Lower Mortgage Rates: A Silver Lining Following Recent Bank Failures

April 3, 2023

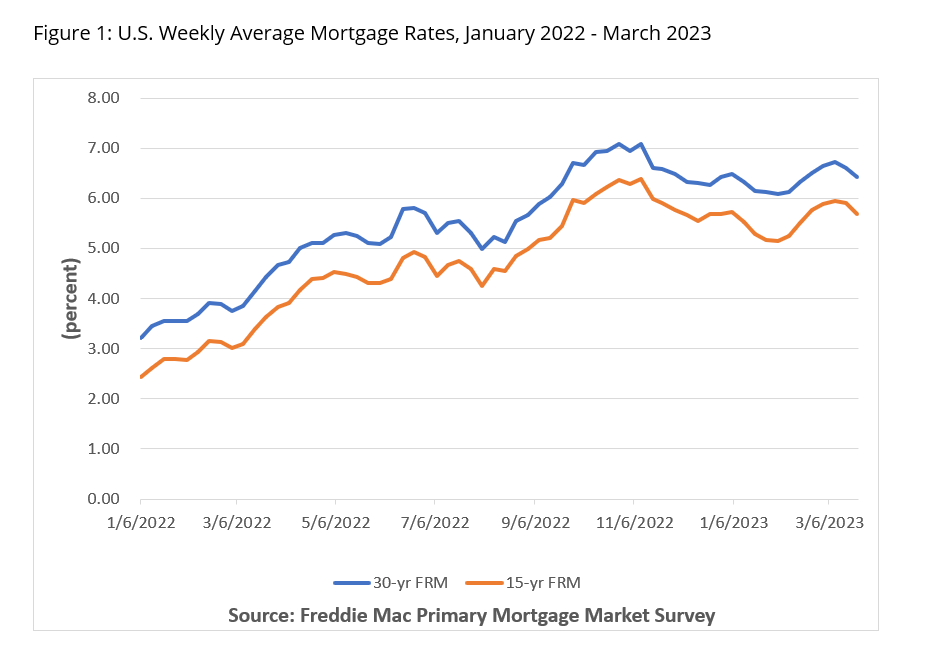

The recent bank failures in the United States have caused quite a bit of turmoil in the financial markets. However, as we head into the spring home-buying season, there is a sliver of hope for the housing market in the form of lower mortgage rates. The 30-year fixed mortgage rate had been increasing for five consecutive weeks, starting in February and reaching a 2023 high of 6.73%. But, following the news of the banking failures of Silicon Valley Bank and other regional banks, mortgage rates have fallen.

What has caused the downward pressure on rates?

Mortgage rates tend to track the yields on 10-year U.S. Treasury bonds. When the yields go up, mortgage rates rise; when they go down, mortgage rates tend to go down as well. The movement in Treasury yields is dependent on the actions of the Federal Reserve and investor sentiment in the market.

Following the collapse of Silicon Valley Bank, other regional banks such as Signature Bank and First Republic Bank, which had similar balance sheets, also faced the risk of deposit outflows. Consumers and investors were looking for safer alternatives to invest their money. Government-backed treasury bonds seemed to be the best bet for many. The increased demand pushed down treasury bond yields, and mortgage rates followed a downward trajectory as well.

Moreover, investors were closely watching how the Federal Reserve would react to the banking sector news and how it would respond during its FOMC meeting in March. To calm the inflationary pressure in the market, the Federal Reserve has been raising its federal funds rate since the beginning of 2022. While the rate change decision doesn’t directly impact mortgage rates, it does affect treasury yields. To signal its faith in the U.S. banking sector, the Federal Reserve raised its benchmark short-term interest rate by 25 basis points during its meeting on March 22. Following this announcement, U.S. treasury yields fell, and mortgage rates followed. As per Freddie Mac’s primary mortgage market survey, the average 30-year fixed rate mortgage fell to 6.42%. Other mortgage term offerings saw a decline in rates as well.

What does this mean for the current housing market?

Although rates remain high compared to a year ago, the slight dip in mortgage rates has boosted mortgage application volumes over the past couple weeks, as reported by the Mortgage Bankers Association. Potential home buyers who were waiting for mortgage rates to drop will be encouraged by the current downward trend in rates, even if it lasts for a short while. Consequently, the spring home-buying season could get an added boost from these rate trends and likely lead to a potential uptick in home sales.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More