Single-Family Construction & Household Formations: A Look at the Widening Gap

April 20, 2023

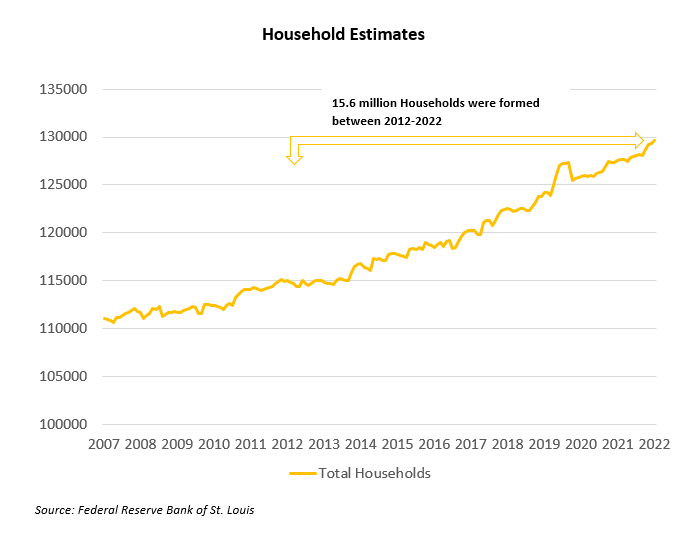

The housing market is continuing to deal with high interest rates and prices holding steady but still climbing in many places, and low inventory continues to impact buyers and sellers alike. Housing inventory has been shrinking since the Great Recession and has not kept pace with the number of households that have been forming. Let’s look at how the gap between household formation (meaning when a person establishes a residence) and single-family construction has continued to widen.

Single-Family Construction Went Down as Home Builder Confidence Fell

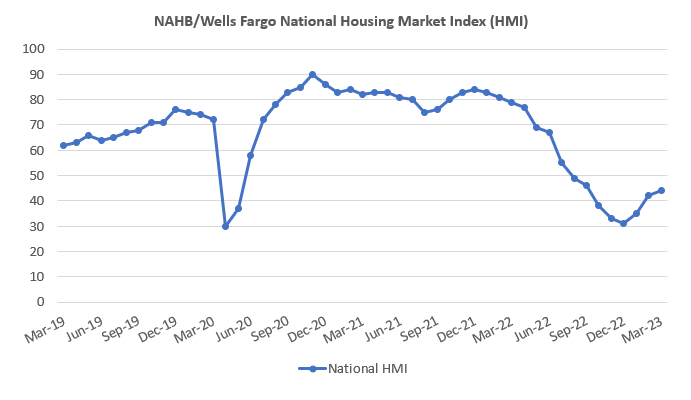

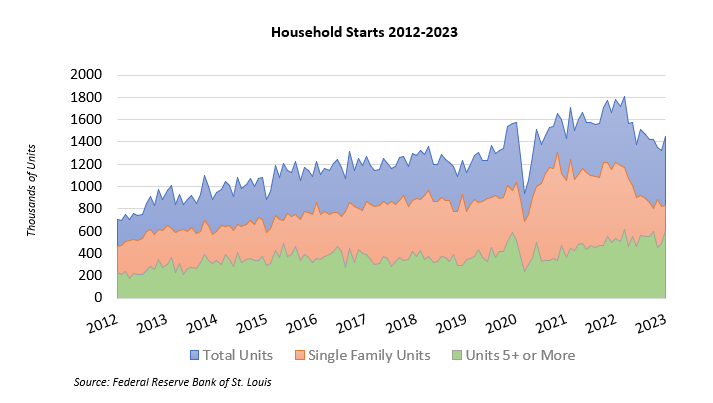

In 2021, housing starts had the highest annual pace since the Great Recession, with nationwide single-family starts reaching 1.13 million units, up 14% from 2020 according to the National Association of Home Builders (NAHB). This would continue into the first half of 2022 but would begin to fall as home prices soared and the Federal Reserve began rate hikes in order to cool inflation. As buyers pulled back from the market due to affordability issues, home builder confidence in newly constructed single-family homes began to wane. By December of 2022, home builder confidence fell to 31, the lowest confidence level since the start of the pandemic in 2020. As builder confidence fell so did single-family housing starts, totaling 1.01 million in 2022, down 10.6% from the previous year.

Construction Numbers in 2023 are Growing

As interest rates have started to come down in recent weeks, there has been a slight uptick in buyer demand. In February of 2023, single-family starts reached a rate of 830,000, up 1.1% from January when it was 821,000. Building permits for single-family units were up 7.6% in February, bringing the total single-family authorizations to 722,000.

Housing completions reached a rate of 1.0 million up 1% from last month. In Virginia, the number of residential permits for single family (1-4 units) in February was 1,648, up 15% from January but down 15.2% from February of last year. Even though inventory levels are beginning to grow, it is still not enough to keep up with the number of households being formed.

Household Formation Outpacing Single-Family Construction

Household formation is more than just a person moving into a place of residence, it sheds a light on what the demand is for housing which influences residential construction. It also plays a role in the economy by increasing spending on household furniture and appliances that are typically purchased for new homes. In 2022, the number of households formations increased by 2.06 million, up from 1.63 million in 2021, the biggest annual increase in more than a decade. The increase brings the total number of households formed between 2012 and 2022 to 15.6 million.

Within the same time period, 13.1 million total housing units were started with single-family starts accounting for 9.03 million units and multi-family starts at 4.2 million units. This has led to a gap of 6.5 million between single-family construction and household formations, a gap that will continue to widen making the housing market more challenging for buyers.

Even with interest rates coming down, buyers continue to remain price conscious and low inventory will continue to make the housing market competitive. There are positive signs that inventory is slowly increasing with the number of permits and starts for single-family units up month-to-month. Despite high construction costs, homebuilders confidence for newly built single-family homes increased for the third straight month in March to 44. According to the NAHB, builders are beginning to see pent-up demand from buyers and many are shifting their sights from existing homes to newly constructed homes.

For more information on housing, demographic, and economic trends in Virginia, be sure to check out Virginia REALTORS® other economic insights blogs and our data page.

You might also like…

Key Takeaways: September 2024 Virginia Home Sales Report

By Virginia REALTORS® - October 23, 2024

Key Takeaways Closed sales activity remains relatively flat compared to last year. There were 8,065 homes sold in September throughout the state, just 42 more than last September,… Read More

Single Family Homes Permit Activity in Virginia

By Dominique Fair - October 15, 2024

Supply has played a huge role in affordability issues for buyers, with the U.S. short 4.5 million units and sellers still holding on to homes with lower rates.… Read More

Mortgage Rates Come Down, Purchasing Power Goes Up

By Abel Opoku-Adjei - October 7, 2024

The moment everyone has been waiting for is slowly coming. One of the most significant indicators influencing potential buyers’ decision-making is mortgage interest rates. The average mortgage rate… Read More