Tighter Credit Conditions Following SVB Collapse and Impact on Real Estate Lending

May 1, 2023

The collapse of the Silicon Valley Bank in mid-March sent shockwaves of uncertainty across the banking sector and the overall economy. While the initial panic among consumers and institutions has subsided, the general sentiment is that of caution, and this recent memory of a bank failure is expected to impact the decisions of financial institutions for months.

According to the American Bankers Association’s latest survey of bank chief economists from major North American banking institutions, credit conditions are expected to weaken as lenders rely on more careful underwriting. Furthermore, the Federal Reserve’s Senior Loan Officer Opinion Survey showed that the percentage of banks tightening their lending standards has been at its highest level in 13 years. There has been anecdotal evidence of lenders ramping up their due diligence as they review loan applications, and even raising interest rates on new debt to cover their risk exposure. These measures are impacting the borrowing capability of consumers and businesses alike.

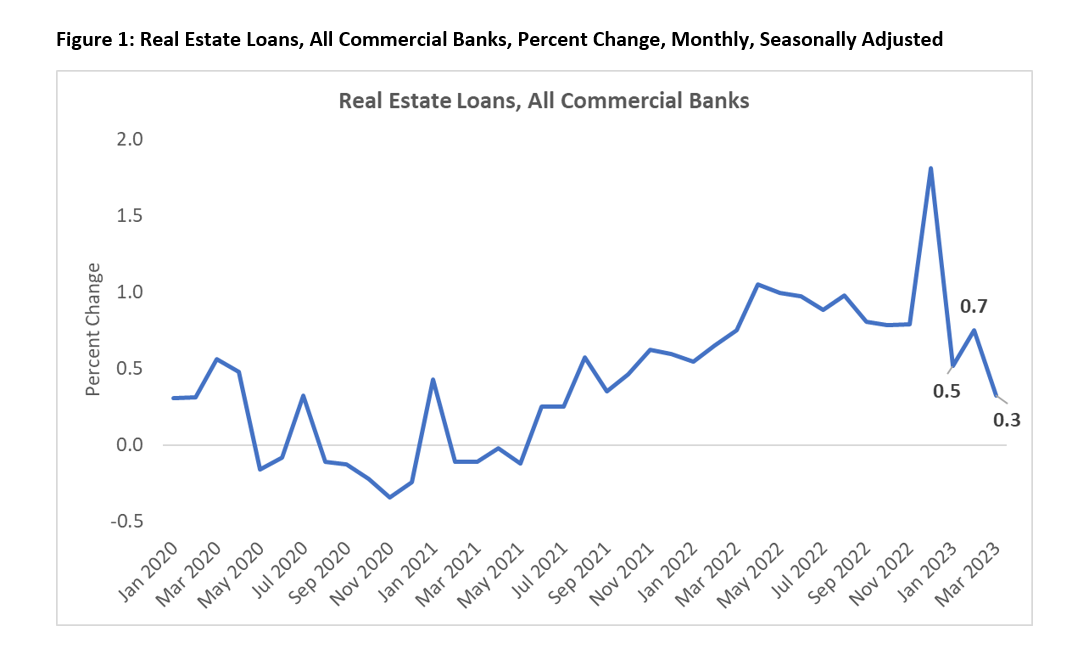

When it comes to the commercial side of the real estate market, firms have been seeing rising interest rates and falling loan-to-value ratios on ongoing loan quotes. This is likely to impact the financing of newer construction projects that are in the pipeline. The commercial real estate sector, which hadn’t fully rebounded from the pandemic, could suffer further due to the stricter lending requirements. On the other hand, borrowers in the residential sector of the market, benefiting from the recent decline in mortgage rates, don’t seem to be having much issue securing favorable lending rates at the moment. Figure 1 below shows the change in the value of all real estate loans on a monthly basis. While there has been an increase in the amount of loans, both commercial and residential, there is a noticeable slowdown in the momentum of real estate loans in March.

Overall, it may be difficult for businesses, especially newer ones, to fund their ventures as banks are looking to reduce their risk amid higher interest rates and uncertainty in the banking sector. However, it is worth noting that these precautionary measures and stricter borrowing conditions are in place in the wake of the recent bank collapse. Once the fears around the health of the economy and specifically the banking sector subside, the lending pipeline will likely loosen up which will lead to more promising options for borrowers.

For more information on housing, demographic and economic trends in Virginia, be sure to check out Virginia REALTORS® other Economic Insights blogs and our Data page.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More