Homeownership Trends in Virginia and Beyond

June 13, 2023

June is National Homeownership Month, a time to reflect on the important role homeownership plays in our lives, and the important role REALTORS® play in achieving the dream of homeownership. From fostering strong communities, to building household wealth, the benefits of homeownership can be powerful. While the benefits are clearly there, the dream of owning a home remains elusive for many Americans. Mounting financial barriers, and a chronically low supply of homes have left many on the sidelines of the housing market. Despite these hurdles, survey after survey reflect that most people still want to achieve homeownership, a resolve that will continue to shape the housing market in the years to come. Let’s take a look at some of the key homeownership trends around the U.S. and right here in Virginia, and how the market has changed in recent years.

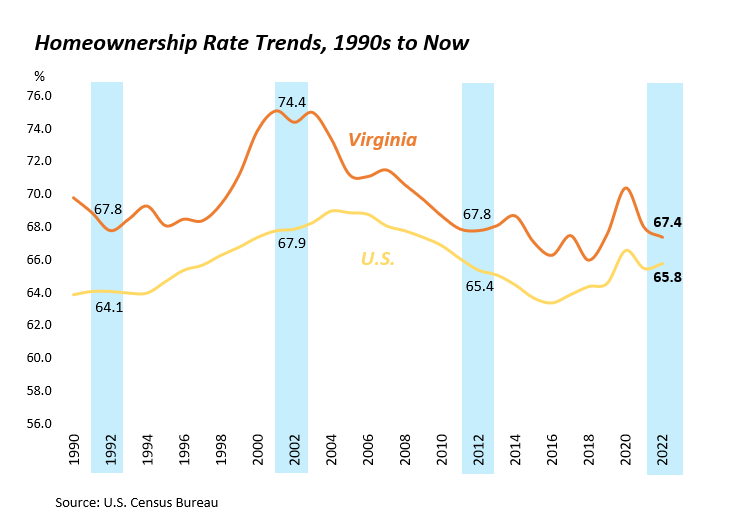

The homeownership rate in Virginia remains higher than the nation as a whole, but the gap has narrowed. About two thirds of Virginian households owned their home as of 2022 (67.4%). This is higher than the nationwide homeownership rate (65.8%), but it’s lower than 28 other states where homeownership is more prevalent. While the nationwide homeownership rate rose last year, it declined in Virginia, likely a reflection of affordability challenges in some of our larger regional housing markets. When we take a step back and look broadly at the homeownership trends over the last two decades, the homeownership rate in many parts of the country, including here in Virginia, has generally been trending down since the early 2000s when our homeownership rate peaked around 75%. The drop in homeownership rates around the U.S. reflect the growing list of challenges facing prospective buyers, from home prices rising faster than income levels, a persistent lack of inventory, and difficulty saving a down payment amid rising debt, among other factors.

