Results from Flash Survey #19: Are Investors a Big Part of the Market?

April 28, 2021

Competition in Virginia’s frenzied housing market has been intense. Buyers face a lot of competition, increasingly from investors who can pay cash. In this month’s Flash Survey, we asked our Virginia REALTORS® members to share insights on whether investors and all-cash buyers are a major part of the local market, and whether rental properties are coming onto the for-sale market. Between April 21 through April 25, we received responses from 689 Virginia REALTORS® members who had worked with a buyer or seller in 2021.

Here are highlights from the April 2021 Flash Survey:

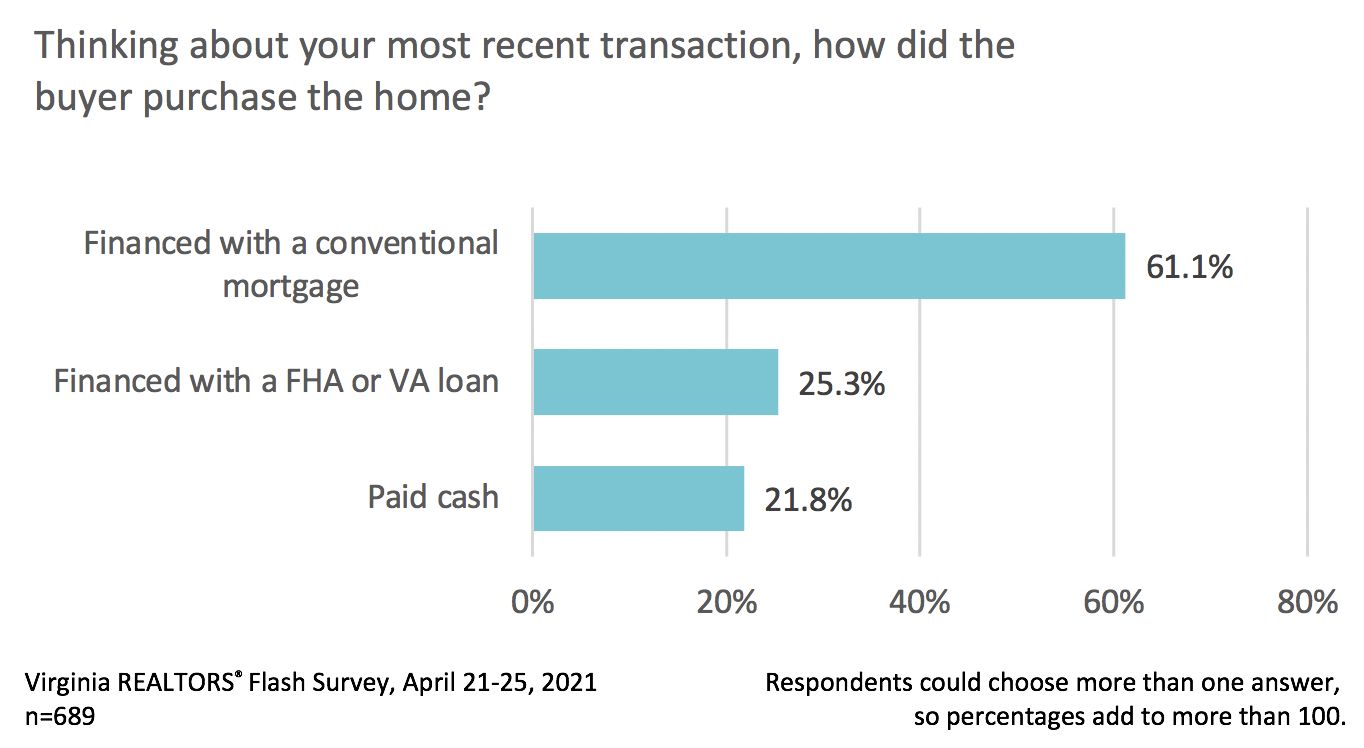

- More than one out of five (21.8%) home sales transactions reported on by Virginia REALTORS® members involved the buyer paying cash.

- The majority of buyers finance their home purchase, with 61.1% of buyers using a conventional mortgage and 25.3% financing with an FHA or VA loan. (Note: respondents could select more than one option so the percentages sum to more than 100.)

