Is Five Months of Supply Really the Sign of a Healthy Housing Market?

April 14, 2022

The idea that five or six months of supply signals a healthy housing market has ingrained itself in real estate lore. Historically, it was said that five or six months of supply is associated with moderate home price appreciation. Anything higher indicates a buyers’ market, while anything lower means a sellers’ market. But where did this belief come from? And how much validity does that metric have?

Months of supply refers to the number of months it would take for the current inventory of homes on the market to sell given the current sales pace. The months of supply statistic is calculated by taking the average monthly sales over the preceding 12-month period and dividing it by the inventory of active listings.

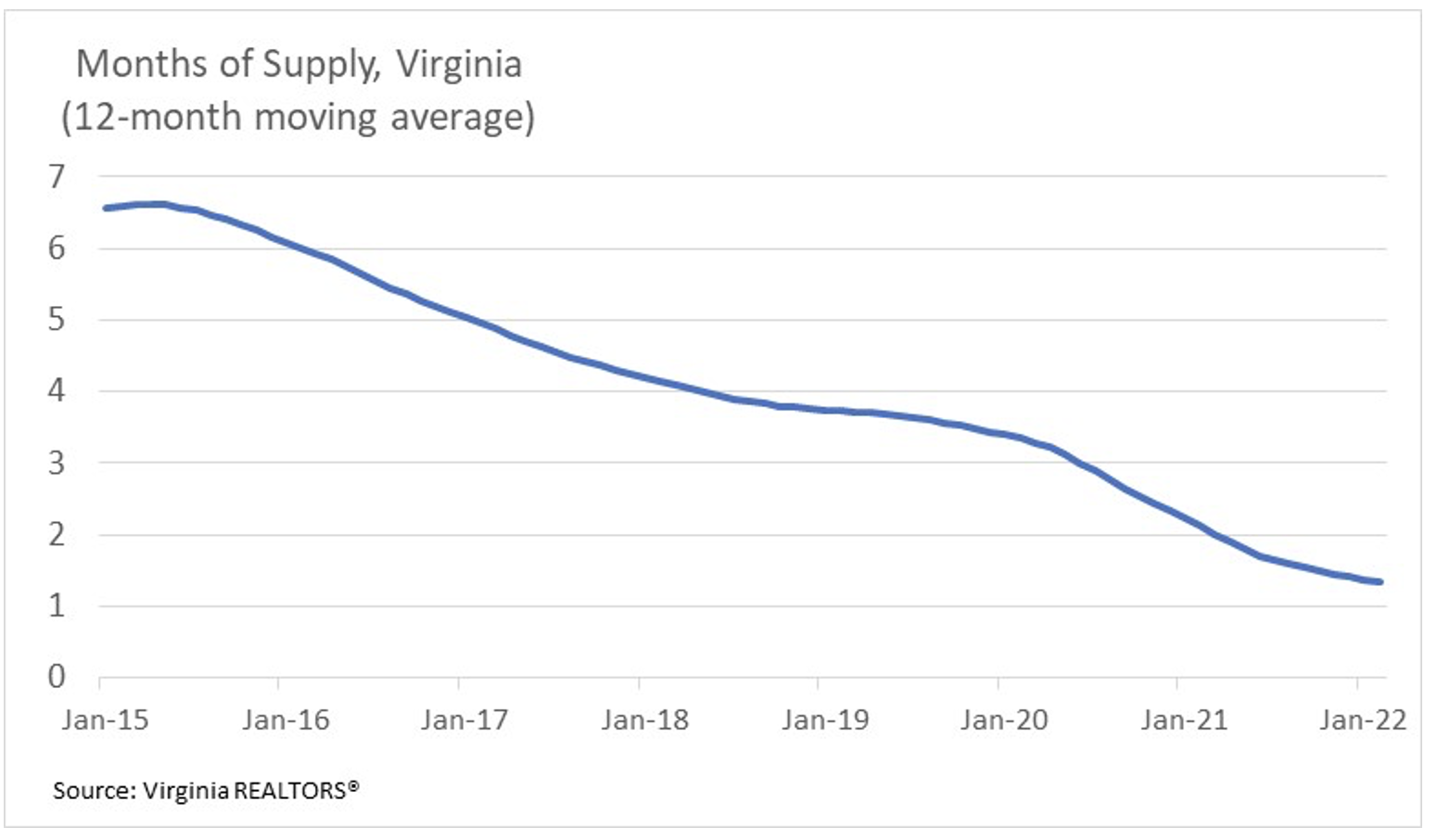

Statewide, in Virginia, there is only about one month’s supply and in some local markets, this measure of inventory is even lower. Inventory has been low—lower than the so-called “healthy” level of five or six months—for years. In fact, the last time there was at least five months of supply statewide in Virginia was September 2016. In the end of March, there was just 0.9 months of supply.

The months of supply metric depends not only on how many listings are on the market, but also how fast homes are going under contract. For example, assume there are 100 homes on the market at the beginning of the month. If there are 100 new listings that come onto the market, there will be 200 active listings at month’s end if no homes are sold. If homes are snapped up quickly, it’s possible that all 100 new listings could be under contract before the end of the month. In this case, the month-end inventory would be 100 and not 200. Therefore, the end-of-the-month inventory—and therefore the months of supply metric—depends on listings but also, very importantly, on the pace of home sales activity.

