Key Factors That Will Shape the Housing Market This Fall

October 2, 2023

Virginia’s housing market of 2023 has been characterized by a slowdown in home sales activity, low inventory, and climbing prices. Economic headwinds following the spending boom that occurred after the Covid-19 pandemic have heavily impacted the residential housing market. As we head into the last quarter of the year, we’ll highlight the key factors that are expected to shape the fall housing market.

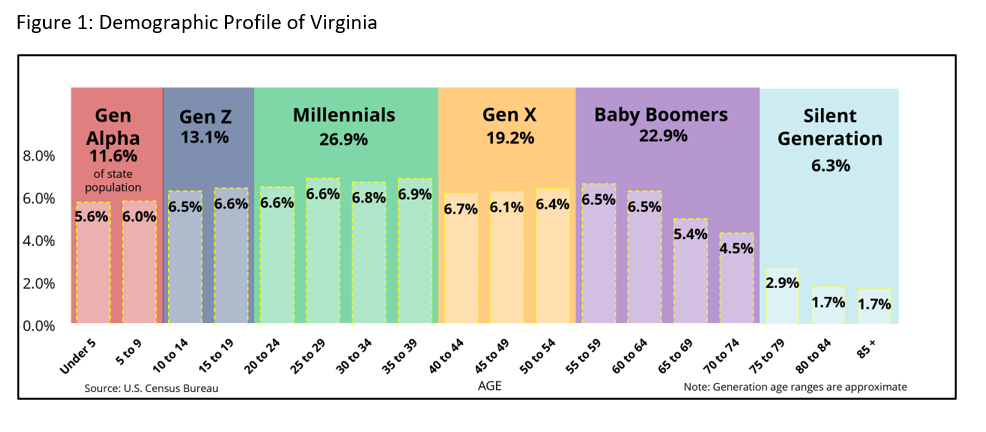

Pent-up Demand

Millennials, who were particularly hard hit by the Great Recession of 2008-09 and the recession following the Covid-19 pandemic, are in their prime home-buying age and want to buy their starter homes. Older adults are looking to downsize. They are particularly interested in favorable options to meet their needs such as senior communities and smaller/single-level homes. At the same time, Gen-Z is starting to enter the market as well. Overall, there is pent-up housing demand from different demographic groups. This demand will cause desirable houses to continue getting multiple offers from buyers and most likely drive up home prices.

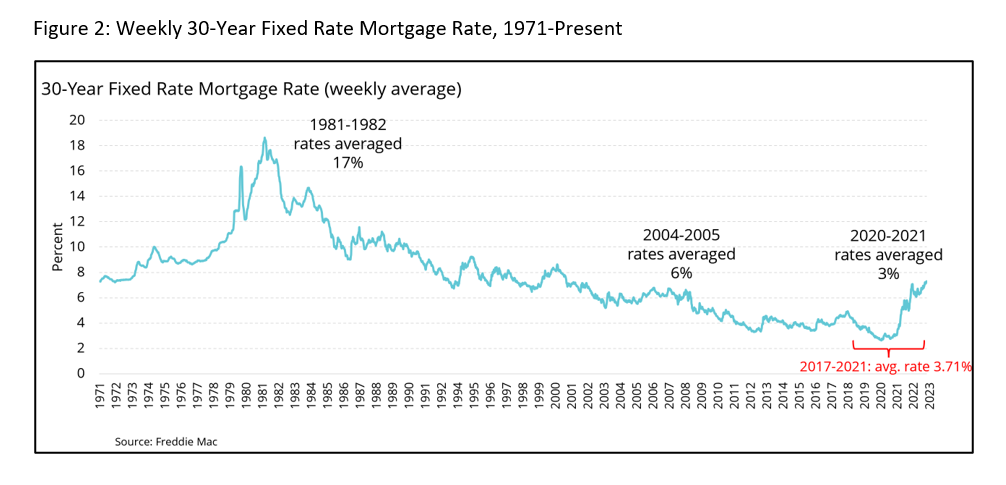

High Mortgage Rates

The years 2017 through 2021 saw historically low mortgage rates which led to a lot of activity in the real estate market. According to Freddie Mac’s weekly Primary Mortgage Market Survey® results on September 28, 2023, the average mortgage rate in the United States was 7.31%. For potential home buyers who missed out on buying during the low mortgage rate period, the current rates seem quite high, more than double what they used to be. Rising mortgage rates, coupled with inflationary pressures, are seriously affecting the purchasing power and decision making of all potential home buyers and will continue to do so in the near future.

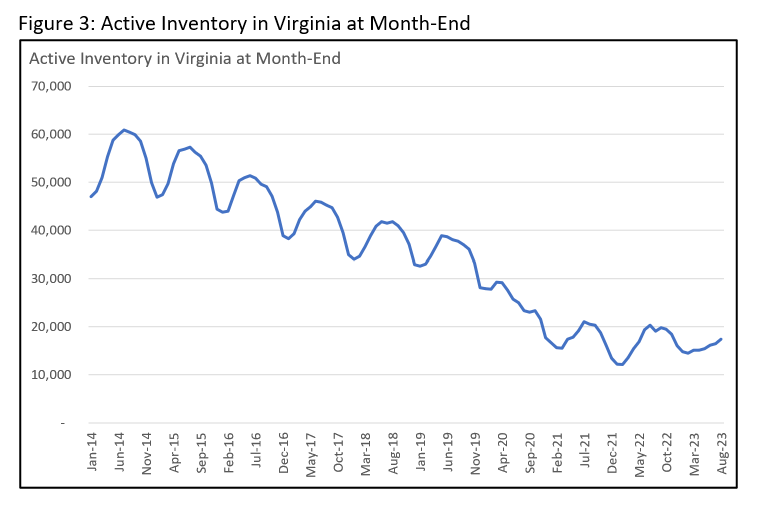

Constrained Supply

Data from the Federal Housing Finance Agency (FHFA) suggests that homeowners in Virginia have locked in very low mortgage interest rates. As of the second quarter of 2023, the average rate that Virginia homeowners are locked into was 3.9%. But current mortgage rates are nearly double that. This gap is causing the “lock-in” effect which is disincentivizing sellers from listing their homes to avoid having to end up with a new mortgage with higher rates. This is worsening the lack of housing supply that was already present due to prolonged under-construction of new homes over the years. As seen in Figure 3, month-end inventory has been on a downward trajectory. While low inventory levels were mostly due to high momentum in sales just a couple years ago, it is now more so because of fewer sellers willing to list their homes along with new supply not able to keep up with demand.

All in all, the combination of a robust pipeline of buyers among different demographic groups, high mortgage rates, and a tight supply of homes leads us to expect a slow but competitive housing market this fall.

For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

See It, Want It, Buy It: Single Female Homeownership

By Dominique Fair - March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a… Read More

Impact of Infrastructure Projects on Residential Markets

By Sejal Naik - February 27, 2025

“Location, location, location” is often quoted in the real estate market and emphasizes the importance of location-based features in people’s housing market decisions. While many locational characteristics stay… Read More

Key Takeaways: January 2025 Virginia Home Sales Report

By Virginia REALTORS® - February 26, 2025

Key Takeaways Virginia’s housing market saw a slight uptick in activity at the beginning of 2025. There were 5,758 home sales across the commonwealth in January 2025, 104… Read More