Who Can Afford to Buy a Home in Virginia?

May 26, 2021

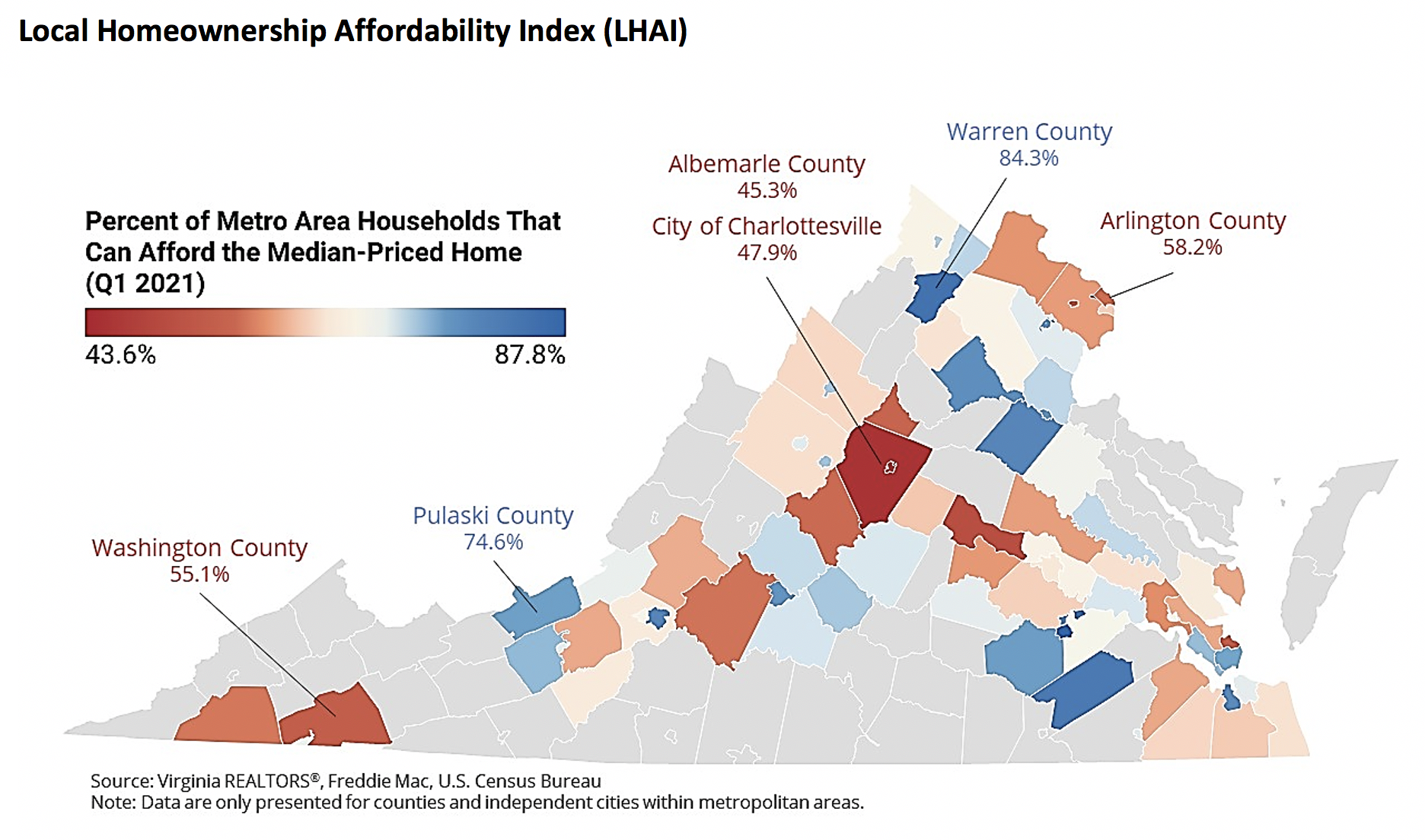

The financial and social benefits of homeownership have been well-documented. However, in the super-competitive housing market in Virginia, homeownership is being pushed further out of reach for many individuals and families. Where is homeownership most attainable across the state? Where is affordability the biggest challenge? And how can REALTORS® talk with prospective home buyers about affordability?

