3 Multifamily Market Trends from the First Quarter

April 16, 2024

For the last three years, the multifamily market has seen high demand, double digit rent growth, and increased construction to meet demand. These trends are expected to shift as rent prices begin to moderate and the construction pipeline slows down. Let’s break down the most recent multifamily report for Virginia and see how things have changed in the first quarter of 2024.

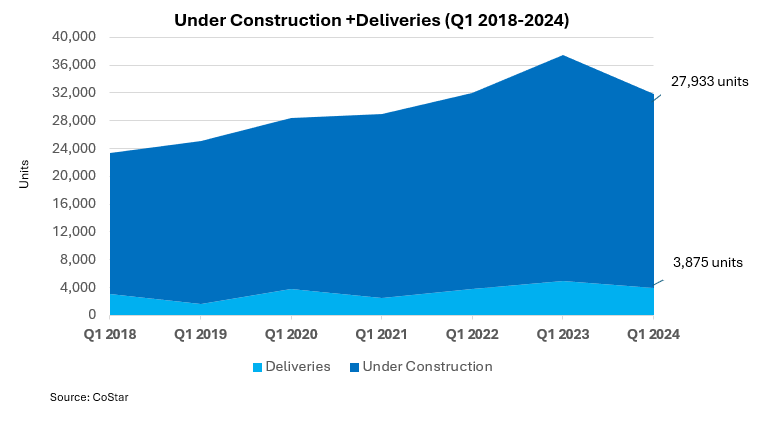

Construction and Deliveries

The National Association of Home Builders recently forecasted that multifamily construction would decline with starts projected to fall 20% this year. This is due in part to the high cost of construction material, labor shortages, and tighter lending conditions in the multifamily market. These effects began at the end of 2023 and continued into the first quarter of 2024 with multifamily construction down 13.7% in Virginia. The number of building permits also showed signs of cooling down with permits up 2.5% from February 2023 to 2024 but down 22.5% from January 2024. More apartment units are set to hit the market this year, but those numbers are starting to dip, with the number of deliveries down 22.3% throughout the state. Despite the slowdown, there is still demand for multifamily units as potential home buyers grapple with affordability issues in the residential market.

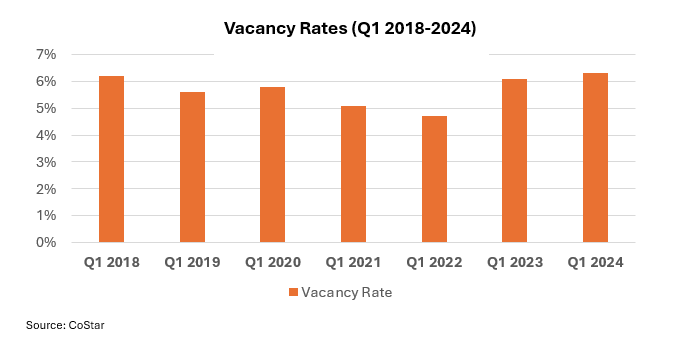

Vacancy Rates

Vacancy rates are up due to high construction activity over the last two years, but are starting to come down with the rate in Virginia reaching 6.3% in Q1 2024. The Richmond market saw vacancy rates rise from 7.7% to 8.4% in Q1 2024, the highest rate in the state. The mid to small metro market areas saw the lowest vacancy rates with Charlottesville at 4.3% and Harrisonburg at 4.0%. We will continue to see vacancy rates stabilize and then fall as the construction levels drop off and the number of newly built units become occupied.

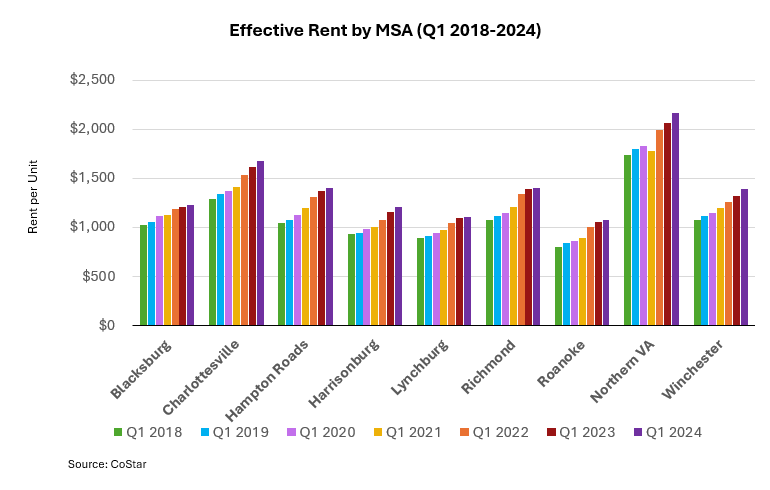

Rent

Rental growth has continued to decelerate throughout the commonwealth with effective rent per unit up 3.7% from last year. In the first quarter of 2024, a unit in Lynchburg was $1,111, up 0.9% from the previous year, the smallest growth in average rent across all nine metro markets. The biggest increase in rent growth took place in one of Virginia’s smaller markets this quarter; rent prices in Winchester went up 5.4% from the previous year, bringing the price of a unit to $1,396 in the area. Northern Virginia saw the average rent price for a unit climb to $2,171, jumping up 5.0% from a year earlier. Although we are seeing rent growth cool down, prices are still elevated with a unit now costing $1,706 in Virginia, 27.5% higher than six years ago.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs. Get the full Q1 2024 Multifamily Market Report here.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More