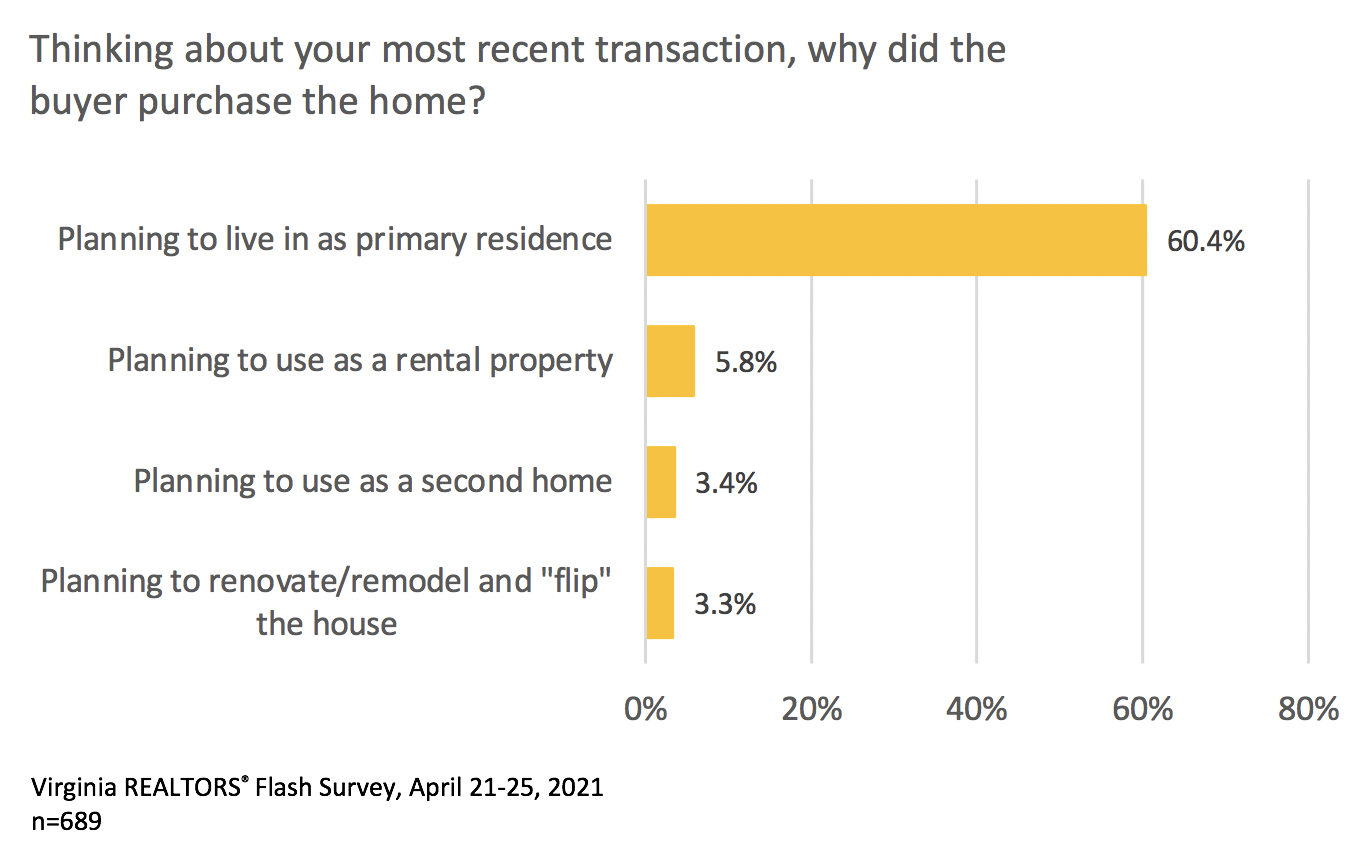

- Based on our survey, about nine percent of transactions in 2021 could be classified as “investor purchases.” According to Virginia REALTORS® members, 5.8% of buyers in recent transactions were planning to use the home as a rental property, and 3.3% were planning to renovate or remodel the home and “flip” it.

- Forty percent of Virginia REALTORS® members who responded to this survey said that they had been involved in the sale of a rental property in 2021. According to these respondents, nearly 60% of rental property sales were sales of single-family rentals. Almost a quarter (22.6%) were townhomes or duplexes and 15.9% were condominium rentals in multifamily buildings.

