Virginia’s Midyear Housing Market Snapshot

August 7, 2023

Economic conditions have impacted the housing market so far in 2023. The average 30-year fixed mortgage rate rose from 6.81% to 6.9% in the first week of August 2023, according to Freddie Mac. This is .09% higher than a week ago and 1.91% higher compared to this time last year. According to the National Association of REALTORS®, this rate change has driven the median monthly mortgage payment for a typical single-family home to $2,192, and $1,905 for the typical condo. The average mortgage rate, along with all lending rates, have been trending up due to the Federal Reserve’s attempt to get inflation under control by raising its Federal Funds Rate. Rising mortgage rates are making it tough for both buyers and sellers looking for homes in the market, and is unfortunately pushing some people out of the housing market altogether. These trends have driven year-over-year sales activity and contract negotiations downwards so far in 2023. Let’s take a closer look at some of the key Virginia market trends midway through 2023.

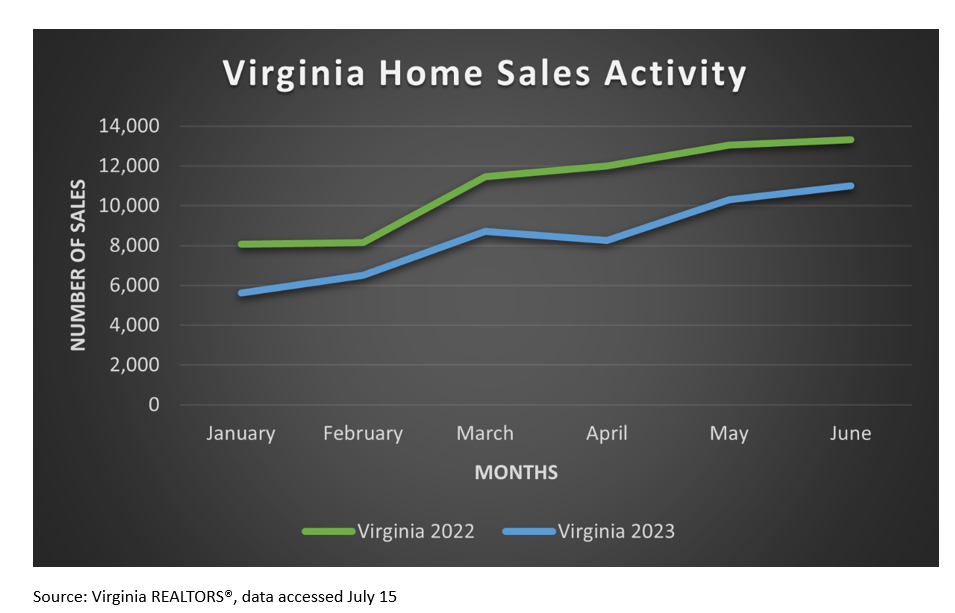

Sales Activity

From January through June, there were 50,359 home sales in Virginia in 2023. This is 15,673 fewer sales compared to the first six months in 2022, a 24% decline. Home sales activity increased between May and June in 2023, which is a typical seasonal change. So far in 2023, the sharpest drop in home sales activity has been the outer suburbs of Northern Virginia, parts of the Shenandoah Valley, and coastal markets such as Hampton Roads and places along the Chesapeake Bay.

