The State of Commercial Real Estate in the Current Economy

May 17, 2023

Commercial real estate is the oft-forgotten half of the U.S. real estate market. This sector, which amounts to about $20 trillion, has been under continuous spotlight following the pandemic, changing consumer preferences, rising interest rates, as well as the recent banking sector turmoil. Last week, in its biannual Financial Stability Report, the Federal Reserve flagged commercial real estate as a potential risk to the financial stability of the United States. To understand why, let’s look at the three components of commercial real estate and how current market conditions are impacting the sector.

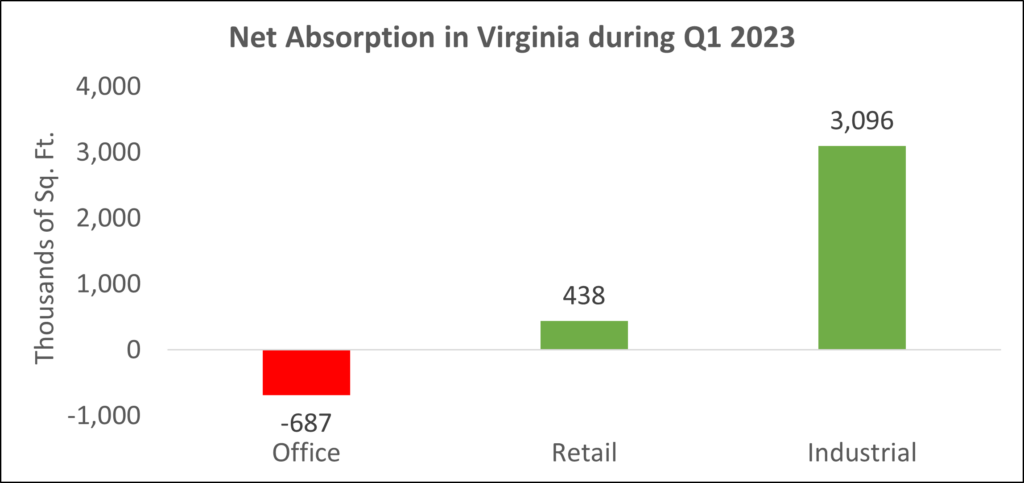

Figure 1: Net Absorption in the Commercial Markets of Virginia During the First Quarter of 2023

First, the office market is the most obvious component that comes to mind when one thinks about commercial real estate. Covid-19 made remote work the norm across many job sectors throughout the country. Three years following the start of the pandemic, hybrid work models are the widespread mode of operations. This has led to a reduced need for office space which is substantiated by the fact that vacancy rates for office buildings rose to a record high of 18.2% by late 2022, according to Cushman & Wakefield, a commercial real estate services company.

Second, the retail market saw significant growth over the past couple years as consumers spent their pent-up savings from the period of the early pandemic. However, given the rising costs due to inflation and fears around job security, consumers are starting to spend less. Retail sales have taken a direct hit from this, causing the demand for retail spaces and storefronts to weaken. This is in addition to the fact that shifting trends towards online shopping have already been taking a toll on the retail market space.

Third, the positive news in the commercial space is coming from the industrial market of the commercial sector. E-commerce activity and proactiveness around supply chain optimization has caused a greater demand for warehouses. Rents for such spaces are increasing and vacancy rates are trending down.

Overall, the current macroeconomic scenario surrounding commercial real estate has been emphasized by rising interest rates, declining valuations, and change in demand. Real estate developers had been relying upon borrowing at low interest rates and investing in a commercial market that was seeing rising asset prices. Rapidly rising interest rates due to the Federal Reserve’s rate hikes have thrown a wrench on this order of operations. Furthermore, the recent bank failures of Silicon Valley Bank and Signature Bank have increased the scrutiny around regional banks that provide a bulk of commercial real estate loans. Deteriorating property valuations, especially in the office market and retail market, will make it difficult for property owners to refinance their loans at the end of upcoming loan terms. These loans are mostly held by banks, and smaller banks might particularly be affected on the downside. As the direct and indirect costs of borrowing increase, plans for business expansion in the commercial real estate space are expected to see a direct negative impact as well.

Despite the apparent dire conditions, it is worth noting that the current situation is very different from the 2008 global financial crisis when there were numerous institutions around the world with too many bad loans in their portfolio. Instead of completely upending the real estate market and, consequently, the country’s economy, the current market conditions will most likely lead to a slight slowdown as well as a redistribution and rethinking of investments in the commercial real estate space in the near future.

For a deep dive into the latest trends in the commercial real estate market in Virginia, be sure to check out Virginia REALTORS® Q1 2023 Commercial Market Reports released by Virginia REALTORS®.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More