2024 Rental Market Outlook

January 17, 2024

The multifamily market has had many highs and lows over the past few years with rising rental prices and a shift in demand, which led to record-breaking construction activity. This changed in 2023 as more apartments came on the market and rent growth began to cool, but will this slowdown continue into 2024? Let’s explore what this new year has in store for the rental market and what this could mean for your business.

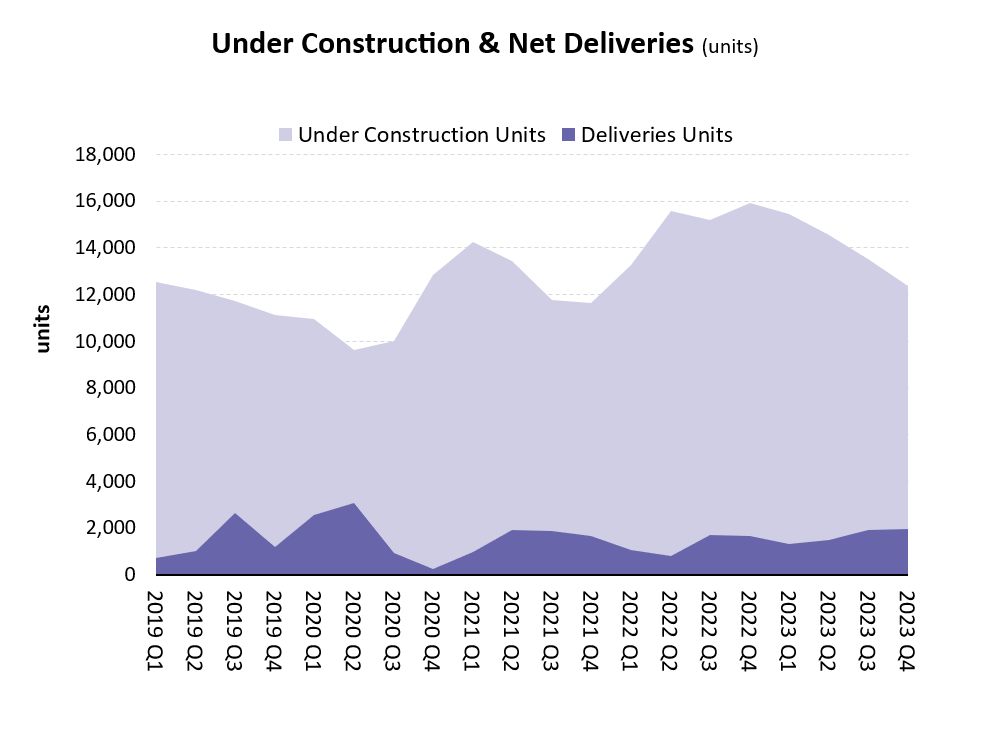

Lower Construction Levels and Higher Deliveries

In Virginia, the number of multifamily units under construction fell to 25,854, down from the historically high year of production last year when 33,050 units were being built. Even with the drop off in construction activity, the demand for multifamily housing remains robust with building permits up 38% from November of 2022 to 2023. The number of apartments that came on the market remained high with 5,225 units delivered in Q4 2023. As renters begin 2024, they will have more options when apartment hunting as more multifamily projects are completed. Deliveries will also peak this year as the economy begins to slow, leading to a cooldown in rental demand.

