Early Signs of Mortgage Rate Optimism Heading into 2024

January 31, 2024

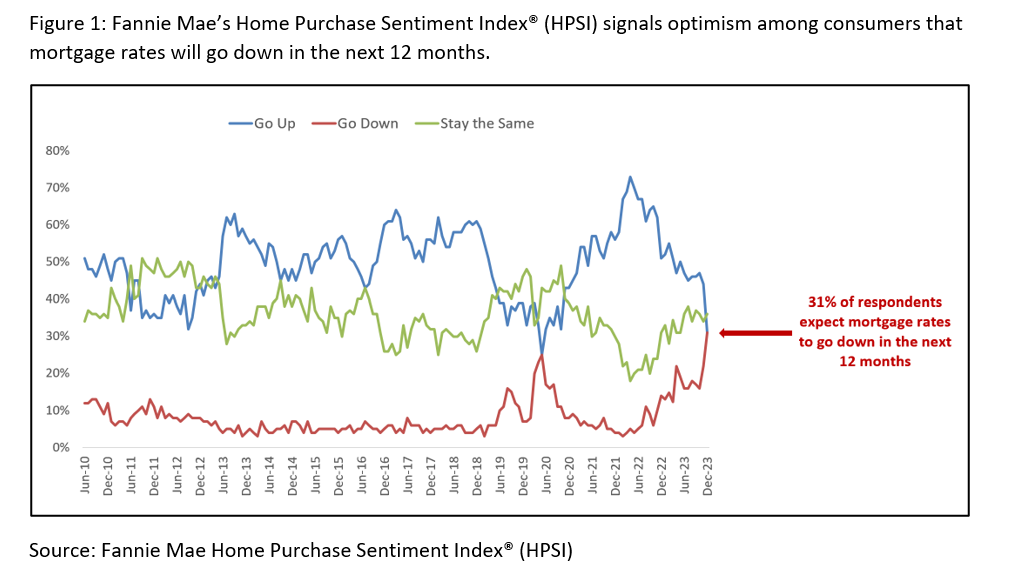

According to Fannie Mae’s Home Purchase Sentiment Index® (HPSI), released in January 2024, 31% of consumers expect mortgage rates to go down in 2024. HPSI is an index based on the National Housing Survey conducted by Fannie Mae that reflects the current and future housing market outcomes. December’s results show that the share of consumers expecting mortgage rates to go down is the highest it has been since the survey’s inception in 2010. Moreover, 17% of consumers indicated that it was a good time to buy a home, which was slightly higher than 14% of consumers in the previous month, adding to the optimistic trend in the housing market expectations.

This sense of optimism was most likely spurred by the declining trend in mortgage rates starting mid-November in 2023 after the average rate had reached almost 8%. Based on the most recent Freddie Mac Primary Mortgage Market Survey®, the 30-year fixed-rate mortgage rate was 6.69%. Consumers seem to be expecting the home affordability pressures to ease going into 2024. High mortgage rates have been the primary reason both potential buyers and sellers think it has been a bad time to buy and a bad time to sell, respectively.

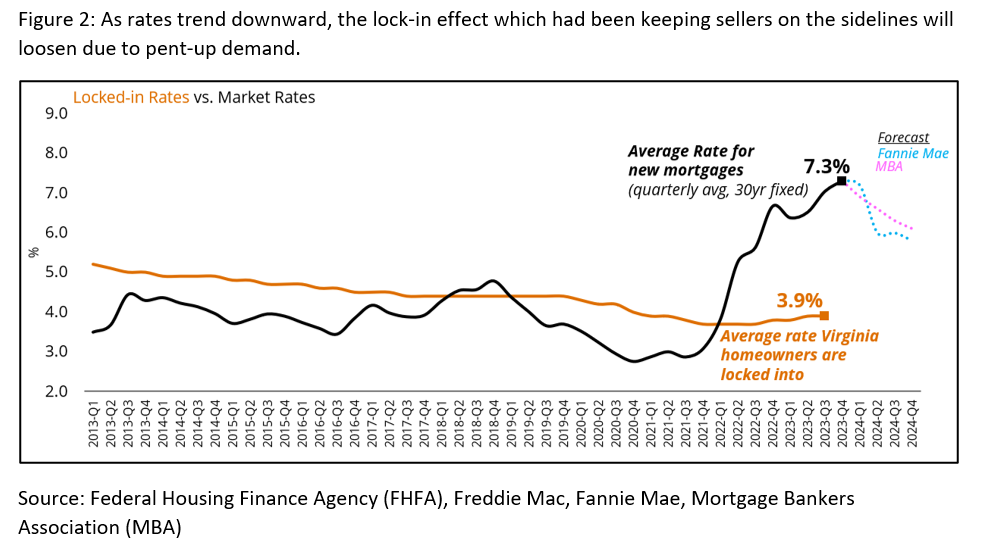

As seen in Figure 2, the decreasing trend in mortgage rate forecasts are expected to lower the gap between market rates and the low average rates Virginia homeowners have been locked into. As that gap narrows, it’s likely that more sellers will be incentivized to list their homes for sale, particularly those who want to buy but have delayed due to the interest rate trends. The increased supply of existing homes is expected to ease up the strains from the pent-up demand in the market.

While all expectations are suggesting that the housing market is headed in the right direction, the way things pan out in 2024 will depend on the extent to which mortgage rates decline. Regardless, these signs of easing affordability issues are a welcome respite, in contrast to the slow home sales activity, rising interest rates, and inventory constraints of 2023, for both homeowners and potential buyers alike.

For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More