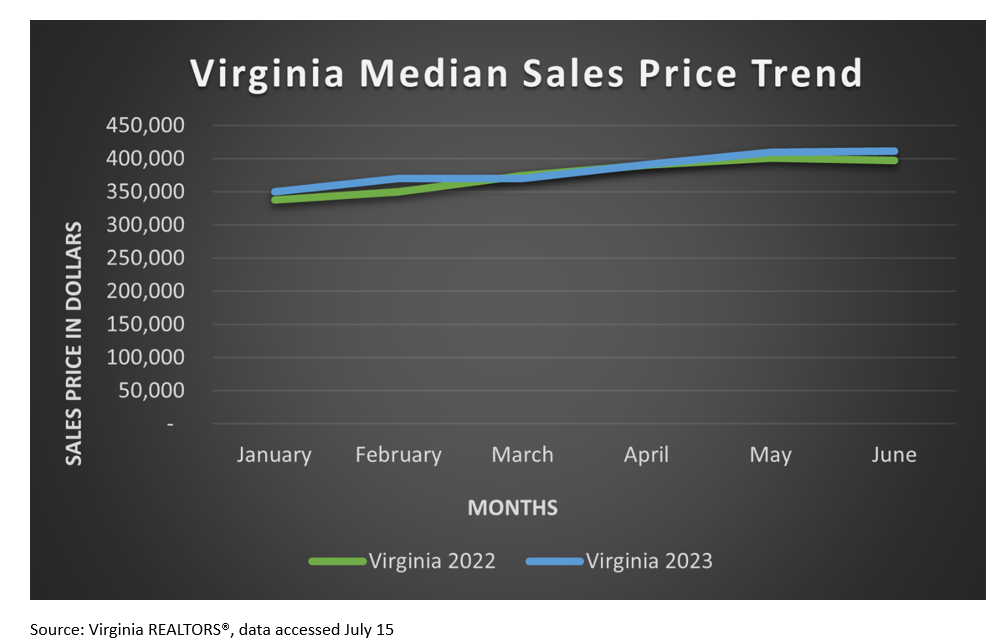

Median Sales Price

Even though sales activity has been declining, the median sales price in Virginia continues to trend upward from a year ago. The median sales price for the first half of the year (year-to-date January through June 2023) in Virginia was $388,825, $8,925 higher than last year, reflecting a 2% rise. At $411,000, the statewide median sales price peaked to an all-time high in Virginia in June, a $13,685 difference from last June (+3.4%).

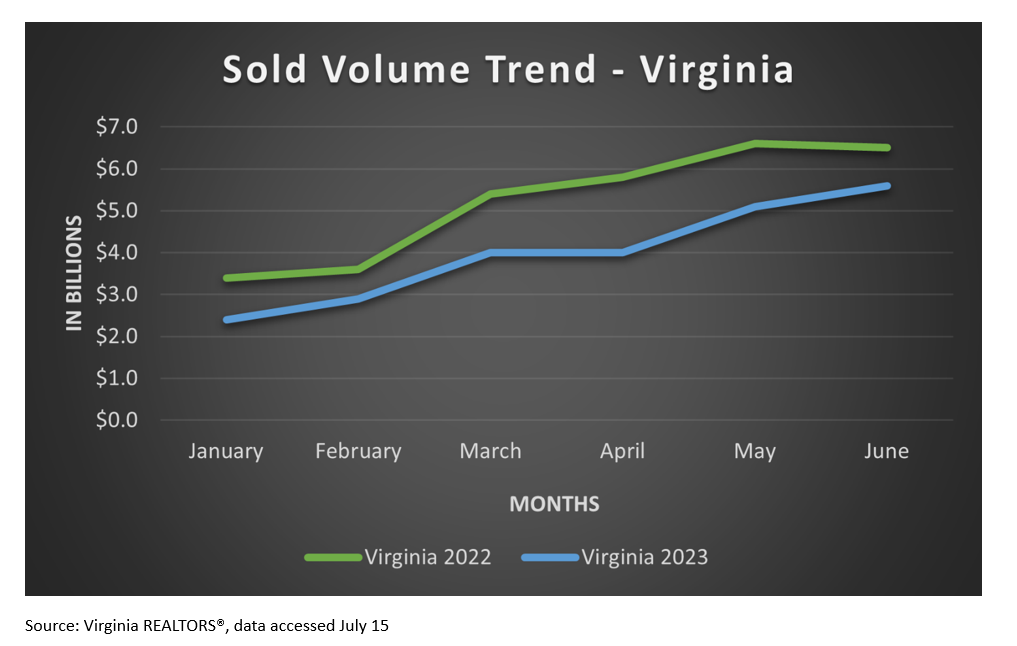

Sold Volume

Despite home prices rising, lower sales throughout Virginia have been driving sold volume levels down. In the first half of 2023, approximately $24.1 billion of volume was sold throughout Virginia, which is about $7 billion lower than last year, marking a 22.5% decline.

