Mortgage Rate Lock-in Effect in Virginia

September 12, 2023

Most recent articles about the housing market discuss the “mortgage rate lock-in effect.” But what does mortgage rate lock-in mean, really? In the period of low interest rates in 2020 and 2021, when rates were as low as 2.7%, home buyers and homeowners were able and eager to finance or refinance their mortgages at very low interest rates. This even led to a whirlwind amount of housing market transactions during those years. However, as economic conditions changed, inflation soared, and this ushered in a year and a half of monetary policy tightening. New mortgages now have average rates that are more than double what they were two years ago. In this situation, current homeowners may feel locked in to staying in their current homes and holding on to their low mortgage rates, because moving would involve increasing their monthly housing payments significantly. This is the mortgage rate lock-in effect, and it is having significant consequences on the housing market overall.

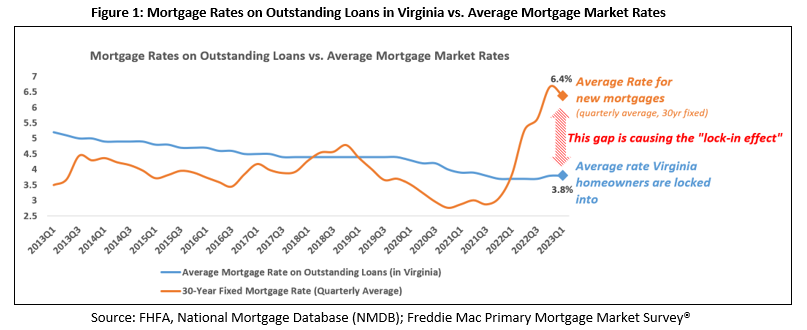

As seen in Figure 1, in Virginia, in the 10 years from 2013 to 2023, the average rate on outstanding mortgages held by current homeowners declined from 5.2% to 3.8%. At the same time, the average rate for new mortgages increased to 6.4%, which is almost twice the average rates homeowners have locked in. This gap between the locked in mortgage rates and the average rate on new mortgages is causing the lock-in effect to persist in Virginia. Further, we can look into how this mortgage rate lock-in effect has been impacting Virginia’s housing market.

How does the lock-in effect impact the housing market?

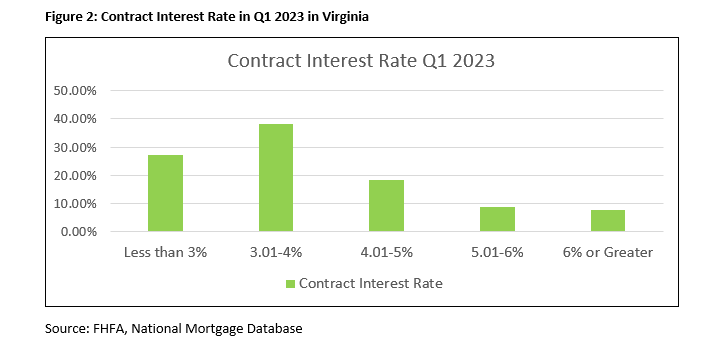

- Low inventory: In the first quarter of 2023, 92.4% of homeowners in Virginia had a rate below 6%. In today’s market of low inventory and rising rates, many potential sellers may feel less than motivated to sell their home, which is leading to fewer listings on the market. In July, new listings were down 20.3% while active listings fell by 19% in the state, bringing the total months of supply to 1.8 months. The lack of existing homes for sale is also keeping home prices high with the median sales price jumping to $400,000 this month. Buyers are competing over what little inventory is left and sellers fear that when they sell their current home, they will have fewer options when moving into a new one. New construction has attempted to fill the gap of existing homes on the market, but it is not enough to keep pace with buyer demand or make up for the years of underbuilding.

- Higher Mortgage Payments: Gone are the days of 2-3% mortgage rates and lower monthly mortgage payments. The 30-year fixed mortgage stands at 7.13% as of August 31st, up from the same time last year when the rate averaged 5.66%. The higher rates are causing more money to come out of buyers’ pockets not only to purchase the home, but to afford monthly payments. For example, if a home buyer purchased a $400,000 home at the average rate for new mortgages in Virginia at 6.4% with a 20% down payment, their monthly mortgage would be $2,575. In comparison, a homeowner with a locked-in rate of 3.8% who purchased a home at the same price would have a monthly mortgage of $1,969, a difference of $606.

As the lock-in effect continues, sellers will pause listing their homes waiting for mortgage rates to come down before exchanging a lower payment for a higher one. For potential home buyers, the effect will keep them competing for homes while also sidelining many who are unable to afford homes at today’s rate and price point.

For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Key Takeaways: September 2024 Virginia Home Sales Report

By Virginia REALTORS® - October 23, 2024

Key Takeaways Closed sales activity remains relatively flat compared to last year. There were 8,065 homes sold in September throughout the state, just 42 more than last September,… Read More

Single Family Homes Permit Activity in Virginia

By Dominique Fair - October 15, 2024

Supply has played a huge role in affordability issues for buyers, with the U.S. short 4.5 million units and sellers still holding on to homes with lower rates.… Read More

Mortgage Rates Come Down, Purchasing Power Goes Up

By Abel Opoku-Adjei - October 7, 2024

The moment everyone has been waiting for is slowly coming. One of the most significant indicators influencing potential buyers’ decision-making is mortgage interest rates. The average mortgage rate… Read More