Challenges for Gen Z in the Rental Market

November 28, 2023

The rental market has experienced several challenges over the last three years due to increased rental demand and a lack of inventory. By March of 2022, rental price growth peaked at 17.71% . Many renters were affected by the rise in rent, particularly the youngest generation of renters, Generation Z. Gen Z has surpassed millennials as the renter majority generation with 74% of the group currently renting, and that number likely to increase as they age into the market. How has the rental market impacted them and what are they doing to adjust to it? Let’s explore that.

Renting in the Pandemic Years

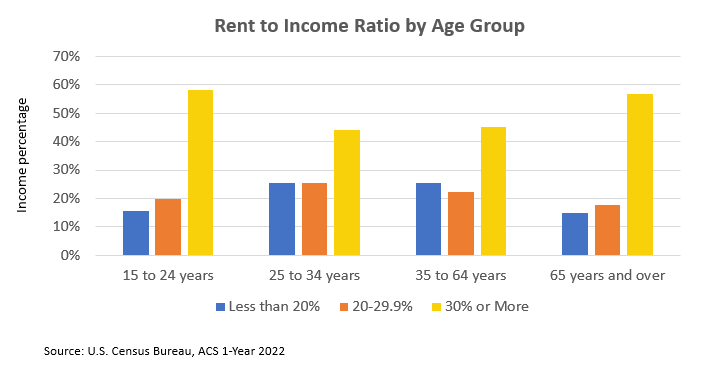

Gen Z entered the job market during the pandemic years when their entry level salaries had to compete with the rise in inflation. In 2021, the median income for Gen Z was $32,500, well below the median household income of $70,784. Rent was also growing rapidly with the national median rent going from $1,435 in January 2021 to $1,789 in January of 2022, a 19.8% increase. With the increased cost of living, many Gen-Zers struggled to afford housing, with those 24 years and under spending roughly 58% of their income on renting last year.

As more of their income became allocated toward housing, Gen Z adults had less money to spend on things such as entertainment, or money to put aside for emergency expenses. In 2022 at a median salary of $40,953, Gen Z had 1.9% of their income left over after housing and other expenses, down from 7.7% in 2020. The combination of growing inflation and a lack of income pushed Gen Z to consider alternative options to offset costs. Of those 18-25 years old, almost one-third of them moved back in with their parents or a family member according to the New York Times.

Current Rental Market

Over the last few months, rents have cooled down due to record-high construction levels while inflation declined from 8.2% in September of last year to 3.7% in September 2023. This has brought some relief to Gen Z renters, but rental prices are still significantly higher than what they were pre-pandemic. For example, the average rent in Virginia was $1,666 in the third quarter of this year, which is 19% higher compared to four years ago. And with student loan payments returning and credit card debt rising, many Gen-Zers are finding that the cost of living is still too high, with 53% of them saying it is a barrier to their financial success. Despite the financial challenges they are facing, Gen Z is putting in the work to combat inflation and rental prices. According to a survey by Bank of America, 73% of Gen-Zers stated that they changed their spending habits because of higher prices. They are also earning extra income by taking on extra work with 39% making money from a full-time job and a side hustle.

Although renting is more expensive than it was for years, it is still seen as the cheaper and better option by Gen Z with 51% saying they prefer it to buying. Generation Z will have a significant impact on the rental market going forward as they continue to age and determine what fits best with their lifestyle.

You might also like…

See It, Want It, Buy It: Single Female Homeownership

By Dominique Fair - March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a… Read More

Impact of Infrastructure Projects on Residential Markets

By Sejal Naik - February 27, 2025

“Location, location, location” is often quoted in the real estate market and emphasizes the importance of location-based features in people’s housing market decisions. While many locational characteristics stay… Read More

Key Takeaways: January 2025 Virginia Home Sales Report

By Virginia REALTORS® - February 26, 2025

Key Takeaways Virginia’s housing market saw a slight uptick in activity at the beginning of 2025. There were 5,758 home sales across the commonwealth in January 2025, 104… Read More