Female Homeownership: Past to Present Trends in Virginia and the U.S.

March 5, 2024

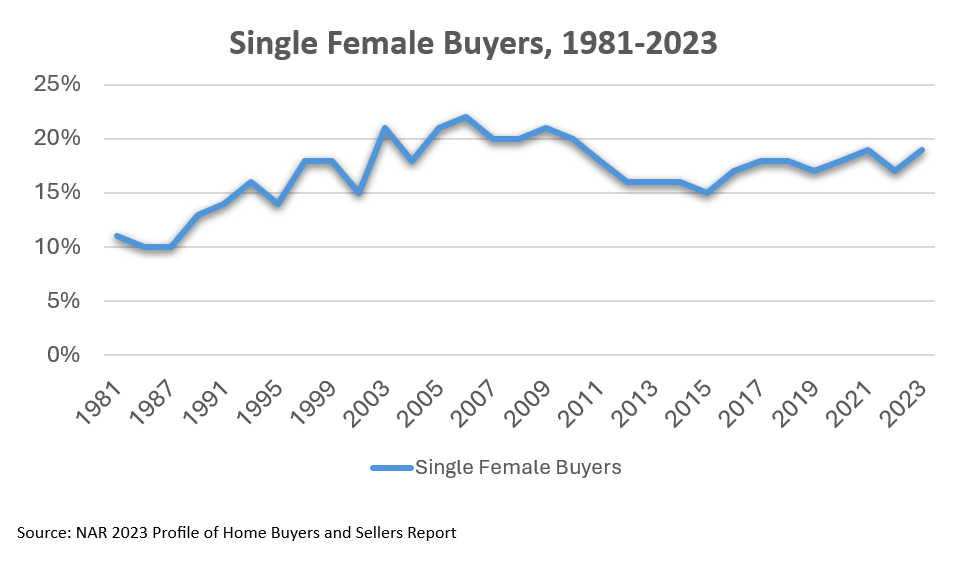

Every year in March, we remember and highlight the contributions that women have made throughout history and in the present day. One of the areas that women have made great strides and have continued to have an impact on is homeownership. According to the National Association of REALTORS® 2023 Profile of Home Buyers and Sellers report, the number of single female buyers went from 17% in 2022 to 19% in 2023. As we enter Women’s History Month, let’s look at how homeownership has changed for women over the years and what challenges they face going forward.

Every year in March, we remember and highlight the contributions that women have made throughout history and in the present day. One of the areas that women have made great strides and have continued to have an impact on is homeownership. According to the National Association of REALTORS® 2023 Profile of Home Buyers and Sellers report, the number of single female buyers went from 17% in 2022 to 19% in 2023. As we enter Women’s History Month, let’s look at how homeownership has changed for women over the years and what challenges they face going forward.

Female homeownership grew after 1974.

In today’s world, women are essential to the home buying market, but that was not always the case. For a long period of time, women were unable to get a credit card or purchase homes without having a husband or co-signer present. It wasn’t until 1974 when the Equal Credit Opportunity Act (ECOA) was signed into law that they were able to finance their own real estate purchases. The ECOA made it unlawful to discriminate against applicants based on race, color, religion, sex, national origin, marital status, and age. This act, coupled with an increase in labor force participation and wages, led to higher homeownership rates among single women. The National Association of REALTORS® (NAR) reported that in 1981 single females made up 11% of all buyers, making them the second largest group of buyers behind married couples, a trend that continues still today.

Women own more homes than men despite earning less.