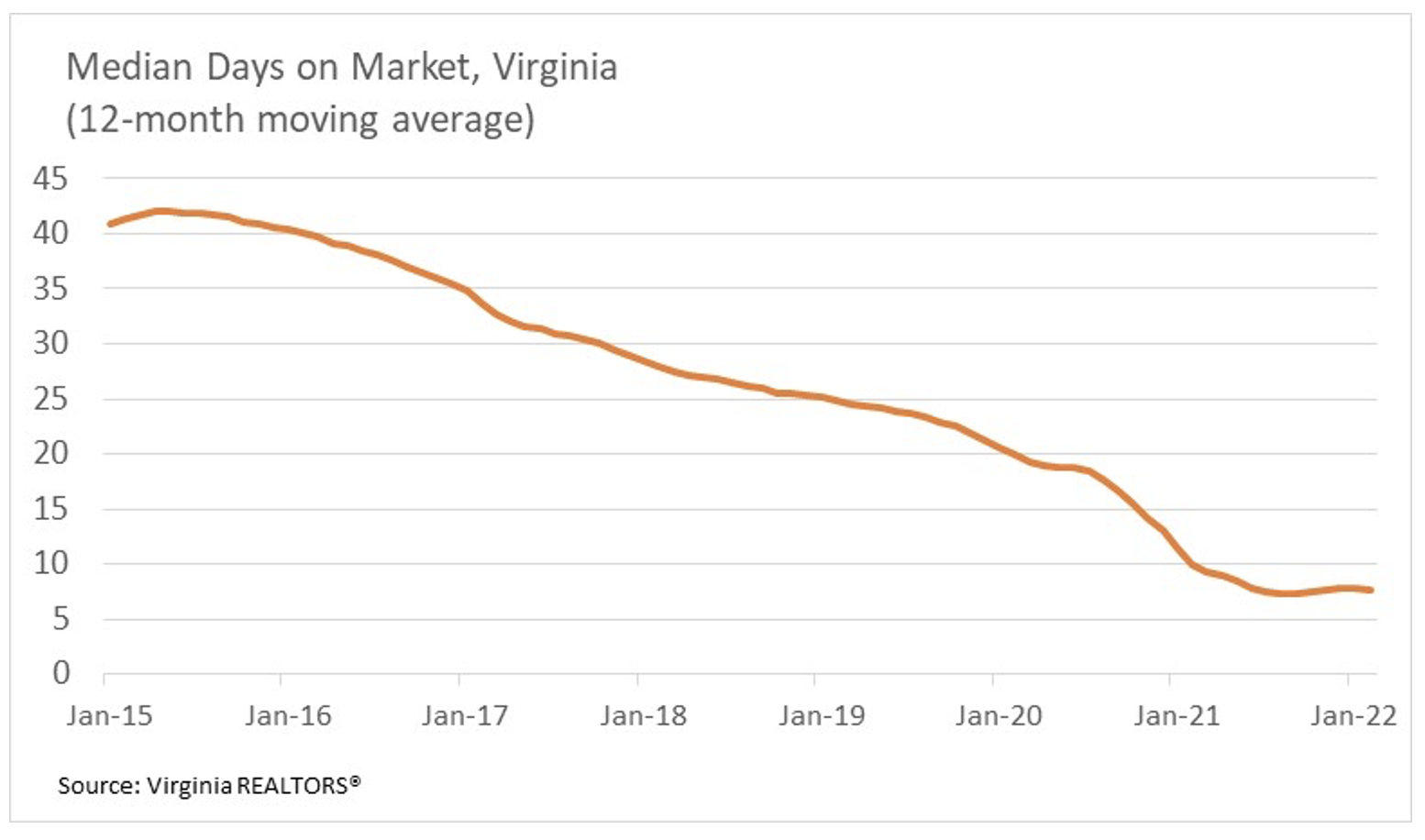

A better measure of a healthy housing market could instead depend on how quickly homes are selling, such as the median days on market. In March, the statewide median days on market was just 5—meaning that half of all homes sold in Virginia were sold in 5 days or less. At this pace, homes are being snapped up very quickly, buyers have very little time to consider their purchase, and the market is obviously very competitive.

How fast would homes be selling in a more balanced housing market? One possibility would be to assume that a median days on market of 30 would indicate a balanced market. This would mean half of all homes sold in 30 days or less and half sold for more than 30 days. The last time the median days on market was consistently around 30 was in 2017.

By any measure, we are definitely in a sellers’ market. It will take both an increase in month-end inventory as well as a slower pace of homes sales before the market is on a trajectory to a more balanced market.

In 2022, buyer activity will probably slow somewhat as a result of higher mortgage rates, though inventory likely will remain low. We will not be back even close to five or six months of inventory. While we will see the median days on market increase, the market will remain a sellers’ market in 2022 and a balanced market is still far on the horizon.

You might also like…

Key Takeaways: September 2024 Virginia Home Sales Report

By Virginia REALTORS® - October 23, 2024

Key Takeaways Closed sales activity remains relatively flat compared to last year. There were 8,065 homes sold in September throughout the state, just 42 more than last September,… Read More

Single Family Homes Permit Activity in Virginia

By Dominique Fair - October 15, 2024

Supply has played a huge role in affordability issues for buyers, with the U.S. short 4.5 million units and sellers still holding on to homes with lower rates.… Read More

Mortgage Rates Come Down, Purchasing Power Goes Up

By Abel Opoku-Adjei - October 7, 2024

The moment everyone has been waiting for is slowly coming. One of the most significant indicators influencing potential buyers’ decision-making is mortgage interest rates. The average mortgage rate… Read More