Three Multifamily Market Trends from the Second Quarter of 2024

July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights from the most recent report for the second quarter of 2024.

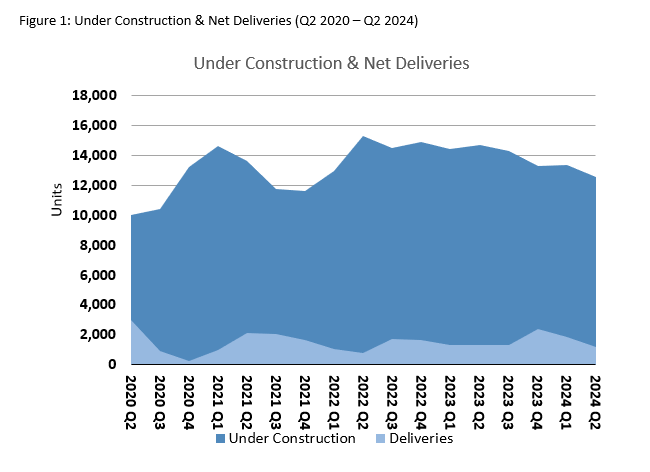

Construction Activity & Supply

2021 and 2022 witnessed a boom in multifamily construction activity. Given the tighter lending conditions over the past couple years, along with labor shortages and high construction costs due to inflation, there has been a slowdown in multifamily construction. The number of units under construction dropped by 15.9% to 26,643 in Q2 2024 from the same quarter a year ago. Northern Virginia and Richmond were the metro markets with the largest share of new construction in the state. However, a lot of multifamily units from construction projects started previously are hitting the market this year which is seen in the increase in supply of newly completed multifamily units. Supply went up in Q2 2024 with 3,796 units delivered, up 9.2% from the same time last year. This is great news for renters and could soften rent growth in some markets.

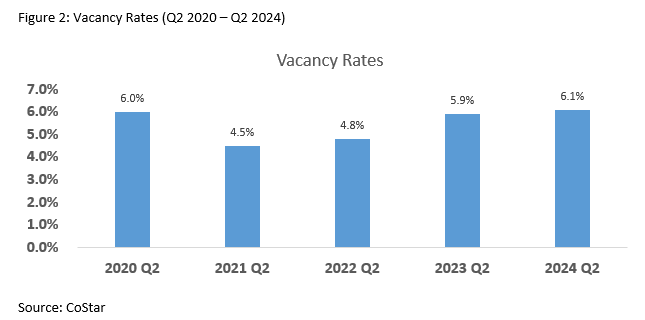

Vacancy Rates

Due to high construction activity over the past few years, the multifamily market in Virginia has seen a rise in vacancy rates, going to 6.1% in the second quarter, up from 5.9% last year. Richmond had the highest vacancy rate in the state at 8.1%, up 0.1% from a year ago. The metro area with the lowest multifamily vacancy rate was Harrisonburg at 3.1%. As construction levels and occupancy levels even out, we expect vacancy rates to stabilize.

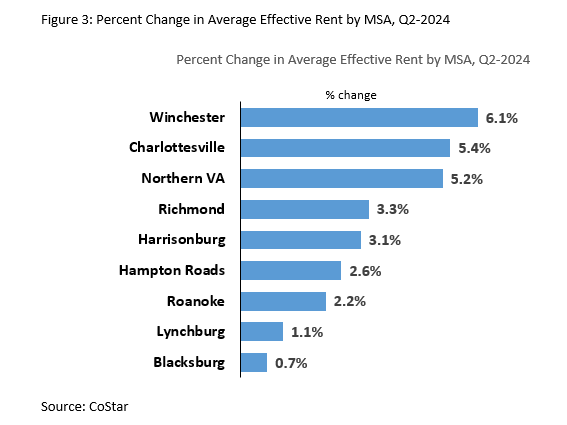

Rent

Rent prices remain elevated throughout the state with the rent for a multifamily unit In Virginia climbing to $1,753 in Q2, up 4.2% from the same time last year. Winchester and Charlottesville saw the highest increase in rent compared to the previous year. The average rent for an apartment in Winchester increased 6.1% to $1,417, while the average rent in Charlottesville rose 5.4% to $1,761. The markets with the smallest increases in average effective rent were Blacksburg at 0.7% and Lynchburg at 1.1%.

Check out the full Q2 Multifamily Market Report here. For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Key Takeaways: February 2025 Virginia Home Sales Report

By Virginia REALTORS® - March 25, 2025

Key Takeaways There was a pullback in closed sales in February. There were 6,129 homes sold statewide this month, down 9% from last February, a reduction of 604… Read More

March Madness Meets Market Madness: Construction Trends in Virginia’s College Towns

By Abel Opoku-Adjei - March 18, 2025

Ongoing economic concerns are impacting both single-family and multifamily construction across the country. According to the National Association of Home Builders, multifamily construction starts are expected to decline… Read More

See It, Want It, Buy It: Single Female Homeownership

By Dominique Fair - March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a… Read More