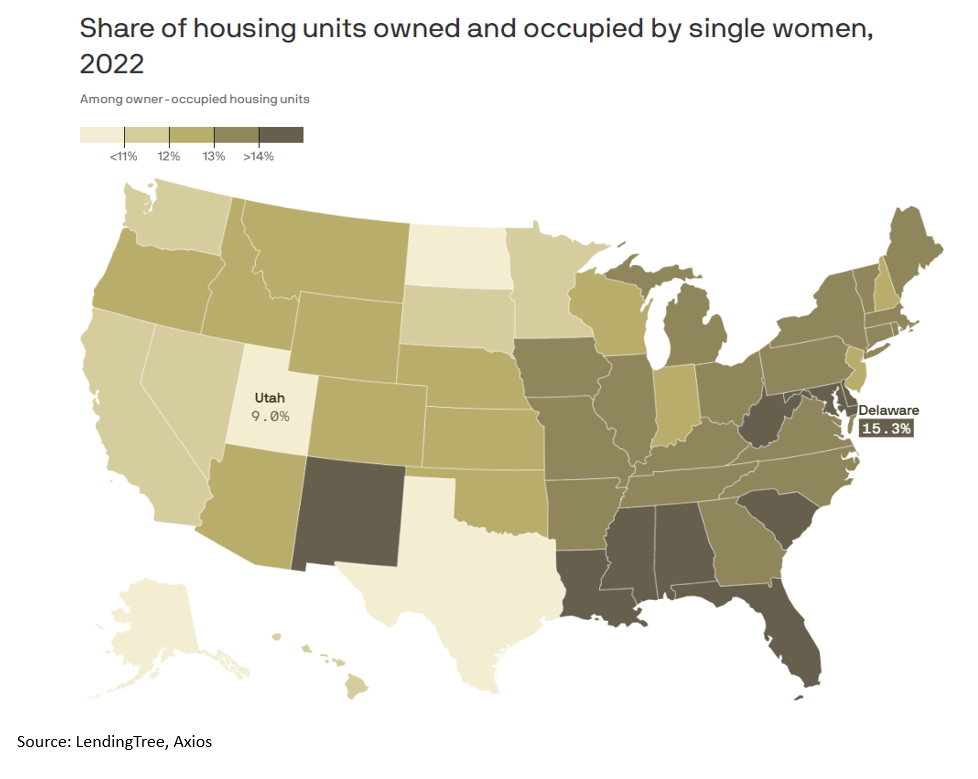

A recent analysis by LendingTree found that single women own 10.95 million homes compared to single men who own 8.24 million homes. The gap in homeownership between single men and women can also be seen across multiple states including Virginia, where 13.55% of homes are owned and occupied by single women versus men at 9.34%.

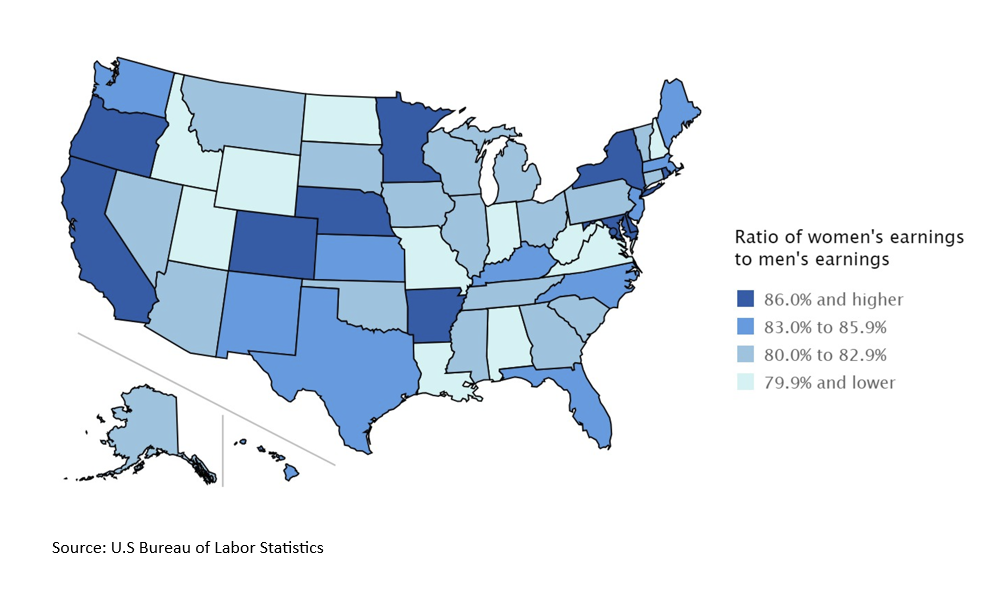

Although women are outpacing men in homeownership, they still face challenges when it comes to owning a home. Women who worked full time made 82% of the median earnings of their male counterparts in 2022, increasing by just 1% from a decade ago. Debt is also a barrier for women when it comes to home buying. A report by NAR found that, of those single women saving for a home, 53% reported high rent and current mortgage payments as the main expense that delayed them from saving, followed by student loan debt at 41%. Despite the lack of income and debt, women are still finding ways to make homeownership happen. Many are cutting spending on entertainment and non-essential items, working extra hours, or moving in with family to be able to afford a home.

Female buyers are older but…

The median age of a single female buyer is 55, but we are seeing younger generations like Gen-Z beginning to shift the narrative around income and home buying. The NAR 2023 Home Buyers and Sellers Generational Trends report found that 18–23-year-olds made up the largest percentage of single female buyers at 31%. Income levels are also changing, particularly for women under 30; in 22 out of 250 metropolitan areas, women make the same or more than men. With a younger generation of women coming into the housing market, it will be important to see how the trend among female buyers continues to change and grow.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More