Virginia’s homeownership rate is on the rise, but with tight inventory and climbing prices, who is missing out?

June 20, 2024

In June, we celebrate National Homeownership Month. It’s a good time to reflect on the milestone of homeownership and how it continues to be a key step for building strong communities and building generational wealth. It’s a time to celebrate the wins, but it is also an important time to assess where improvements are needed, where the gaps exist, and who in our communities may be struggling to make the dream of homeownership a reality. Let’s dive into the most recent homeownership trends here in Virginia and see what the data is telling us.

Virginia’s homeownership rate ranks 24th in the country, jumping up from 29th a year ago.

Our homeownership rate here in Virginia has had a big jump over the past year and continues to exceed the national rate. In 2023, the homeownership rate in Virginia was 69.1%. This is a big jump from 67.4% a year ago, making Virginia tied for the fifth largest jump in homeownership rate between 2022 and 2023. (We’re tied with Alabama on this.) In terms of the overall level of homeownership, Virginia is in the middle of the pack compared to other states. We have the 24th highest homeownership rate in the nation, just above Tennessee (68.9%), and just below Wisconsin (69.2%). Notably, we are up from 29th in 2022. The national homeownership rate was 65.9% in 2023, inching up from 65.8% in 2022.

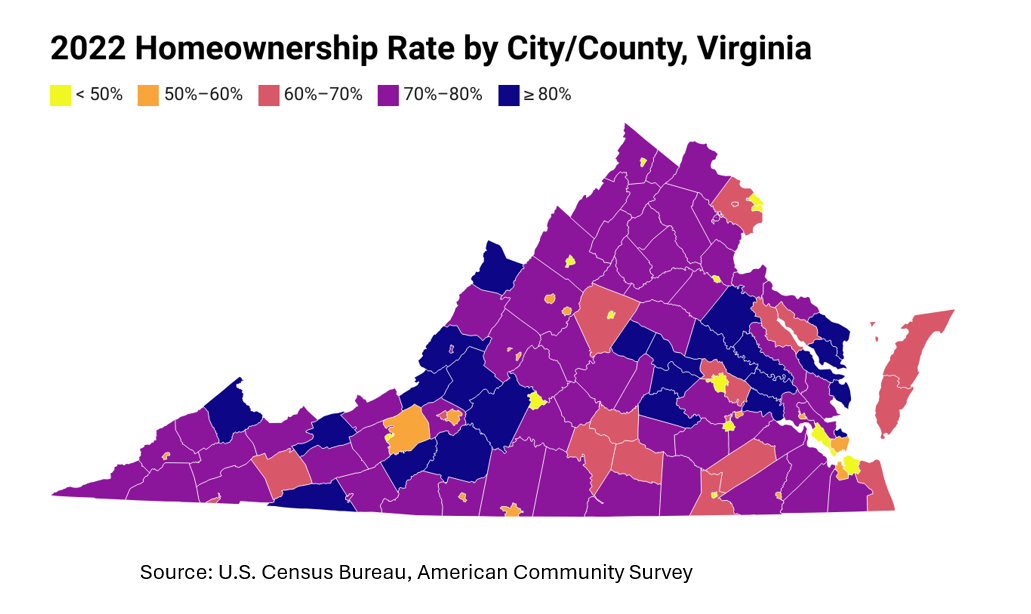

Within the commonwealth, the homeownership rate varies widely. As of 2022, the highest homeownership rate in Virginia was in New Kent County at 92.3%, and the lowest was in Petersburg at 37.4%. Nearly half of the cities and counties in Virginia have a homeownership rate in the 70% to 80% range. The highest homeownership rates tend to be in rural areas, and the lowest in more urban and suburban areas, and also in Virginia’s college towns.

Virginia’s overall homeownership rate is up, but the gap between races remains wide and is at risk of widening.

