A Profile of LGBTQ Home Buyers

June 17, 2021

In 2021, nearly six percent of Americans identify as lesbian, gay, bisexual, transgender, or queer (LGBTQ), which is a 60% increase over the number five years ago. Younger people are much more likely to say that they consider themselves part of the LGBTQ community, with 9% of Millennials and 16% of Generation Z identifying themselves to be something other than heterosexual.

In 2021, nearly six percent of Americans identify as lesbian, gay, bisexual, transgender, or queer (LGBTQ), which is a 60% increase over the number five years ago. Younger people are much more likely to say that they consider themselves part of the LGBTQ community, with 9% of Millennials and 16% of Generation Z identifying themselves to be something other than heterosexual.

While the LGBTQ community makes up a relatively small share of the population, they are tremendously important consumers, with an estimated $1 trillion in purchasing power. Homeownership is an increasingly important goal among members of the LGBTQ community. According to the National Association of Gay & Lesbian Real Estate Professionals, LGBTQ homeownership is expected to rise significantly over the next 10 years.

Characteristics of LGBTQ Home Buyers

The National Association of REALTORS® (NAR) and the National Association of Gay & Lesbian Real Estate Professionals (NAGLREP) recently published reports on the LGBTQ home buyer population. Both national real estate associations document the changing characteristics and preferences of LGBTQ home buyers and highlight how important it is for real estate professionals to pay attention to this demographic.

Some key findings:

- LGBTQ home buyers are more likely than non-LGBTQ home buyers to be first-time buyers. This difference is largely due to the fact that LGBTQ buyers are younger.

- A growing share of LGBTQ buyers are married and have children. Nearly four out of 10 LGBTQ buyers indicate they are married, and 17% of LGBTQ buyers have children in the household.

- About eight in ten LGBTQ home buyers purchased a detached single-family home, the same share as non-LGBTQ homebuyers. However, LGBTQ buyers tend to purchase older and smaller homes. They are also more likely to purchase in an urban area or central city and less likely to purchase in rural areas or small towns.

- Compared to non-LGBTQ home buyers, LGBTQ buyers are less likely to say that they value quality of school districts and convenience to schools and health facilities. However, the three most important qualities for both LGBTQ and non-LGBTQ buyers are the same: quality of neighborhood, convenience to job, and overall affordability.

LGBTQ Discrimination in the Housing Market

NAGLREP members report that fear of discrimination in the home-buying process keeps some LGBTQ individuals away from homeownership. Nearly half of LGBTQ renters are concerned about discrimination, and NAGLREP members report that this keeps some renters renting longer than they would like.

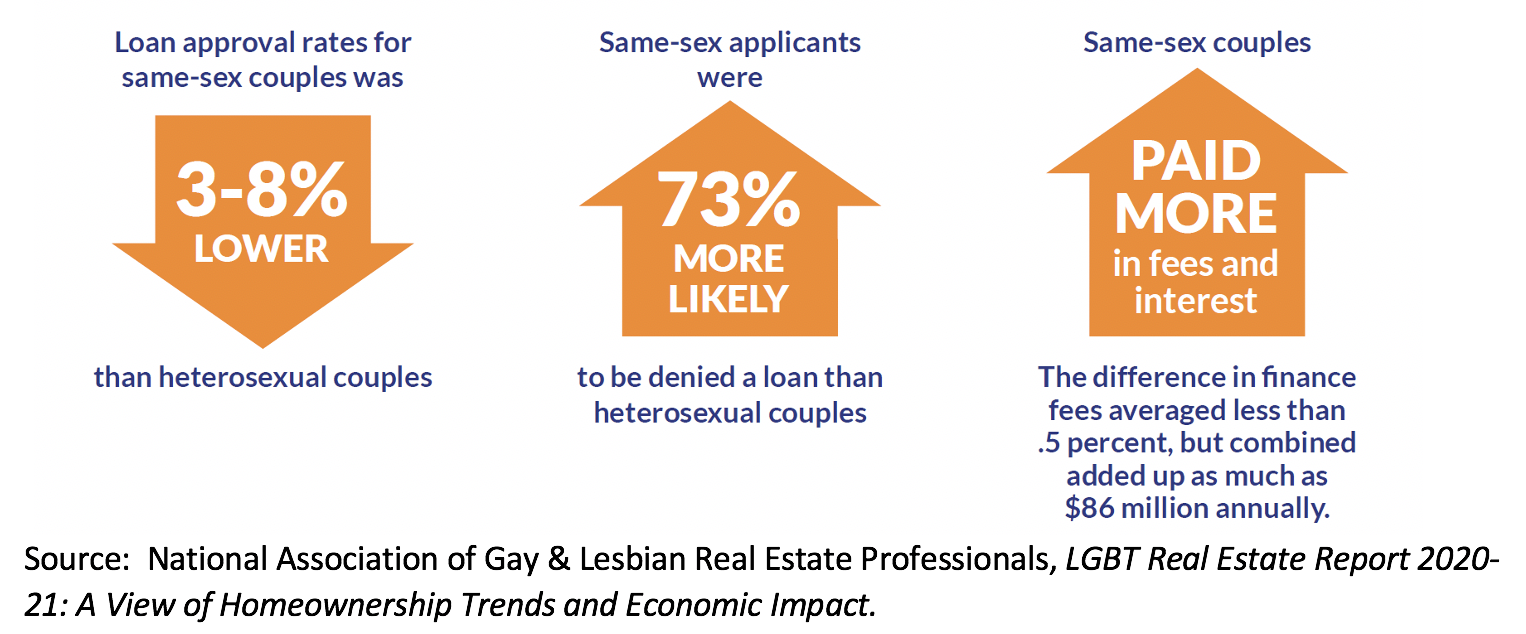

Beyond just stated concerns, there is documented evidence of housing discrimination against members of the LGBTQ community. Compared to heterosexual couples, same sex couples are significantly more likely to be denied a home mortgage. They also tend to pay more in interest and fees when they do secure a home loan.

Supporting LGBTQ Homeownership

In the U.S., there is growing support for the LGBTQ community, including a record high share of Americans saying that they support same-sex marriage. Greater acceptance, along with an increasing share of individuals identifying as LGBTQ, means that this demographic will be a growing part of the home-buying population in the future.

The NAGLREP has offered several ways in which real estate professionals can raise awareness for LGBTQ homeownership and help end discrimination in housing market transactions. Some immediate steps include the following:

- The real estate industry overall could spend more advertising money on national LGBTQ publications and websites, promoting homeownership among the LGBTQ community.

- Local REALTORS® can participate in Pride Month and other LGBTQ events to demonstrate support for the LGBTQ community.

- Local REALTOR® associations could advertise more broadly in local and regional LGBTQ publications and websites, not only to encourage homeownership but also to promote LGBTQ REALTOR® members.

Click here to send any comments or questions about this piece to Virginia REALTORS® Chief Economist Lisa Sturtevant, PhD.

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More