Mortgage Rates: Poised to Rise?

November 19, 2021

Mortgage rates continue to hover near historic lows, but there are signs that rates will be rising. An improving economy coupled with high inflation could push the Federal Reserve to take actions that will ultimately lead to higher mortgage rates. However, it is likely that rate increases will be modest and will not have a major impact on the housing market.

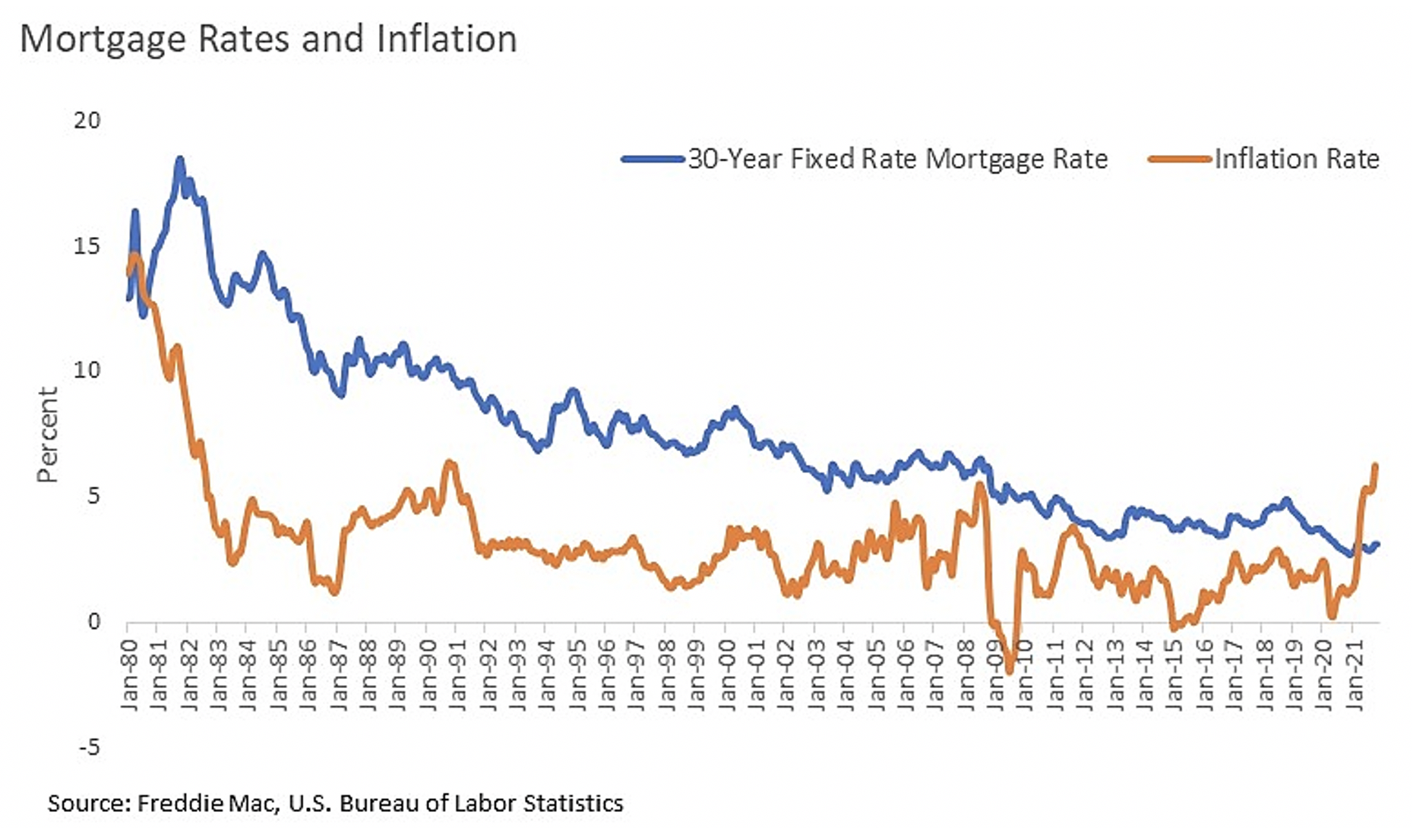

The average rate on a 30-year fixed rate mortgage has been steadily declining since the 1980s, when mortgage rates topped 18%. Since the onset of the COVID-19 pandemic, average mortgage rates have consistently been below 3%, supporting a strong for-sale market and encouraging record levels of refinancing activity.