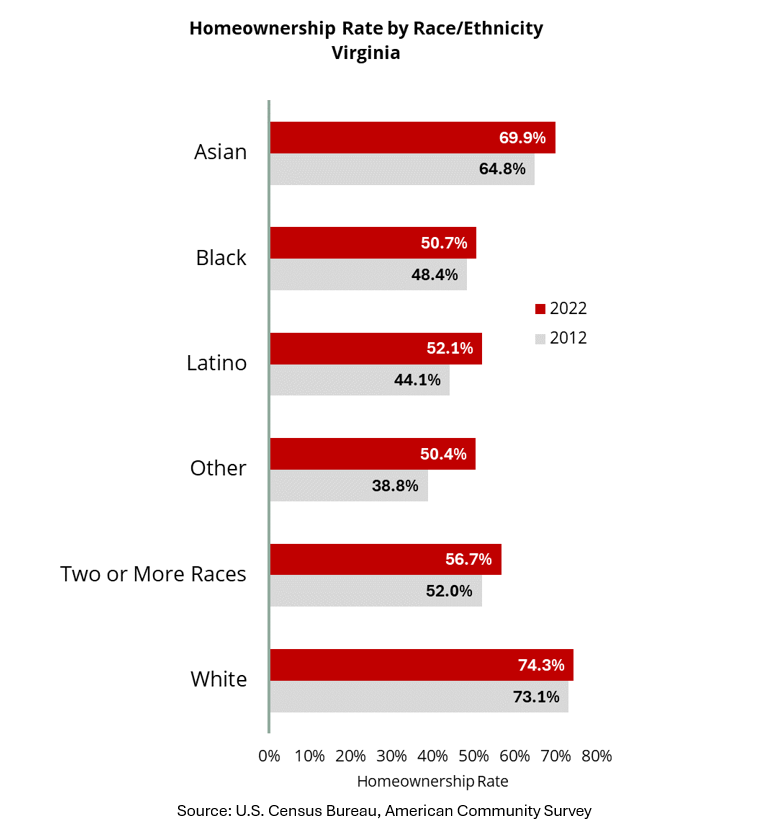

Similar to national trends, there continues to be a wide gap in the homeownership rate between different races and ethnicities here in Virginia. In 2022, the homeownership rate for White households in the commonwealth was 74.3%, while the homeownership rate for Black households was 50.7%. About 52.1% of Latino households in Virginia owned their home in 2022, and 69.9% of Asian households are homeowners.

Based on this data, there is clearly still a lot of work to do to narrow the gap and broaden access to homeownership across communities in our state. We have seen the gap narrow over the last decade, but it is a needle that has been very slow to move for some. Also, in the current interest rate and home price environment we are in, there is a risk that these gains in homeownership could be lost as affordability challenges mount. Over the last decade, the homeownership rate of Black households has only inched up 2.3 percentage points. Latino households, on the other hand, have one of the fastest-growing homeownership rates in Virginia. The Latino homeownership rate jumped up 8 percentage points between 2012 and 2022. The homeownership rate for Asian households rose 5.1 percentage points, and homeownership rate for White households increased 1.2 percentage points.

Without more housing supply, and specifically a wider range of housing types and price points, it will be difficult to continue to narrow these racial homeownership gaps. Our housing inventory here in Virginia is in a dramatically different place than it was a decade ago. We have far fewer homes available, and the demand pipeline has grown while the supply has dwindled. This has created competitive market conditions and rapidly rising home prices in many local markets. Increasing the supply of homes and diversifying our housing stock in Virginia will be a key strategy for narrowing the racial homeownership gap in the coming years.

Affordability challenges are growing for Virginia’s younger home buyers.

Housing affordability and availability can also have a big impact on younger Virginians. Millennials are in their prime homebuying years. Younger Millennials, in their early 30s are in the first-time home-buying years, while some older Millennials in their early 40s are likely repeat buyers, looking for larger homes to meet the changing needs of their families. As we’ve seen inventory conditions tighten and home prices escalate in recent years, the data suggests that many of Virginia’s younger buyers are likely struggling to afford homeownership in our state.

