2023 First-Time Home Buyer Profile

December 4, 2023

2023 has been a tumultuous time for the housing market with many buyers, particularly first-time buyers having to adjust their home-buying expectations or put their plans to buy one on hold. The NAR 2023 Profile of Home Buyers and Sellers was recently released, providing insights into buyer and seller activity, demographics, and housing preferences. Let’s look at first-time home buyer trends and how they have changed this year.

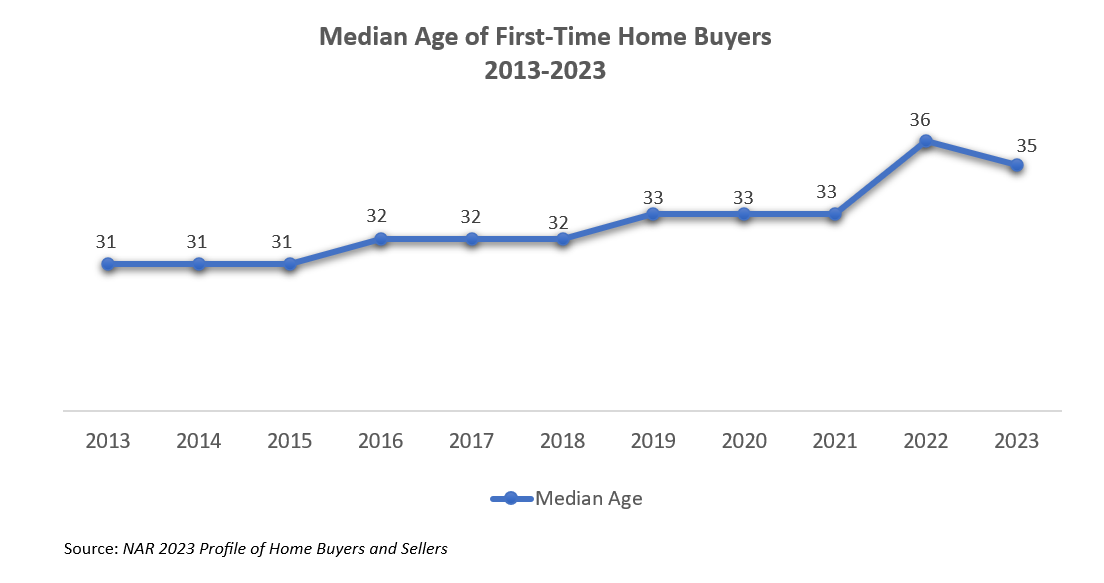

First-time buyers are more diverse but still older.

There were more married first-time home buyer households this year at 52% while the number of homes with no children increased from 57% to 63%. First-time buyers were more racially diverse with 12% being Hispanic/Latino, 11% Black/African American, and 11% Asian/Pacific Islander. The median age of a first-time buyer also changed from 36 years old in 2022 to 35 years old in 2023, dipping slightly but still higher than the historical average. This is reflective of the lack of inventory in the market which is making it harder for buyers to not only find a home but also afford one as home prices remain elevated. Despite home-buying challenges, first-time home buyers found their way back into the market making up 32% of all buyers this year, a significant increase from the prior year’s low of 26%.

Income, debt, and down payments grew for first-time home buyers.

First-time home buyers earned more money this year with a median income of $95,900, which is $24,900 more than they were making a year ago. The income boost was needed by new buyers to make them competitive in the market with the typical down payment on a home increasing from 6% to 8% this year, the highest it has been since 1997. Despite having more money in their pocket, 38% of buyers who saved for a down payment said it was the most difficult part of the home-buying process with high rent and current mortgage payments delaying 56% of first-time buyers, followed by student loans at 45%. To offset the debt, many first-time home buyers cut spending on luxury or non-essential items, entertainment, and clothes to save up for their dream homes. They also began using more financial assets such as stocks or bonds (11%) and 401k or pension funds (9%) as down payment sources.

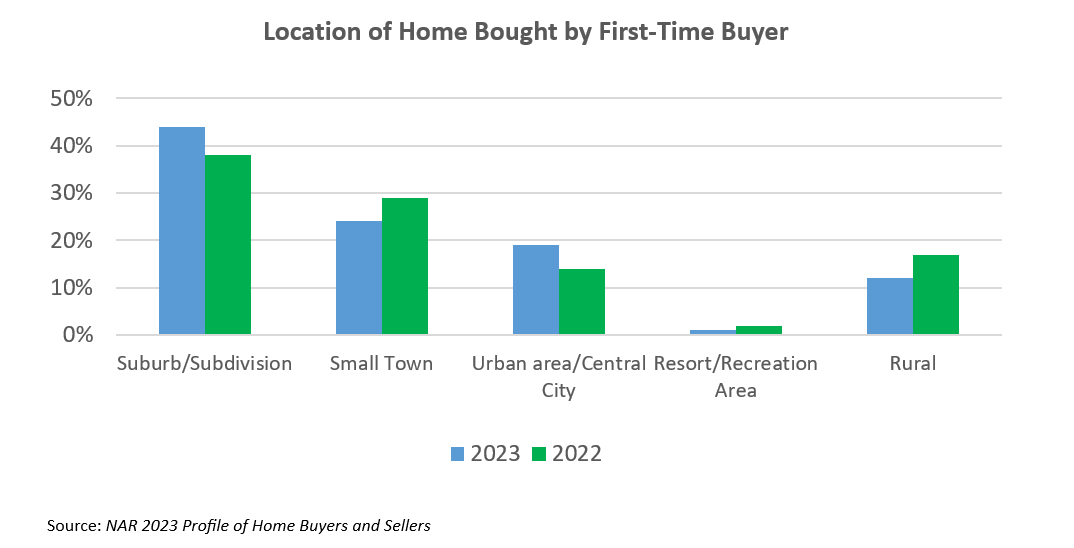

First-time buyers purchased single-family, suburban homes with more space.

The typical home purchased by a first-time buyer this year was a single family detached with three bedrooms and two bathrooms. The characteristics new home buyers were willing to compromise on were the price (38%) and the condition of the home (31%). Most first-time buyers (44%) bought their home in a suburb/subdivision area with a median size of 1,670 sq ft, showing that space and cost of living is still an important factor when choosing a home. The number of first-time home buyers who bought a home in an urban area/central city also went up this year as many companies mandated return to office and increased income levels allowed them to afford homes in this area.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More