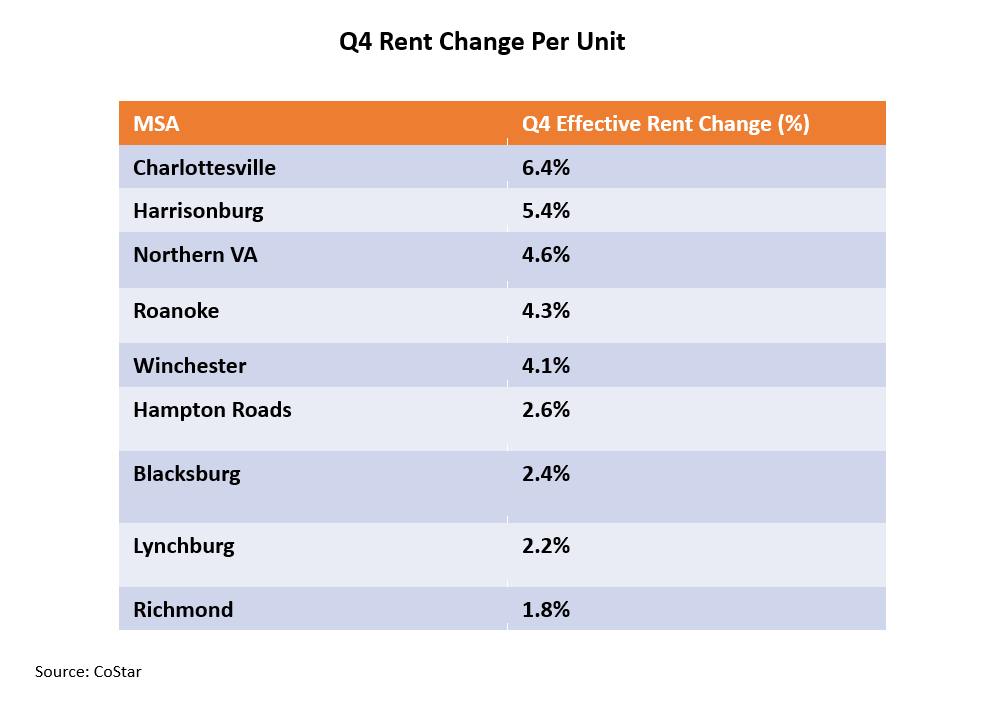

Rent Growth Trending Up but Stable

Rent growth began to stabilize in 2023 after two years of double-digit growth. In Virginia, effective rent was up 3.7% in Q4 of 2023, decreasing by 0.4 percentage points compared to Q4 2022 when rental rates were up by 4.1%. The deceleration in rental growth is due to higher construction activity and more apartment deliveries which helped to bring down renter demand. At the local level, Richmond had the smallest increase in effective rent this quarter at 1.8%, while Charlottesville saw rent increase the most, rising to 6.4%. In 2024, rent growth will continue to moderate as supply grows and vacancies rise but rental prices will not see a dramatic decline.

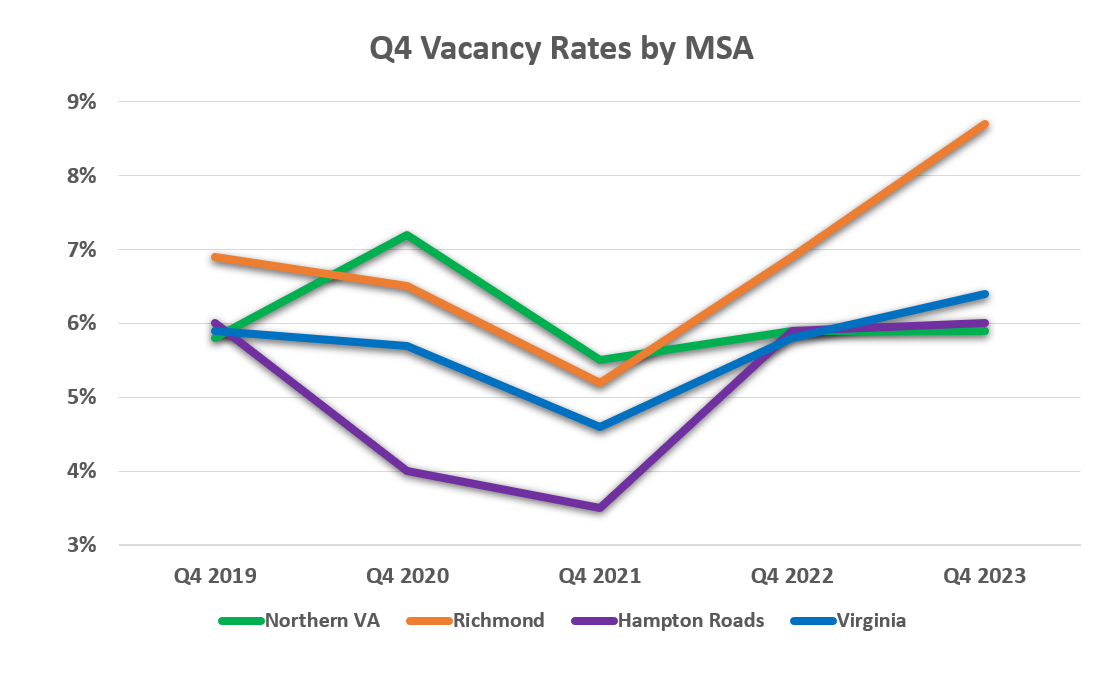

Vacancy Rates Moderate

Vacancy rates have been steadily climbing over the last year with Q4 2023 ending at a rate of 6.4%, up from 5.8% last year. In Richmond, vacancy rates went from 6.9% in Q4 2022 to 8.7% in Q4 of 2023 and in Hampton Roads rates inched up going from 5.9% to 6.0%. The rise in vacancy rates is attributed to the apartment construction boom of 2022 as builders attempted to meet the need for more housing. There is more inventory that is expected to hit the market in 2024 but as construction begins to plateau and units become occupied, we will see vacancy rates begin to trend down but remain steady.

Entering 2024, the multifamily market will continue to moderate as rent growth slows and supply increases, a stark contrast to the for-sale residential market where home prices are climbing quickly in many markets around the state, and inventory remains very low.

You might also like…

Key Takeaways: September 2024 Virginia Home Sales Report

By Virginia REALTORS® - October 23, 2024

Key Takeaways Closed sales activity remains relatively flat compared to last year. There were 8,065 homes sold in September throughout the state, just 42 more than last September,… Read More

Single Family Homes Permit Activity in Virginia

By Dominique Fair - October 15, 2024

Supply has played a huge role in affordability issues for buyers, with the U.S. short 4.5 million units and sellers still holding on to homes with lower rates.… Read More

Mortgage Rates Come Down, Purchasing Power Goes Up

By Abel Opoku-Adjei - October 7, 2024

The moment everyone has been waiting for is slowly coming. One of the most significant indicators influencing potential buyers’ decision-making is mortgage interest rates. The average mortgage rate… Read More