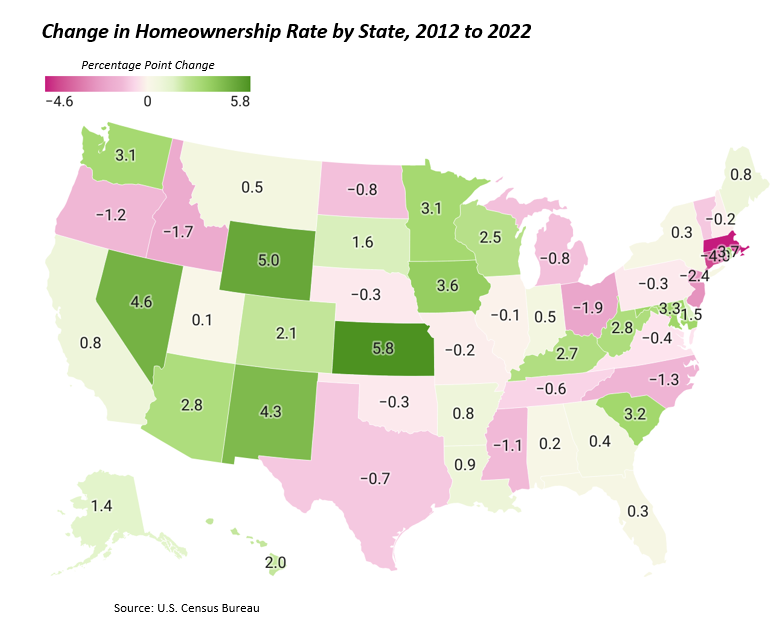

Homeownership rates have fallen in 21 states over the last decade, Virginia is one of them. Following the mortgage crisis and global recession in 2008-09, homeownership rates in many parts of the U.S. fell as foreclosures were widespread, and millions of people lost their jobs and were reluctant to enter the housing market. As the economy stabilized and expanded during the 2010s, more people started buying homes, and the homeownership rate started trending back up in many places. This pivot really started to take off around 2015 and continued through 2020. During this five-year span, the average interest rate for a 30-year fixed mortgage was below 4% which helped fuel a lot of the activity. However, even with this period of more buyers entering the market, the underlying challenges remained in place. Not enough homes were being produced to meet the growing demand pipeline, specifically a swell of millennial first-time home buyers, and affordability challenges continued to be a big factor. As a result, the homeownership rate in nearly half of the country is lower than it was a decade ago.

Homeownership aspirations continue to be high, but barriers are keeping many on the sidelines. According to Fannie Mae’s most recent National Housing Survey conducted between October and December 2022, about 87% of people surveyed believe owning a home is important to “live the good life,” which is unchanged from the same survey two years prior. This sentiment is likely driven by the fact that homeownership continues to be the primary driver of wealth generation in our country. Over the last decade, real estate equity has more than tripled in the U.S., going from about $8.5 trillion in 2012 to $31.1 trillion in 2022.

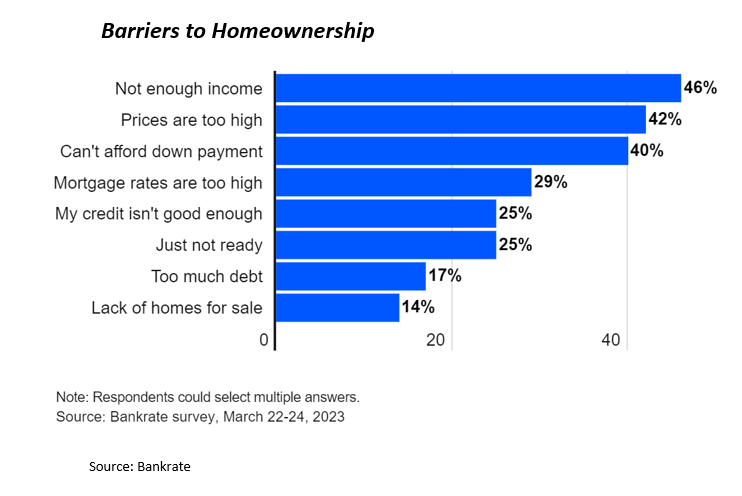

Even though mortgage interest rates have more than doubled and home prices have surged over the last two years, the desirability of homeownership continues to be very important. The demand pipeline is strong, but the housing supply is tight, and affordability issues remain front and center for many. According to another survey conducted by Bankrate, affordability challenges accounted for the top four barriers to homeownership for those who do not own a home. From not having enough of a down payment, to getting priced out of the housing market altogether, many would-be buyers are stuck on the sidelines.

Homeownership continues to be a cornerstone to wealth generation in our country. While many are struggling to buy their first home amid the growing list of obstacles, the data remains clear, the homeownership journey is worth it. REALTORS® play a critical role in guiding, educating, and advising individuals and families on this journey. From navigating the complexities of local housing markets, to connecting prospective home buyers with the tools and resources to make their dream a reality, REALTORS® help create opportunities for future homeowners.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs.

You might also like…

Key Takeaways: September 2024 Virginia Home Sales Report

By Virginia REALTORS® - October 23, 2024

Key Takeaways Closed sales activity remains relatively flat compared to last year. There were 8,065 homes sold in September throughout the state, just 42 more than last September,… Read More

Single Family Homes Permit Activity in Virginia

By Dominique Fair - October 15, 2024

Supply has played a huge role in affordability issues for buyers, with the U.S. short 4.5 million units and sellers still holding on to homes with lower rates.… Read More

Mortgage Rates Come Down, Purchasing Power Goes Up

By Abel Opoku-Adjei - October 7, 2024

The moment everyone has been waiting for is slowly coming. One of the most significant indicators influencing potential buyers’ decision-making is mortgage interest rates. The average mortgage rate… Read More