Cost-Burdened Renters: America’s Rental Trends

March 19, 2024

The multifamily market saw many ups and downs with high renter demand, rent hikes, and a surge in apartment construction in 2022. The Joint Center for Housing Studies of Harvard University (JCHS) recently put out a report highlighting these trends in the rental market and trends among renter households. Here is the breakdown of how renter demographics have shifted nationally over the last few years (according to the most recent Census data available) and how this might be impacting your market.

Cost-burdened renters are at a record high.

According to the JCHS report, there were 22.4 million cost-burdened renters in 2022, two million more than before the pandemic. A renter is considered cost-burdened if they are spending more than 30% of their gross income on rent and utilities each month. The number of severely cost-burdened renters, those spending more than 50% of their income on rent and utilities, also rose during this period reaching 12.1 million. Rising rent prices and pandemic related rental assistance programs ending led to more cost-burdened renters during this time. Rent growth has cooled from its peak of 17.5% in 2022 to -0.7 at the of 2023, but income levels have not kept pace. In 2022, the median nominal income grew by 10.6% but declined to 3.9% in 2023.

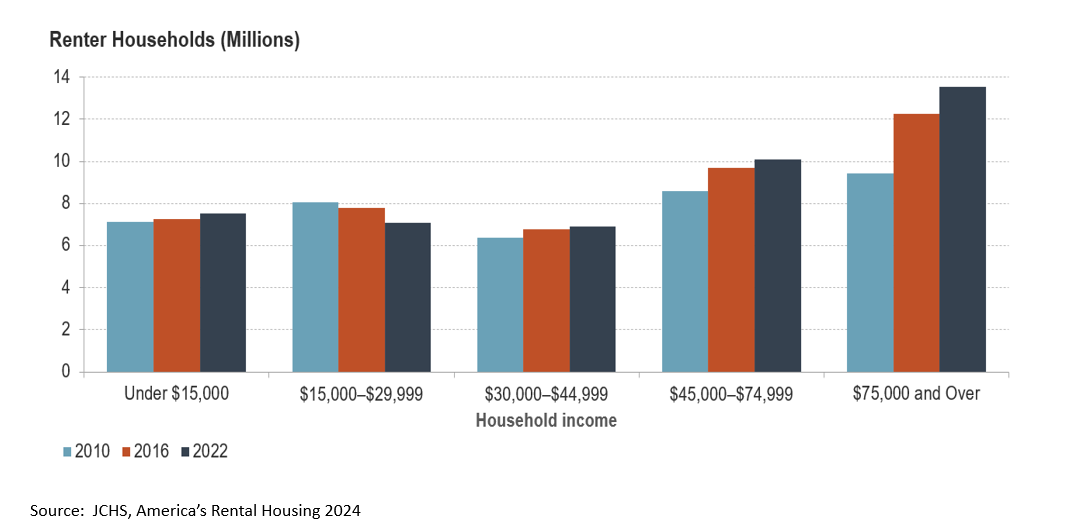

Middle income renter households increased.

Prior to the pandemic, higher income households drove renter demand with 1.3 million renter households added between 2016 and 2019. This changed when the pandemic hit, as many high-income renters took advantage of low mortgage rates in 2020 and 2021 and bought a home. Renters making less than $75,000 added 1.1 million households between 2019 and 2022, while higher income renter households rose by just 16,000. Although middle-income renters were responsible for most of the rental growth over the last few years, they were also greatly affected by the lack of affordability. In 2022, 41% of those making between $45,000 and $74,999 were cost burdened, an increase of 5.4 percentage points from 2019. Although middle-income renters were hit hard by increased housing costs, lower income renters saw their level of cost burden rise to 83%, the largest rate across all income brackets.

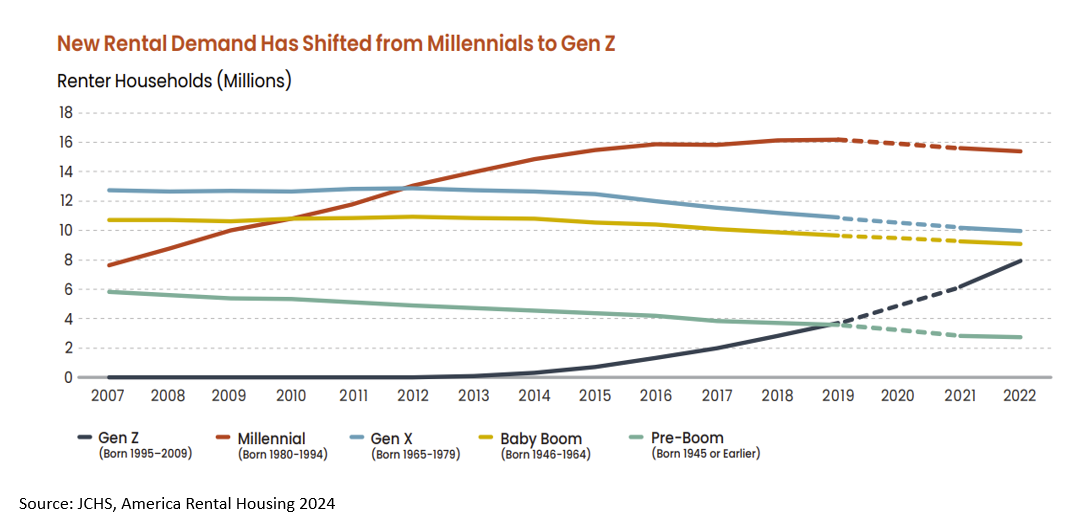

Generation Z and Baby Boomers are driving rental demand.

Millennials made up much of the growth in renter households with 6.2 million households added between 2009 and 2019. This changed with the pandemic as mortgage rates were at record lows and Millennials came into their prime home-buying years. Millennials still have more renter households, but Gen Z has now become the renter majority generation with 7.9 million renter households in 2022. For many in Generation Z, renting is a cheaper option than buying a home, while also allowing the flexibility to move where they want. Another generation that is impacting the rental market is Baby Boomers, who saw the number of renter households increase by 1 million in the last 5 years. Both younger and older renters still had high rent-to-income ratios. Of those renter households 25 and under, 61% were cost burdened while 55–64-year-olds and those aged 65 and over had renter burden rates at 49% and 57%.

Rent is less affordable in large metro areas.

Larger metro areas saw higher rates of unaffordability among renter households than smaller metro areas. JCHS found that 51% of renters living in 56 metros with populations over a million were cost burdened in 2022. Larger metro areas have higher housing costs making them a less affordable option compared to smaller cities with a lower cost of living. Small metro areas, those with a population under 250,000 saw 45% of cost-burdened renters going up 2.6 percentage points since 2019. In rural areas, affordability was higher for renters with 40% being cost burdened up 1.7 percentage points from 2019 to 2022.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

Key Takeaways: September 2024 Virginia Home Sales Report

By Virginia REALTORS® - October 23, 2024

Key Takeaways Closed sales activity remains relatively flat compared to last year. There were 8,065 homes sold in September throughout the state, just 42 more than last September,… Read More

Single Family Homes Permit Activity in Virginia

By Dominique Fair - October 15, 2024

Supply has played a huge role in affordability issues for buyers, with the U.S. short 4.5 million units and sellers still holding on to homes with lower rates.… Read More

Mortgage Rates Come Down, Purchasing Power Goes Up

By Abel Opoku-Adjei - October 7, 2024

The moment everyone has been waiting for is slowly coming. One of the most significant indicators influencing potential buyers’ decision-making is mortgage interest rates. The average mortgage rate… Read More