Mortgage Rates Come Down, Purchasing Power Goes Up

October 7, 2024

The moment everyone has been waiting for is slowly coming. One of the most significant indicators influencing potential buyers’ decision-making is mortgage interest rates. The average mortgage rate began to trend downwards each week after the release of some economic data in August. According to Freddie Mac, the average 30-year fixed mortgage rate is 6.12%, a 1.37% decline from a year ago. The average 15-year mortgage rate is 5.25%, which is 1.53% lower than this time last year. This means potential buyers can now breathe a sigh of relief, knowing they have more purchasing power than they did last year.

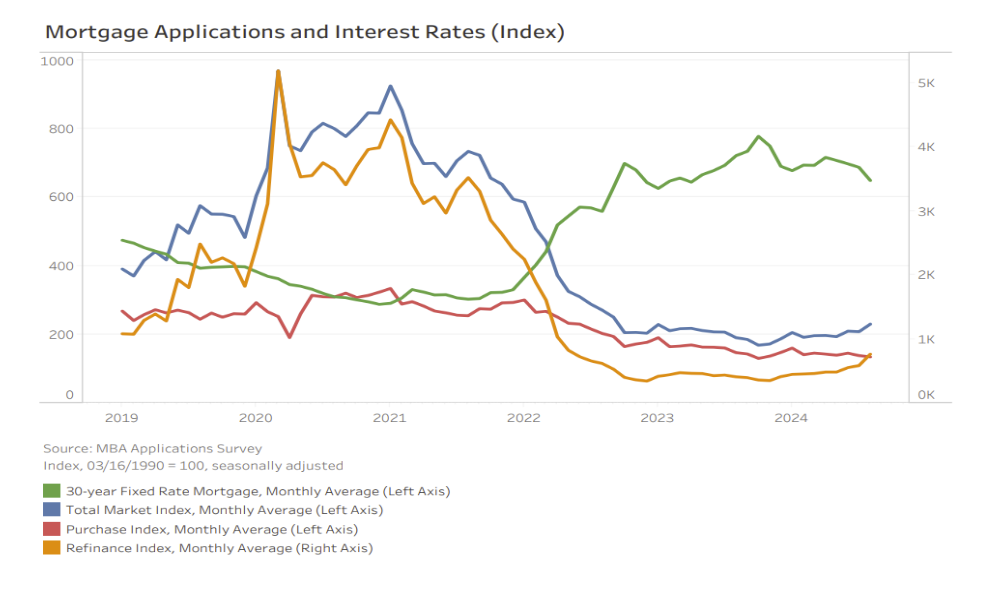

Inflation began to surge as the economy was recovering from the pandemic, and it hit record highs at 9.1% in June 2022. Since then, the FED increased the interest rates for nearly two years to help contain inflationary pressures. This approach has helped bring inflation to 2.5%, the lowest it’s been since 2021. The 10-year treasury yield has also dipped to 3.69% after peaking at 4.98% last October, influencing the decline in mortgage rates.

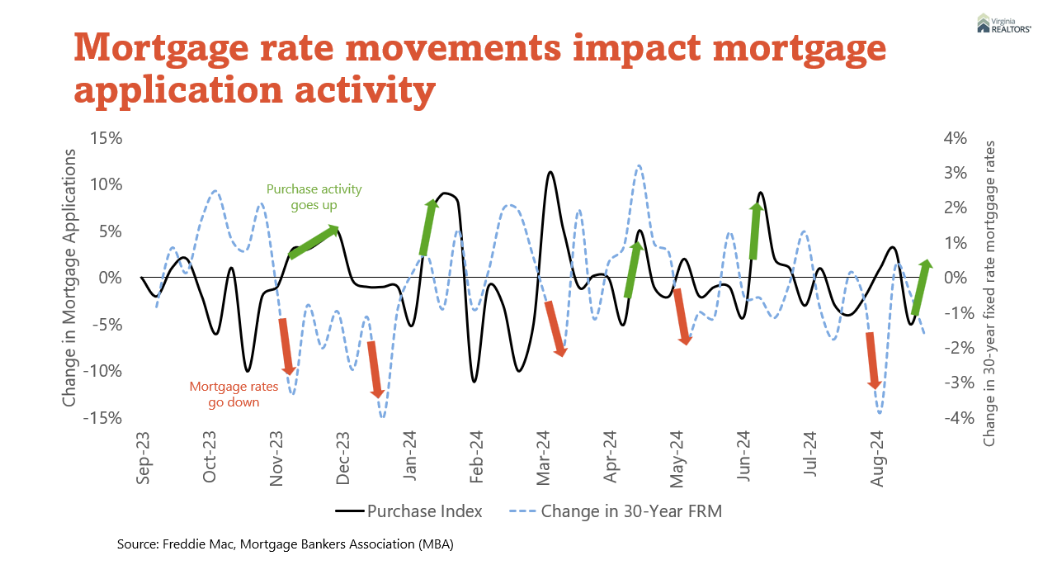

REALTORS® across the country have relayed that their clients are waiting on the sidelines for rates to drop before entering the market to purchase or, in some cases, sell their home. A buyer’s purchasing power is correlated to their income, outstanding debts, and current interest rates. According to the Mortgage Banker Association, as interest rates began to trend downward, purchase applications slowly increased. There was a 3% increase in home purchase applications on a seasonally adjusted basis in the first week of September, but it was 4% lower than the previous year. This is most likely because home prices continue to increase year-over-year.

Many current homeowners are looking to refinance their homes for a lower rate than they initially had. As rates began to trend down, the refinance share of applications averaged 46% in August, the highest it’s been since March 2022, according to Mortgage Bankers Association’s survey. This is 10.7% higher than the prior month and 20.8% higher than last August. Lower mortgage rates will bring not only more buyers to the market but also sellers. Homeowners who were able to lock in a low rate during the pandemic era are not encouraged to sell their homes for a higher mortgage rate or higher monthly payment. When rates hit lower levels, more owners will be encouraged to move and list their homes, which will help with the housing shortage the nation is facing.

The real estate market is set to experience a significant boost from this trend. Sales activity in the future looks more promising than it has in recent times. Lower mortgage rates are a game changer for potential home buyers, providing them with more purchasing power in this competitive sellers’ market. This will not only expand their options but also empower them to make stronger bids to secure the home they want. For real estate professionals, this is a beacon of hope, signaling a brighter future for the industry.

You might also like…

NAREB 2024 State of Housing in Black America

By Dominique Fair - February 19, 2025

In 1926, a historian named Carter G. Woodson started Black History Week, which would expand to Black History Month in 1976. Its purpose is to highlight the achievements… Read More

Virginia’s Ranks 17th for In-Migration in the United States

By Sejal Naik - February 18, 2025

Every year, U-Haul releases a ranking of U.S. states based on their estimates of growth in population since the prior year. This ranking helps understand the net influx… Read More

Virginia’s Thriving Labor Market in 2024

By Abel Opoku-Adjei - February 3, 2025

The labor market in the U.S. showed resilience in 2024 despite the looming economic uncertainty amongst many Americans. According to the recent Bureau of Labor Statistics data, approximately… Read More