5 Myths About FHA Loans (Debunked!)

June 5, 2023

With elevated interest rates and climbing home prices, many potential buyers are looking for alternative ways to buy a home without breaking the bank. FHA loans have more lenient financial requirements than conventional loans, making them a popular source of financing for those buying their first home. A common myth is that because first-time buyers benefit greatly from FHA loans, they are the only ones who can qualify for them. Let’s tackle this and a few more misconceptions people may have about this type of loan.

Myth: FHA loans are only for first-time home buyers.

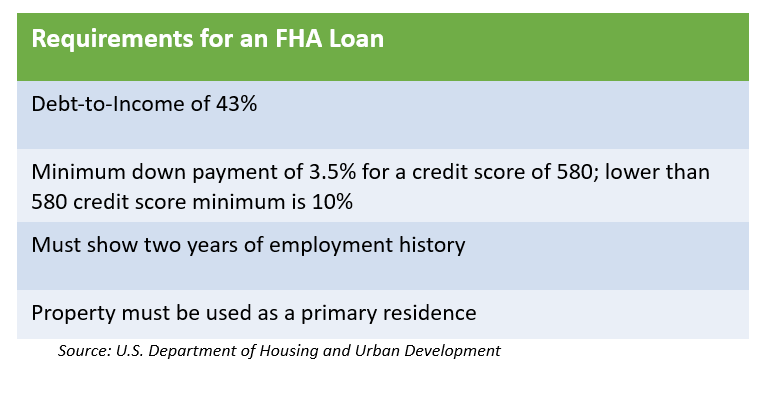

Fact: Anyone can qualify for an FHA loan as long as they meet the financial requirements. First-time home buyers view it as a more attractive option because it allows them the chance to afford a home even if they have a lower credit score and little down payment money.

Myth: You can’t get an FHA loan if you have student loans.

Fact: Lenders do factor your student loan debt into your debt-to-income (DTI) ratio, but the guidelines have now changed. FHA lenders must use the actual payment amount for student loans or 0.5% of the student loan balance if the payment is showing zero or is deferred.

Myth: If you make a 20% down payment, you do not need FHA mortgage insurance.

Fact: No matter the size of the down payment, you are required to pay the mortgage insurance premium (MIP) which protects FHA lenders in case borrowers are unable to pay back the loan. MIPs are paid up front at closing and throughout the life of the loan on a monthly basis. If a borrower has a down payment of at least 10%, then they are eligible for their MIP to drop off after 11 years.

Myth: There are income limits for FHA Loans.

Fact: There are no income limits that would disqualify or prevent you from obtaining an FHA insured loan, but you must have a two-year employment history and an established credit history to qualify.

Myth: FHA loans are only for single-family homes.

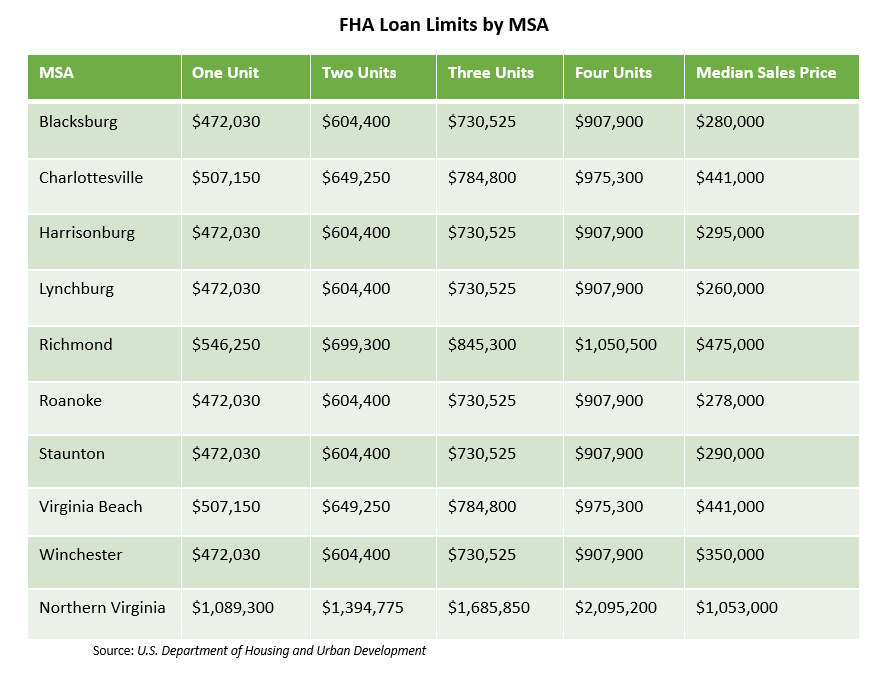

Fact: FHA loans can be used to purchase properties with one to four units, and they can also be used to finance manufactured homes, but the home’s value must be within the FHA loan limits. According to HUD, the national FHA limits for a single-unit property are $472,030 in lower-cost areas and $1,089,300 in areas that are more expensive.

FHA loans can be helpful for any home buyer looking to purchase a home regardless of if they are a first-time buyer or not. If your client is considering an FHA loan but does not know where to start, HUD is a great source where they can search for FHA lenders, housing counsel programs, and information on local resources on housing in Virginia.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® economic insights blogs and our data page.

You might also like…

March Madness Meets Market Madness: Construction Trends in Virginia’s College Towns

By Abel Opoku-Adjei - March 18, 2025

Ongoing economic concerns are impacting both single-family and multifamily construction across the country. According to the National Association of Home Builders, multifamily construction starts are expected to decline… Read More

See It, Want It, Buy It: Single Female Homeownership

By Dominique Fair - March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a… Read More

Impact of Infrastructure Projects on Residential Markets

By Sejal Naik - February 27, 2025

“Location, location, location” is often quoted in the real estate market and emphasizes the importance of location-based features in people’s housing market decisions. While many locational characteristics stay… Read More