Takeaways From the JCHS 2024 State of the Nation’s Housing

July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners and renters. Let’s look at some of the key takeaways.

Buyers and Renters Grapple with Affordability

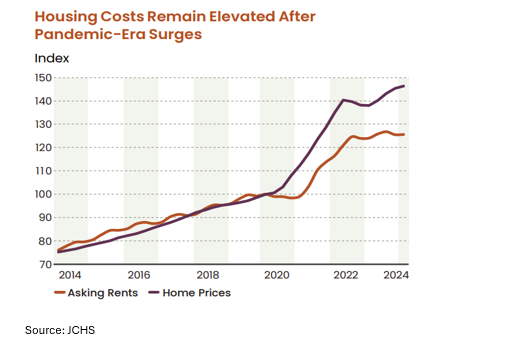

Affordability challenges continue to affect the current market with home prices up 47% nationwide since the pandemic, and rates continuing to edge closer to 7%. The combination of these factors has led to higher mortgage payments, with a buyer needing to make $119,800 to afford the median mortgage payment of $2,201. For renters, only one in seven can afford mortgage payments at this level. According to the JCHS 1 in 4 households are now worriedly feeling the financial strain of higher housing costs. Many first-time buyers, those 35 years and under, are being priced out of the market with loan originations falling by 17% and homeownership rates dropping 0.4 percentage points. Across all age groups, homeownership went up 0.1 percentage point in 2023, the lowest increase since 2016.

On the rental market side, rent growth has slowed to 0.2% but is still 26% higher than it was in the beginning of 2020. With rent outpacing income levels, half of all renters (22.4 million) are now cost burdened while the number of severely cost burdened, those spending more than 50% of their income on housing, rose to a high of 12.1 million.

Tight Supply Leads to New Construction

In 2023 there were 4.1 million existing home sales, down 19% from the previous year and the lowest sale rate in almost 30 years. High home prices and rates have contributed to the lack of supply with many buyers unwilling to give up the lower interest rates on their current home. The limited existing inventory on the market has led to a rise in the demand for new single-family construction with housing starts averaging 1.06 million in the first quarter of 2024. Builders are offering rate buydowns and building smaller homes to incentivize buyers while also offsetting costs. The supply of newly built multifamily buildings has also been on the rise with 487,000 units added over the last year, the highest completion level since May of 1988. Although we are seeing supply increase in both markets, there are challenges as insurance premiums and operating costs increase and lending conditions tighten due to higher interest rates.

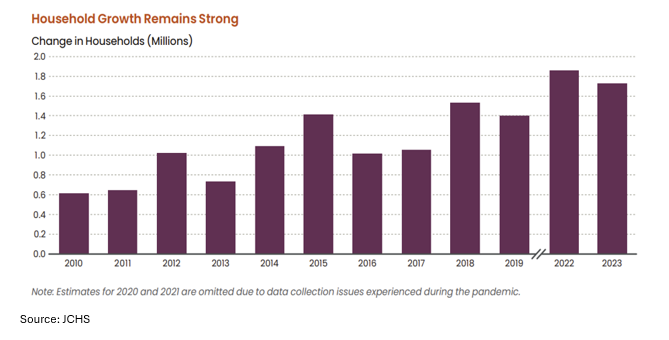

Younger, More Diverse Groups Heading Households

Even with the rise in housing costs, there were 1.7 million households added last year bringing the total number of households to 130.3 million in the U.S. Most of the growth in households has come from the younger generations, with Generation Z creating 8.1 million households between 2017 and 2022 and millennials adding 6.9 million households. Gen Z and millennials are more racially diverse compared to previous generations with nearly 80% of household growth attributed to households of color in the last five years. A third of these households of color are headed by immigrants who are impacting population growth, going from less than 500,000 in 2019 to 3.3 million in 2023.

The cost of housing remains an ongoing issue for buyers and renters, but the market is showing some signs of improvement. Rent growth has decreased as more apartments hit the market while the inventory of existing homes rose to 1.28 million units at the end of May 2024, an 18.5% jump from a year ago.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

Look Who is Renting: 2024 Profile of Virginia Renters

By Dominique Fair - December 16, 2025

The rental market has shifted over the last year with both construction and rental prices slowing down, but even with these changes, the cost of housing remains high… Read More

Key Takeaways from NAR’s 2025 Profile of Home Buyers and Sellers

By Sejal Naik - December 8, 2025

The National Association of REALTORS® recently released its annual profile of home buyers and sellers. This report summarizes the results from a survey of home buyers and sellers… Read More

Key Takeaways: October 2025 Virginia Home Sales Report

By Virginia REALTORS® - November 19, 2025

Key Takeaways In October, home sales continued their upward trajectory since this summer. There were 9,006 closed sales across the Commonwealth, 274 more sales than a year ago,… Read More