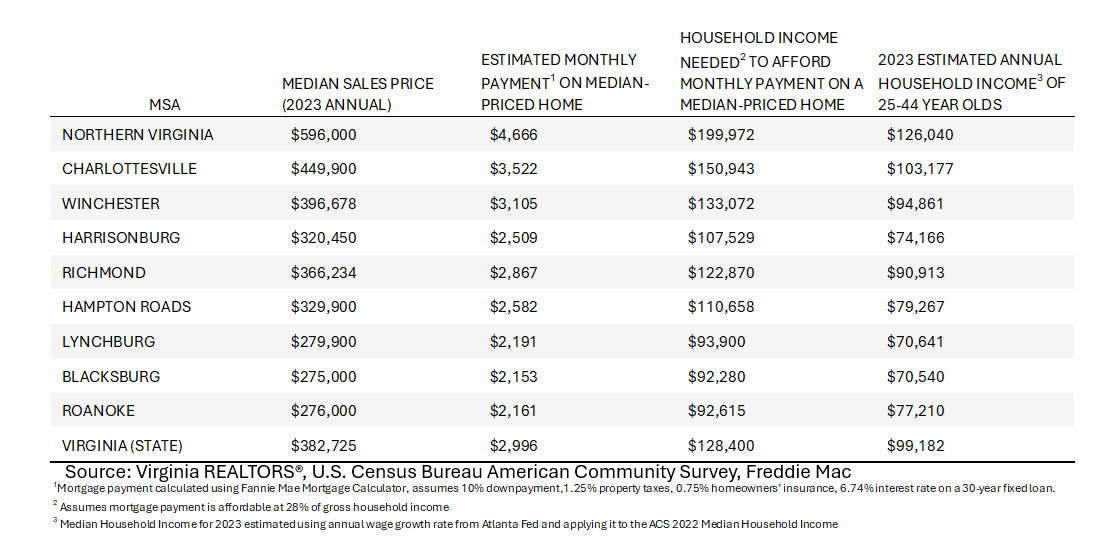

Virginia REALTORS® analyzed home prices and income trends in Virginia’s nine metropolitan regions. Using current mortgage rates and median home prices, we estimated what a typical monthly mortgage payment would be for a median-priced home in Virginia’s nine metro areas. We then estimated the annual household income needed to afford that monthly payment based on federal standards of affordability.

The findings are striking and raise concerns that homeownership is becoming increasingly difficult for Virginia’s younger households (age 25 to 44). The median annual income levels for 25- to 44-year-olds falls well short of the income needed to afford a median-priced home in all nine metro regions in the state. The most acute affordability challenges exist in Northern Virginia and Charlottesville, where it is estimated that 25- to 44-year-olds make about $74K and $48k below what is needed to afford a median priced home in those two markets. If these trends hold or worsen, we could see more out-migration of younger households from higher-cost regions to lower-cost regions, a trend that has already started to gain traction in some parts of the state.

Our housing market is strong in Virginia, and it has been resilient. Even as inventory has tightened, mortgage rates have doubled, and prices are climbing, we’ve seen our homeownership rate rise. This should be celebrated; more Virginians are owning their homes, which is good for our communities and our economy.

We also need to take stock of where we are missing the mark, and who is not able to make the dream of homeownership a reality and build generational wealth. For example, the families that are saving all they can for a down payment, but the price points are still out of reach, or there are limited options of homes to choose from in their communities. Solutions will be wide ranging, and multilayered. Demanding side resources like down payment assistance programs and grant programs, like those provided by Virginia Housing, are vital. Equally important are supply-side initiatives, like taking a closer look at zoning and evaluating ways to facilitate more housing, a variety of types of housing, all different sizes and price points, to meet the needs of Virginians where they are in their homeownership journey. The broader we can make the homeownership tent, the better Virginia will be, both now, and in the future.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out the Virginia REALTORS® Research Team resources at virginiarealtors.org/research.

You might also like…

Key Takeaways: February 2025 Virginia Home Sales Report

By Virginia REALTORS® - March 25, 2025

Key Takeaways There was a pullback in closed sales in February. There were 6,129 homes sold statewide this month, down 9% from last February, a reduction of 604… Read More

March Madness Meets Market Madness: Construction Trends in Virginia’s College Towns

By Abel Opoku-Adjei - March 18, 2025

Ongoing economic concerns are impacting both single-family and multifamily construction across the country. According to the National Association of Home Builders, multifamily construction starts are expected to decline… Read More

See It, Want It, Buy It: Single Female Homeownership

By Dominique Fair - March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a… Read More