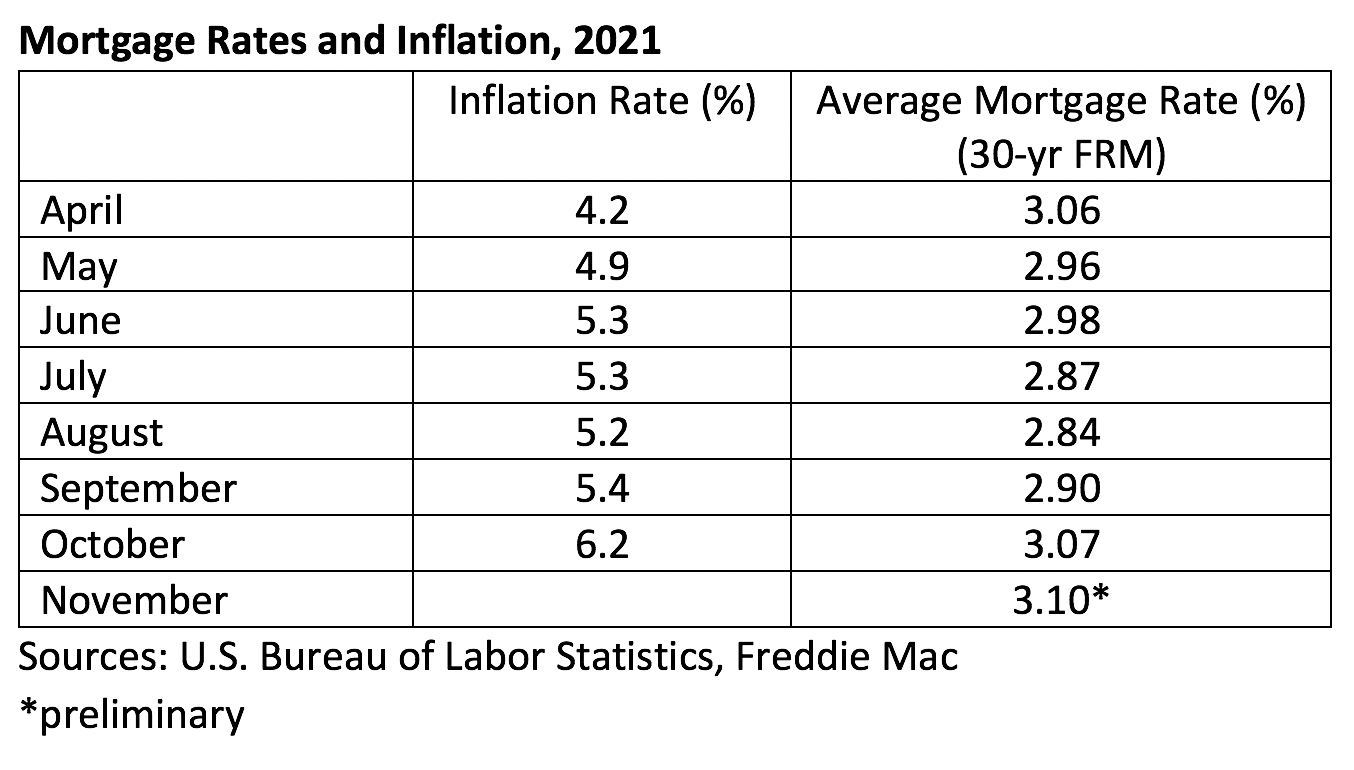

While still low, there have been growing concerns that mortgage rates are set to rise. High inflation has stoked fears that the Federal Reserve will take actions that will end up moving mortgage rates higher.

Historically, the average rate on a 30-year fixed-rate mortgage has run below the average inflation rate. The last time mortgage rates were higher than inflation was in August 1980. Mortgage rates have been below the rate of inflation since then. But recent spikes in the inflation rate have led to a flip, where now inflation is running higher than mortgage rates.

Looking back over the past 40 years shows that there is a relationship between mortgage rates and interest rates. Inflation is one of two key metrics that the Federal Reserve monitors closely during economic recoveries. (Employment levels are the other.) The Fed tries to keep inflation running at around 2%. When the inflation rate is higher than that, there is a risk that the economy is overheating, which causes the Fed to take action.

Tapering Bond Purchases

The Fed recently announced its timetable for reducing its monthly bond purchases, which will affect mortgage rates. At the beginning of the recession, the Fed’s bond purchasing program was important for supporting the fragile economy. Those bond purchases also have helped keep mortgage rates at very low levels for much of the last 18 months. As the Fed pulls back those bond purchases, mortgage rates will head higher.

Raising the Federal Funds Rate

If the Federal Reserve becomes more concerned about the high inflation numbers, and become more convinced that they are long-term rather than transitory, they may decide to raise the Federal Funds rate. The Federal Funds rate is the rate banks charge each other to lend money overnight. The Fed does not directly impact long-term rates, such as mortgage rates, but by increasing the cost of these short-term rates, there will be an overall impact on the cost of lending month. As a result, mortgage rates will see upward pressure.

It seems clear that mortgage rates will begin to rise at the end of 2021 and through 2022. It is likely, that the average rate on a 30-year fixed rate mortgage will remain below 3.5% for the rest of 2021 and will stay under 4% in 2022. Even with these rate increases, mortgage rates will still remain quite low by historic standards.

Click here to send any comments or questions about this piece to Virginia REALTORS® Chief Economist Lisa Sturtevant, PhD.

You might also like…

Key Takeaways: September 2024 Virginia Home Sales Report

By Virginia REALTORS® - October 23, 2024

Key Takeaways Closed sales activity remains relatively flat compared to last year. There were 8,065 homes sold in September throughout the state, just 42 more than last September,… Read More

Single Family Homes Permit Activity in Virginia

By Dominique Fair - October 15, 2024

Supply has played a huge role in affordability issues for buyers, with the U.S. short 4.5 million units and sellers still holding on to homes with lower rates.… Read More

Mortgage Rates Come Down, Purchasing Power Goes Up

By Abel Opoku-Adjei - October 7, 2024

The moment everyone has been waiting for is slowly coming. One of the most significant indicators influencing potential buyers’ decision-making is mortgage interest rates. The average mortgage rate… Read More