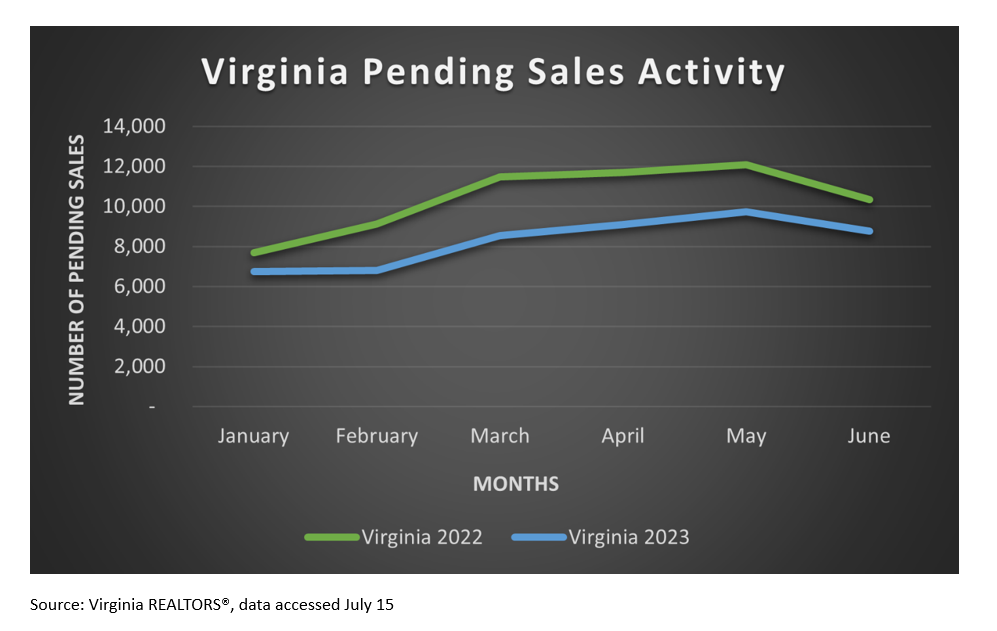

Pending Sales

Pending sales activity allows us to foresee how sales activity will be in the future. Between January and June 2023, there were 49,696 pending sales throughout the commonwealth, a 20.4% decline compared to last year, which is 12,716 fewer pending sales.

Inventory

Supply in Virginia has been one of the major concerning factors in Virginia’s housing market. At the end of June, there were 16,426 active listings across Virginia. This reflects a 16.1% decline from last year, which is 3,129 fewer listings. The number of active sellers has reduced significantly because many homeowners were able to lock in lower rates than the ones currently.