Homeownership Affordability Index

An affordability index is one way to track how affordable homeownership is in different markets. The National Association of REALTORS® Housing Affordability Index (HAI) measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home. The HAI is a useful way to examine general trends in affordability, but it is not designed to evaluate housing affordability in local markets.

To assess local affordability, we can look at how many households can afford to purchase a home in a county or city. This metric looks at the incomes of all households in a metropolitan area and calculates what share of households could afford the median-priced home in a county or city. Homeownership affordability takes into account not only home prices and mortgage rates, but also typical household incomes in a metropolitan area.

Local Homeownership Affordability Index (LHAI) Key Assumptions:

- Q1 2021 median home sales price by county/independent city

- 30-year fixed-rate mortgage rate, average of weekly averages over the quarter

- 5% down payment

- Loan amount calculated as median home price minus down payment

- Monthly payment calculated as: loan amount * (mortgage rate/12)/(1-(1/(1+mortgage rate/12)^360)) (PMT function in Excel)

- Households spend no more than 28% of their income on a monthly payment

Distant Suburban Communities Are the Most Affordable. Or Are They?

Not surprisingly, the LHAI shows that homeownership is more affordable in communities furthest away from a metropolitan area’s central city. For example, only 58.2% of households in the Northern Virginia region can afford the typical home in Arlington County. By comparison, 84.3% of households in Northern Virginia can afford the median-priced home in Warren County.

In the Charlottesville region, less than half of households can afford the median-priced home in the City of Charlottesville (47.9%) or Albemarle County (45.3%). In Buckingham County, south of the city, 72.5% of the Charlottesville region’s households can afford the county’s median-priced home.

It is important to remember that housing costs are just one part of the overall cost of living. In particular, transportation costs can often eat up any “savings” on housing costs if workers have long commutes. Therefore, any housing affordability index that looks at just income and housing costs could be missing other costs that could be significant for a family.

Incomes Matter, Sometimes More than Home Prices

In some communities in Virginia, homeownership affordability is low not because housing costs are high, but because household incomes in the region are relatively low. In Washington County, for example, the median sales price in the 1st quarter of 2021 was $233,775, about $100,000 lower than the statewide median home sales price. But the median household income in the Bristol region was just $48,600, much lower than household incomes in many other parts of the state. As a result, homeownership affordability appears low.

Pulaski County offers a different example. Affordability in Pulaski County is relatively high. Home prices are low in the county, but household incomes in the Roanoke region are also higher. So, more households in the region can afford a home in Pulaski County.

Talking About Affordability

Even with mortgage rates at historically low levels, some homebuyers, including many first-time buyers, are finding they are bumping up against affordability constraints. REALTORS® working with prospective buyers may get questions about how to think about affordability. Having up-to-date information on housing market conditions can help REALTORS® be a resource to their clients. Other issues to keep in mind as questions about housing affordability come up include the following:

- Buyers need to evaluate not only the price of the home but also the costs of commuting. A less expensive home further from work could result in higher gas and vehicle maintenance costs. If buyers will be working from home, proximity to an office won’t be a consideration—at least in the near term.

- Mortgage rates are important for determining the affordability of a monthly housing payment. However, other factors are important, including down payment, closing costs, moving costs, and home maintenance costs. Prospective home buyers need to consider all costs associated with the home purchase transaction.

- Sometimes people think renting is cheaper than owning, but that is not necessarily true. If a family has sufficient resources for a down payment—or can qualify for a zero-percent down VA loan—today’s low mortgage rates can mean monthly ownership costs are lower than monthly rent.

Click here to send any comments or questions about this piece to Virginia REALTORS® Chief Economist Lisa Sturtevant, PhD.

You might also like…

Key Takeaways: February 2025 Virginia Home Sales Report

By Virginia REALTORS® - March 25, 2025

Key Takeaways There was a pullback in closed sales in February. There were 6,129 homes sold statewide this month, down 9% from last February, a reduction of 604… Read More

March Madness Meets Market Madness: Construction Trends in Virginia’s College Towns

By Abel Opoku-Adjei - March 18, 2025

Ongoing economic concerns are impacting both single-family and multifamily construction across the country. According to the National Association of Home Builders, multifamily construction starts are expected to decline… Read More

See It, Want It, Buy It: Single Female Homeownership

By Dominique Fair - March 11, 2025

Women have fought for a lot over the last 177 years, whether it was for fair wages, the right to vote, or to be able to own a… Read More