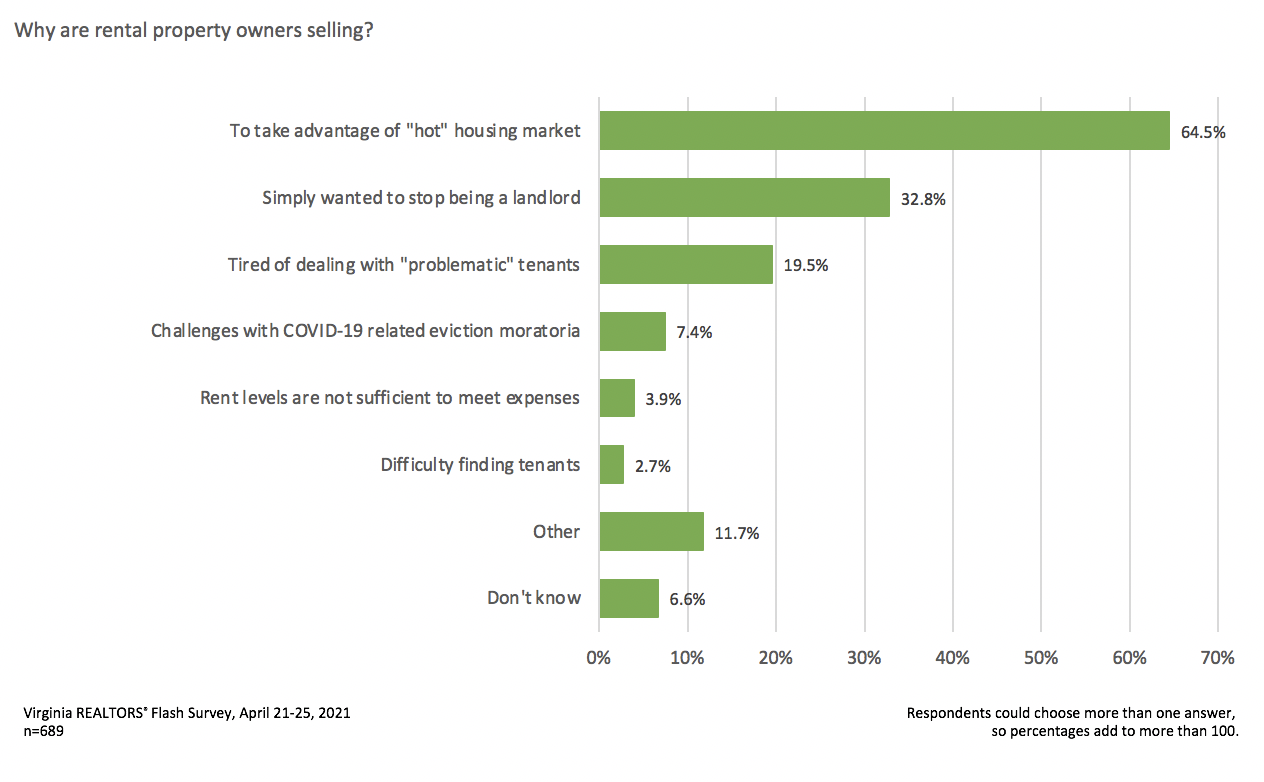

- Owners of rental properties were most often looking to sell because demand and home sales prices are high. Nearly two-thirds of REALTORS® (64.5%) involved in the sale of a rental property said that the sellers listed their rental property to take advantage of the “hot” housing market.

- Some owners of rental properties were selling because of challenges with being a landlord or property manager. About one in five REALTORS® (19.5%) said that the rental property owner they worked with was tired of dealing with “problematic” tenants, including tenants who fail to pay rent and/or damage the property. About a third (32.8%) said that they owner simply wanted to stop being a landlord or get out of the property management business.

- Seven percent of REALTORS® said that the COVID-19-related eviction moratoria prompted the rental property owner to sell the home.

A note about surveys: This is not a randomized sample survey of Virginia REALTORS® members. However, the number of responses and the geographic coverage of respondents make it possible to draw conclusions about the population of Virginia REALTORS® working with buyers and sellers in 2021 with a certain level of confidence. These statistics from this survey have a margin of error of +/- 3.7%.

Responses to our surveys are confidential. We do not look at individual responses but rather report data in the aggregate.

Virginia REALTORS® reports on the economy and housing market in Virginia. New information is updated on the Virginia REALTORS® website. A new Flash Survey is sent out at the end of each month. For more information or to make suggestions for a Flash Survey topic, please contact Virginia REALTORS® Chief Economist, Lisa Sturtevant (lsturtevant@virginiarealtors.org).

You might also like…

Midway Through 2024, Virginia Home Sales Activity Slightly Outpacing Last Year

By Robin Spensieri - July 24, 2024

According to the June 2024 Virginia Home Sales Report released by Virginia REALTORS®, there were 10,018 homes sold across the commonwealth last month. This is 974 fewer sales… Read More

Three Multifamily Market Trends from the Second Quarter of 2024

By Sejal Naik - July 16, 2024

Each quarter, through its Multifamily Market report, the research team at Virginia REALTORS® analyzes the trends and changes in the multifamily market. Here, we share the key highlights… Read More

Takeaways From the JCHS 2024 State of the Nation’s Housing

By Dominique Fair - July 15, 2024

The Joint Center for Housing Studies from Harvard University released this year’s State of the Nation’s Housing report highlighting the impact today’s market is having on both homeowners… Read More