Don’t Call It a Comeback: Should Your Clients Consider an Adjustable-Rate Mortgage?

August 25, 2022

The housing market has been through quite a lot in the last eight months. Prices skyrocketed amidst a shrinking inventory of homes, causing potential homebuyers to waive inspections, buy homes sight unseen, or offer thousands of dollars over the asking price to stay competitive. But now, with interest rates hovering over 5% and the inflation rate reaching 8.5%, the market has begun to cool down as many buyers take a step back with affordability as their main cause of concern. According to the Mortgage Bankers Association (MBA), loan applications decreased by 2.3% from one week earlier, reaching the lowest level since 2000. With mortgage applications down and prices still high, many are looking for other options to be able to afford the home of their dreams. One of these options which has started to gain some traction is an Adjustable-Rate Mortgage (ARM). Adjustable-Rate Mortgages gained popularity in the early 2000s before playing a role in the 2008 housing crisis. Thankfully, due to the Dodd-Frank Act, there are now protections put in place for ARM loans and people are beginning to see it as a viable home loan option. Today, adjustable-rate mortgages account for 7% of all loan applications, more than double of what it was around the same time last year per the MBA .

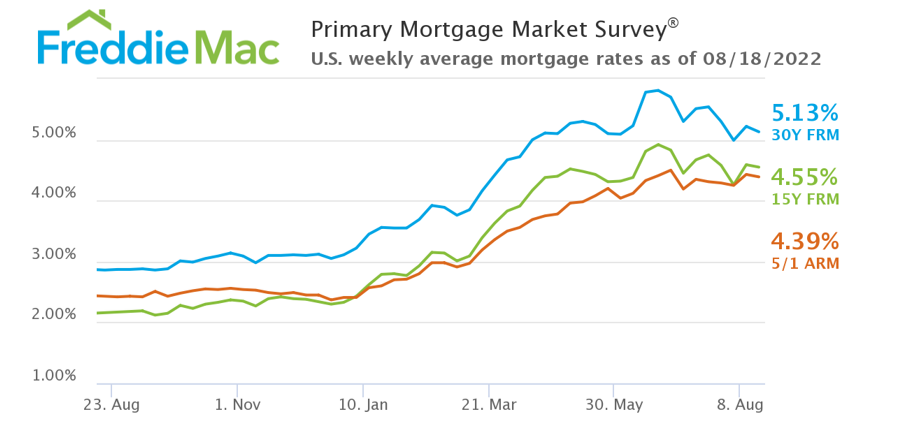

An adjustable-rate mortgage is a loan where the interest rate changes throughout the lifetime of the loan. They start off with a fixed period where the interest rate stays the same during the beginning of the loan, which can range from five to ten years. This is an appealing alternative for many borrowers as the interest rates for ARMs start off lower than those of a traditional 30-year loan. This allows potential buyers flexibility in their home spending budget and allows them the opportunity to save money during a time of rising rates. The current rate for a 5/1 ARM is 4.39% compared to 5.13% for a 30-year fixed rate loan according Freddie Mac. ARMs also give buyers more flexibility if they only see themselves staying in the home a short period of time; they can enjoy lower monthly payments the first few years and then sell the home before the adjustment period kicks in.

Lower interest rates, monthly payments, and the chance to save money, are all benefits of an adjustable-rate mortgage, but there are some things that you should keep in mind before finalizing your decision. The first thing to keep in mind is the adjustable-rate phase that comes after the first few years of the loan. For example, if a buyer has a 5/1 ARM loan, the rate is fixed for the first five years, and then the rate adjusts once a year after that. During this stage, the interest rate for the loan changes based on the market, meaning that the monthly payments could go up or down. This can make it more difficult to budget or make financial decisions as payments change. That may sound scary, especially with the current market challenges, but there are caps put into place for how much rates can change. When deciding on a loan to consider, it is important your clients considers not just where they are now, but what the next few years look like. Is this a starter home that they are planning to sell in the next few years? Will they be able to afford a higher mortgage payment down the road? If the answer is “yes” to these questions, then an ARM loan may be something to consider, but the key is to plan ahead.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More