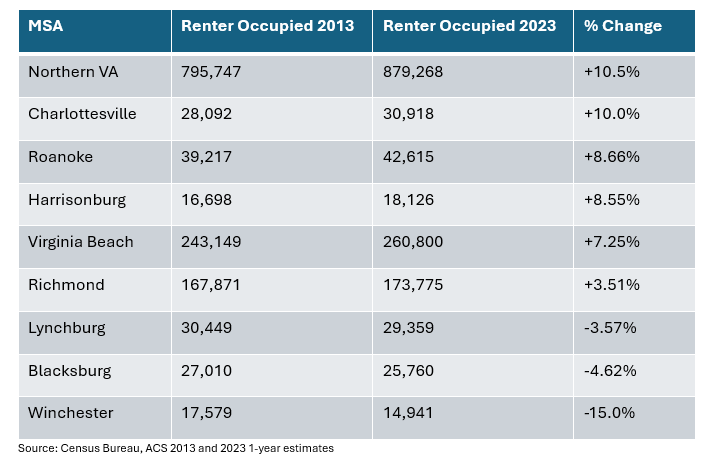

In Virginia, the number of occupied renter units went from 1.05 million in 2013 to 1.09 million in 2023, increasing by 4.27%. Many local markets experienced an increase in the number of renter households with the renter population in Northern Virginia jumping up 10.5% over the last 10 years. Some of the mid-size to smaller markets in the state, such as Charlottesville (+10.0%) and Roanoke (8.66%) saw big gains in renter occupied households. Winchester had the biggest decrease in renter household occupancy levels (-15.0%).

Income and Costs

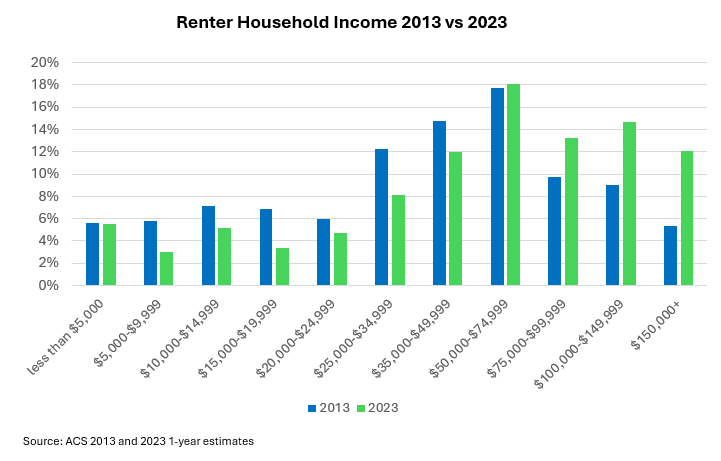

The median household income for renters in Virginia has grown 46.5% over the decade bringing the median income to $60,380 in 2023. Monthly housing costs also increased during this time with renters paying a median of $1,567 last year, jumping up 44.3% since 2013. With rental costs rising, the level of cost burden, those spending 30% or more of their income on housing, began to shift across income groups. Renters making $50,000 to $74,999 saw cost burden levels increase by 4.4 percentage points, the largest growth compared to all other income brackets. Cost burden rates also went up 3.6 percentage points for those renters making $75,000 or more.

The number of renter households continues to climb in Virginia and with mortgage rates and home prices still elevated and supply shortages in the for-sale market, renting will continue to be a sought-after option for many. Many renters are future home buyers so it’s important to keep an eye on the changing demographic and financial characteristics of this market segment.

For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Key Takeaways: February 2025 Virginia Home Sales Report

By Virginia REALTORS® - March 25, 2025

Key Takeaways There was a pullback in closed sales in February. There were 6,129 homes sold statewide this month, down 9% from last February, a reduction of 604… Read More

March Madness Meets Market Madness: Construction Trends in Virginia’s College Towns

By Abel Opoku-Adjei - March 18, 2025

Ongoing economic concerns are impacting both single-family and multifamily construction across the country. According to the National Association of Home Builders, multifamily construction starts are expected to decline… Read More

See It, Want It, Buy It: Single Female Homeownership

By Dominique Fair - March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a… Read More