Pulse Check on Rent in Virginia’s Metro Markets

October 23, 2023

Virginia’s housing market has seen many highs over the last year with interest rates above 7% and housing prices above $400,000. These factors have pushed many potential home buyers to the sidelines and shifted their sights back to the rental market. The multi-family market has also seen a significant change as pent-up demand led to a more competitive market, bringing rents up more than 17% nationally. As rent in Virginia followed a similar pattern, let’s look at the multifamily market and how rents have changed over the past few years.

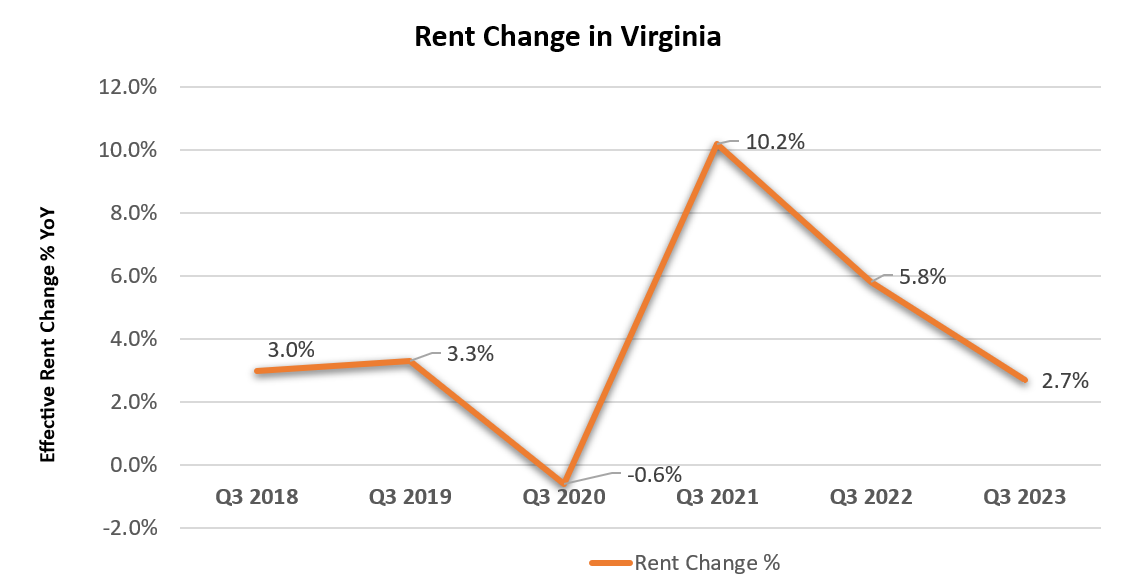

During the middle of the pandemic, rental prices in Virginia increased by double-digits as many people decided they needed more space or opted to move to an entirely different state due to remote work. There were record breaking construction levels in 2022 as developers tried to keep up with high housing demand. In Virginia, there were over 31,000 apartment units in development and more than 3,000 units delivered in Q3 2022, one of the highest construction levels in 13 years. Currently, we are seeing that demand for rental housing is easing due to the influx of new supply in the market and growing affordability challenges. Construction activity has also edged down, falling 7% from last year. This has led to a deceleration in rental prices within the state. The slowdown in rent growth is a positive sign for renters that the multifamily market is beginning to stabilize.

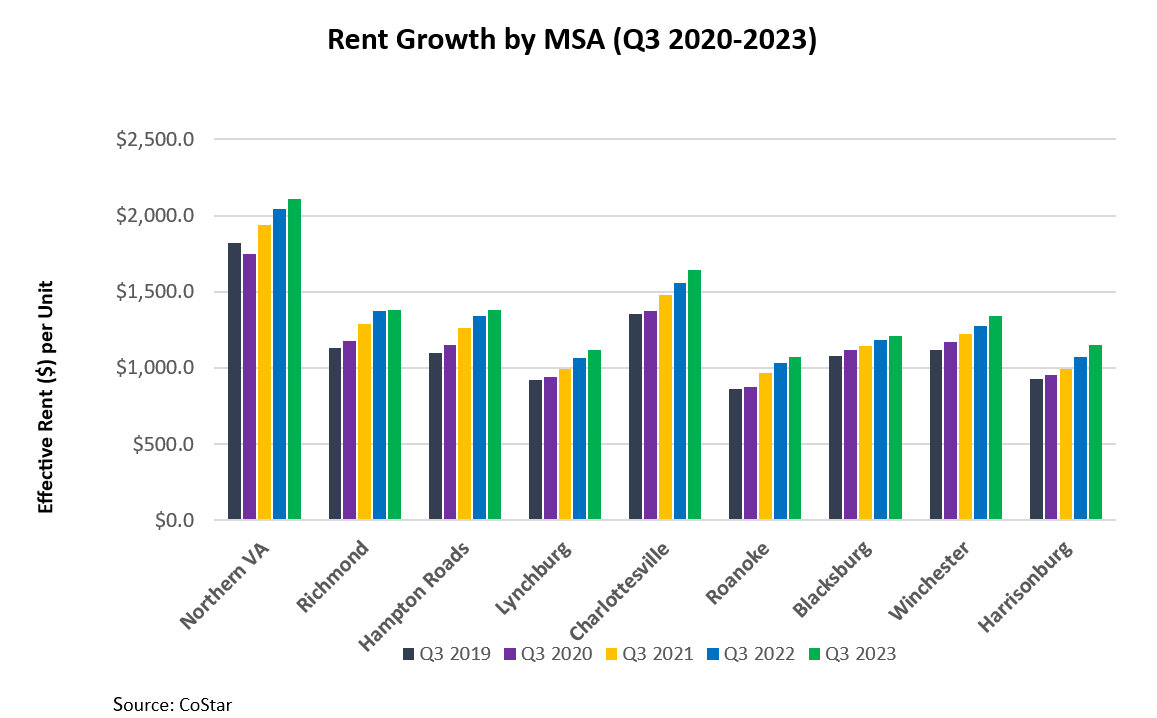

Statewide, rent growth has started to decrease with rents up 2.7% from a year ago, but prices continue to remain elevated. Virginia’s biggest metro markets had the smallest increases in rental price this quarter. In the third quarter of this year, rent for a unit in Northern Virginia was $2,107 on average, up 3.0% from the previous year and 15.5% more than in Q3 2019. In the Richmond metro market, average rent reached $1,378, increasing by $7 or 0.5% from the same time last year. This was the smallest growth in rent across all multifamily markets in the state. The smaller metro areas saw higher levels of rent growth in Q3 of this year. Rental prices in Winchester grew by 5.2% bringing the average price of an apartment unit to $1,344. Harrisonburg had the biggest jump in average rent price growth at 7.5% with rent for an apartment in the area now averaging $1,152, which is 24.4% higher than in 2019.

Despite rental growth cooling in many parts of the state, it is important to remember that rents are still 19% higher than they were four years ago. The multifamily market will be important to watch as mortgage rates continue to cause affordability challenges for would-be home buyers and the supply of new apartments begins to moderate.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More