Foreclosure Wave? Don’t Hold Your Breath

June 3, 2021

The competitive housing market has led some buyers to hold out hope that a flood of foreclosures may offer them more choices in the coming months. Unfortunately for these prospective buyers, it is unlikely that foreclosures and short sales will add to the inventory in any meaningful way.

During the COVID-19 pandemic, millions of homeowners requested a loan forbearance from their lenders, allowing them to take a pause on monthly mortgage payments. However, when forbearance periods end, homeowners must resume mortgage payments.

How Many Loans are in a Forbearance Programs?

According to the most recent data from the Mortgage Bankers Association, about 2.2 million homeowners are currently in a forbearance program, accounting for about 4.4% of all home loans. The share of loans in a forbearance program ranges from 2.3% of Fannie Mae or Freddie Mac loans to 8.6% of portfolio loans and private-label securities.

According to the most recent data from the Mortgage Bankers Association, about 2.2 million homeowners are currently in a forbearance program, accounting for about 4.4% of all home loans. The share of loans in a forbearance program ranges from 2.3% of Fannie Mae or Freddie Mac loans to 8.6% of portfolio loans and private-label securities.

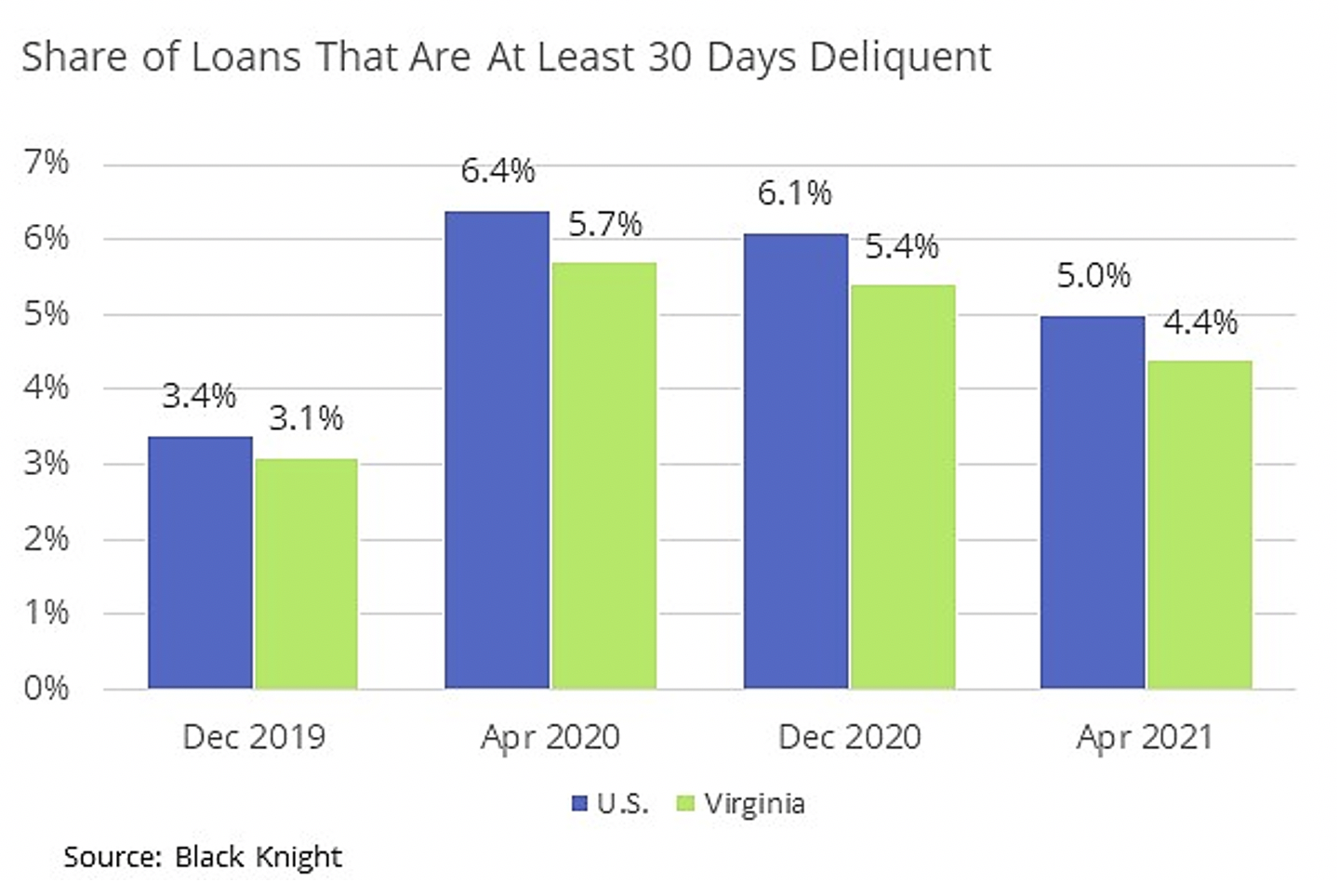

While there is no good data on forbearance rates by state, Black Knight tracks state-level data on mortgage delinquencies and foreclosures. In April 2021, about 4.4% of home loans in Virginia were at least 30 days delinquent and just 0.1% were in a formal foreclosure process. While these rates are slightly higher than they were in 2019, delinquencies and foreclosures have declined over the past year and remain at very low levels, especially compared to the Great Recession.

Will the End of Forbearance Mean the Beginning of Foreclosures?

While it might disappoint some frustrated buyers, there is little to suggest that existing homeowners will be forced into foreclosure when forbearance periods end. There are several reasons why we should not be waiting for a foreclosure wave:

- The sheer number of home loans in a forbearance program is very small. If Virginia looks like the U.S., there is probably only between four and five percent of mortgage holders currently in a forbearance program.

- While some homeowners are still concerned about making loan payments, there are many families in relatively good financial situations and can easily resume payments when the forbearance period ends.

- The fast-paced housing market and rising home prices further minimize foreclosure risk. If homeowners are unable to make payments, they will be able to list their home for sale and attract many interested borrowers, which allows them to get out of their loan.

The inventory of homes available for sale has been shrinking for years, but the supply has been drawn down even faster during the COVID-19 pandemic. There is no quick solution for the inventory shortage, but there has been a glimmer of good news recently. In many local markets across Virginia, there has been an uptick in new listings this spring, as the economy has opened up and the vaccines have become more widely available. Inventory will remain low through the year, but buyers should find slightly more choices as we head into summer. They just should not expect to find foreclosures to snap up.

Click here to send any comments or questions about this piece to Virginia REALTORS® Chief Economist Lisa Sturtevant, PhD.

You might also like…

RESPA & Joint Ventures: What Is Allowed?

By Laura M. Murray - March 6, 2023

We have heard reports that state Attorneys General may be taking an increased interest in certain joint venture arrangements between real estate licensees and settlement companies. Agents may… Read More

DPOR Update: Death or Disability of a Broker

By Laura M. Murray - December 5, 2022

In the 2022 Session, the General Assembly passed a law updating what happens in the event of the death or disability of a sole proprietor or sole broker… Read More

What Do Federal Reserve Rate Hikes Mean for the Housing Market and for Your Business?

By Dr. Lisa Sturtevant - April 4, 2022

In March, the Federal Reserve raised the short-term federal funds rate by 0.25 percentage points. This rate hike was the first time the Fed has raised rates since… Read More