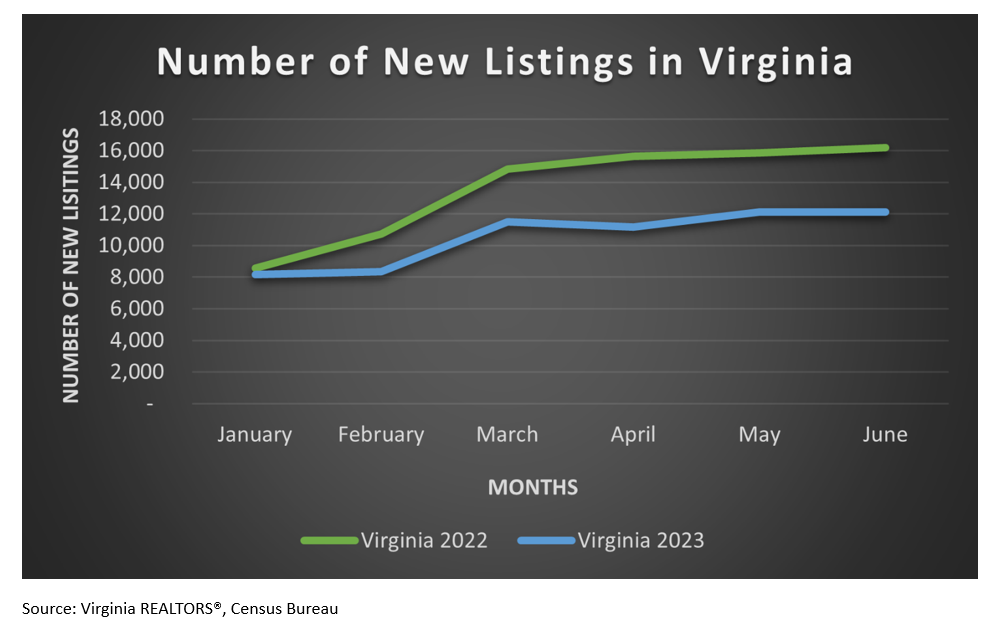

New Listings

The number of new listings continues to fall sharply compared to the first half of 2022 in Virginia. Midway through the year, there were 63,440 new listings in Virginia, 18,334 fewer listings than a year ago, a 22.4% decline. This is the state’s lowest number of active listings at midyear in over ten years.

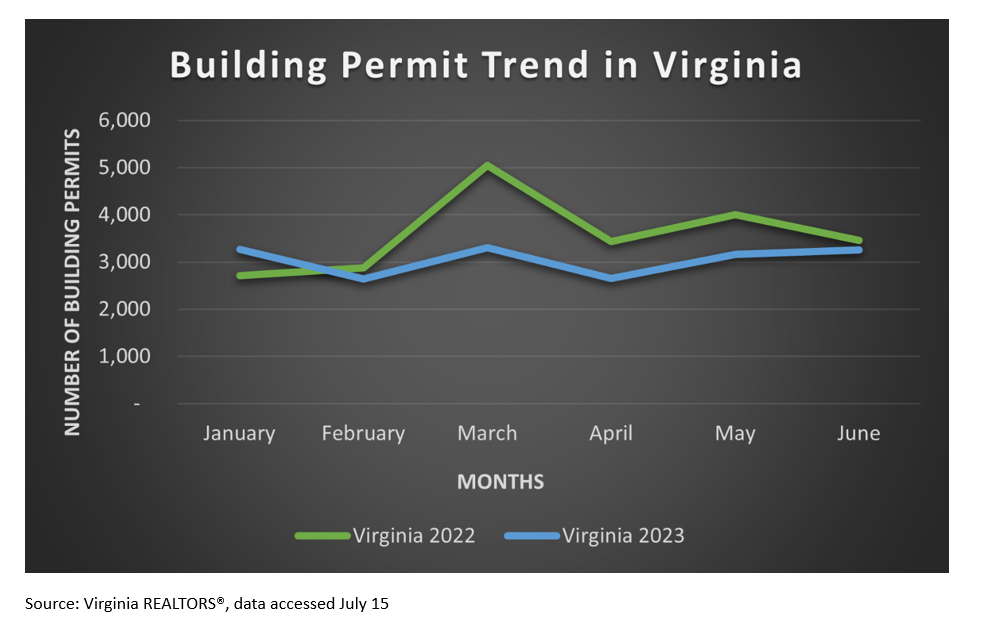

Building Permits

According to the Census Bureau, there have been 18,292 approved residential building permits in Virginia in 2023, which is 3,244 fewer building permits than the previous year, a 15% decline.

Home prices tend to come down often as housing sales cool, but the inventory shortage in Virginia has been the biggest impediment in the state’s housing market and have kept prices insulated as fewer sales are occurring. Many existing homeowners are reluctant to sell their homes and lose their low mortgage rates making the market very competitive for potential buyers to enter as there are few options to choose from. Many sellers are still getting over their listing price as the average sold-to-list ratio is at 100.54% for the year, which is down from 102.4% this time last year. New home construction will benefit the current demand in Virginia but will most likely not be enough to push inventory back to a healthy level. Housing affordability continues to be a significant factor affecting many regional markets around Virginia as mortgage rates continue to rise, and prices continue to hold firm and trend upward in many cases. These current trends will likely continue to be at play as we head through the second half of 2023.

Stay updated with Virginia’s housing data at Virginia REALTORS®.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More